- Taiwan

- /

- Metals and Mining

- /

- TPEX:6175

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets respond to recent political shifts and economic policy changes, investors are witnessing significant movements across major indices, with U.S. stocks rallying on growth and tax hopes following the election. Amidst these evolving market dynamics, dividend stocks can offer a stable income stream and potential for capital appreciation, making them an appealing choice for those looking to enhance their portfolios in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

