- Philippines

- /

- Food

- /

- PSE:RFM

Undervalued Small Caps With Insider Buying In Asian Markets May 2025

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown resilience amid easing global trade tensions and positive sentiment from better-than-expected corporate earnings. This environment has sparked interest in small-cap stocks, which often hold potential for growth due to their nimbleness and ability to capitalize on emerging opportunities. In this context, identifying undervalued small-cap companies with insider buying can be particularly appealing for investors looking to navigate these dynamic market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.5x | 1.0x | 42.74% | ★★★★★★ |

| Puregold Price Club | 8.8x | 0.4x | 31.16% | ★★★★★☆ |

| Atturra | 28.9x | 1.2x | 35.82% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 34.55% | ★★★★★☆ |

| Dicker Data | 19.9x | 0.7x | -41.97% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.5x | 44.58% | ★★★★☆☆ |

| Smart Parking | 70.7x | 6.2x | 47.74% | ★★★☆☆☆ |

| Integral Diagnostics | 157.8x | 1.8x | 41.69% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.7x | 40.91% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.5x | 23.27% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Autosports Group (ASX:ASG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Autosports Group operates in the motor vehicle retailing industry, specializing in the sale of new and used luxury vehicles, with a market cap of A$0.59 billion.

Operations: The company's revenue primarily stems from motor vehicle retailing, with a gross profit margin of 18.71% as of December 2024. Operating expenses have increased over time, reaching A$385.04 million, while non-operating expenses were A$79.32 million in the same period. The net income margin has shown variability, recorded at 1.35% by December 2024.

PE: 11.2x

Autosports Group, a small company in Asia, recently saw insider confidence with a purchase of 60,000 shares by an executive for A$102K. Despite reporting sales growth to A$1.37 billion for the half-year ending December 2024, net income dropped significantly from A$35.18 million to A$10.41 million compared to the previous year. The company's profit margin decreased from 2.5% to 1.3%, and its funding relies entirely on higher-risk external borrowing, though earnings are projected to grow annually by 11%.

- Unlock comprehensive insights into our analysis of Autosports Group stock in this valuation report.

Explore historical data to track Autosports Group's performance over time in our Past section.

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management firm that specializes in global equities and infrastructure, with a market capitalization of approximately A$4.67 billion.

Operations: Fund Investments and Segment Adjustment are key revenue streams, contributing significantly to the company's total revenue. The company has experienced fluctuations in its net income margin, with a notable peak of 69.63% in Q2 2022. Operating expenses include general and administrative costs, which have varied over time but recently stood at A$28.92 million by the end of 2024.

PE: 6.0x

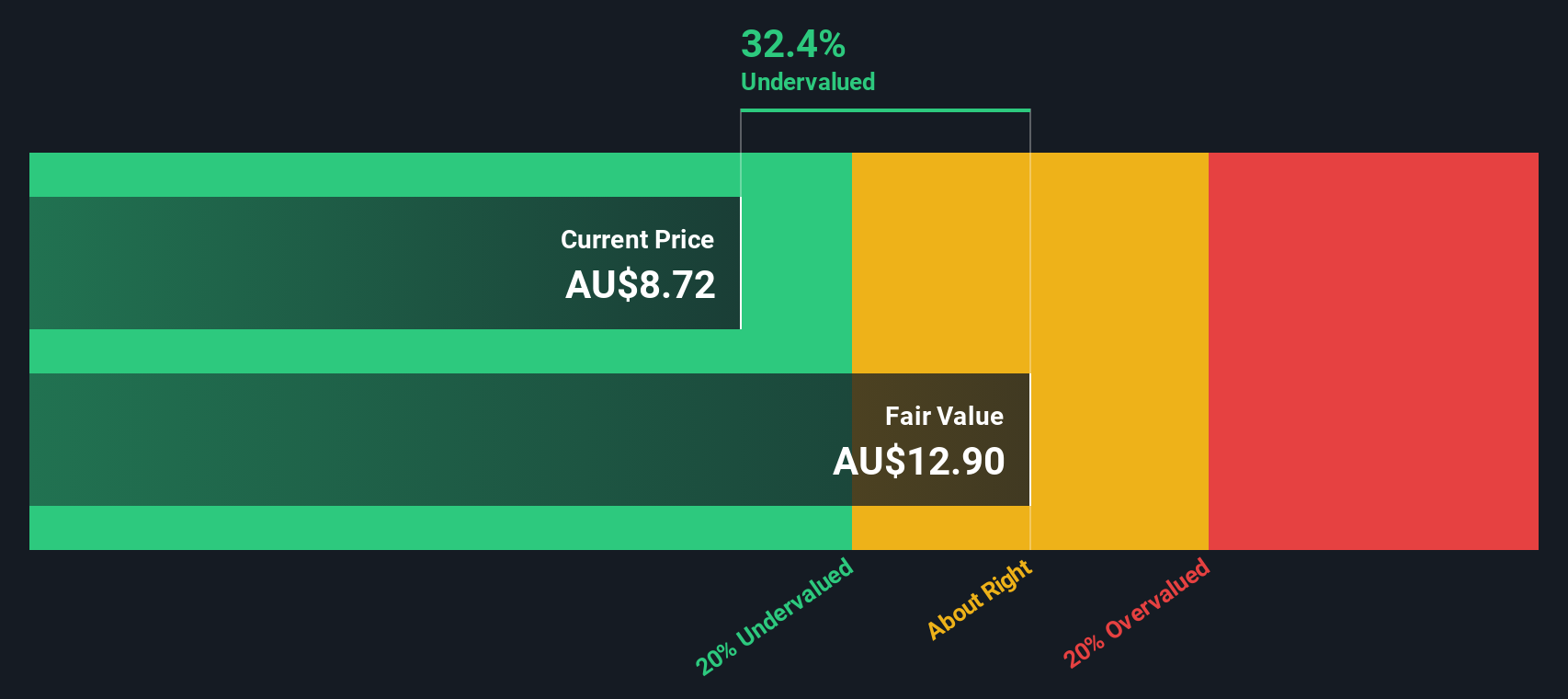

Magellan Financial Group, a smaller player in Asia's investment landscape, recently demonstrated insider confidence through significant share repurchases, totaling A$70.6 million for 6.9 million shares since March 2022. Despite earnings forecasted to decline by an average of 13% annually over the next three years, recent executive appointments aim to bolster strategic direction with experienced leaders like Ben McVicar and Ofer Karliner. While revenue rose to A$178.61 million for the half-year ending December 2024, net income dipped slightly compared to the previous year.

RFM (PSE:RFM)

Simply Wall St Value Rating: ★★☆☆☆☆

Overview: RFM Corporation is a food and beverage company in the Philippines, engaged in the manufacture and distribution of products such as pasta, milk, ice cream, and other consumer goods with a market capitalization of ₱15.25 billion.

Operations: RFM's revenue primarily comes from sales, with recent figures reaching ₱21.85 billion. The company has seen fluctuations in its gross profit margin, which was at 33.40% as of March 2025. Operating expenses are significant, with sales and marketing being a major component, amounting to ₱4.13 billion in the same period.

PE: 9.2x

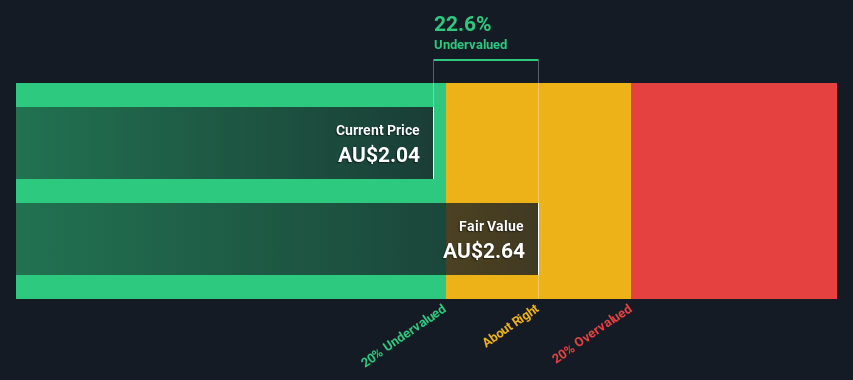

RFM, a small company in Asia, has shown insider confidence with recent share purchases. In the first quarter of 2025, they reported sales of PHP 4.5 billion and net income rising to PHP 310 million from PHP 200 million the previous year. The company also approved a total cash dividend of PHP 400 million for the year. Despite relying on external borrowing for funding, their earnings growth and dividends suggest potential value for investors seeking opportunities in smaller companies.

- Click to explore a detailed breakdown of our findings in RFM's valuation report.

Gain insights into RFM's past trends and performance with our Past report.

Key Takeaways

- Unlock more gems! Our Undervalued Asian Small Caps With Insider Buying screener has unearthed 63 more companies for you to explore.Click here to unveil our expertly curated list of 66 Undervalued Asian Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:RFM

RFM

Engages in milling, manufacturing, and marketing food and beverage products in the Philippines and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives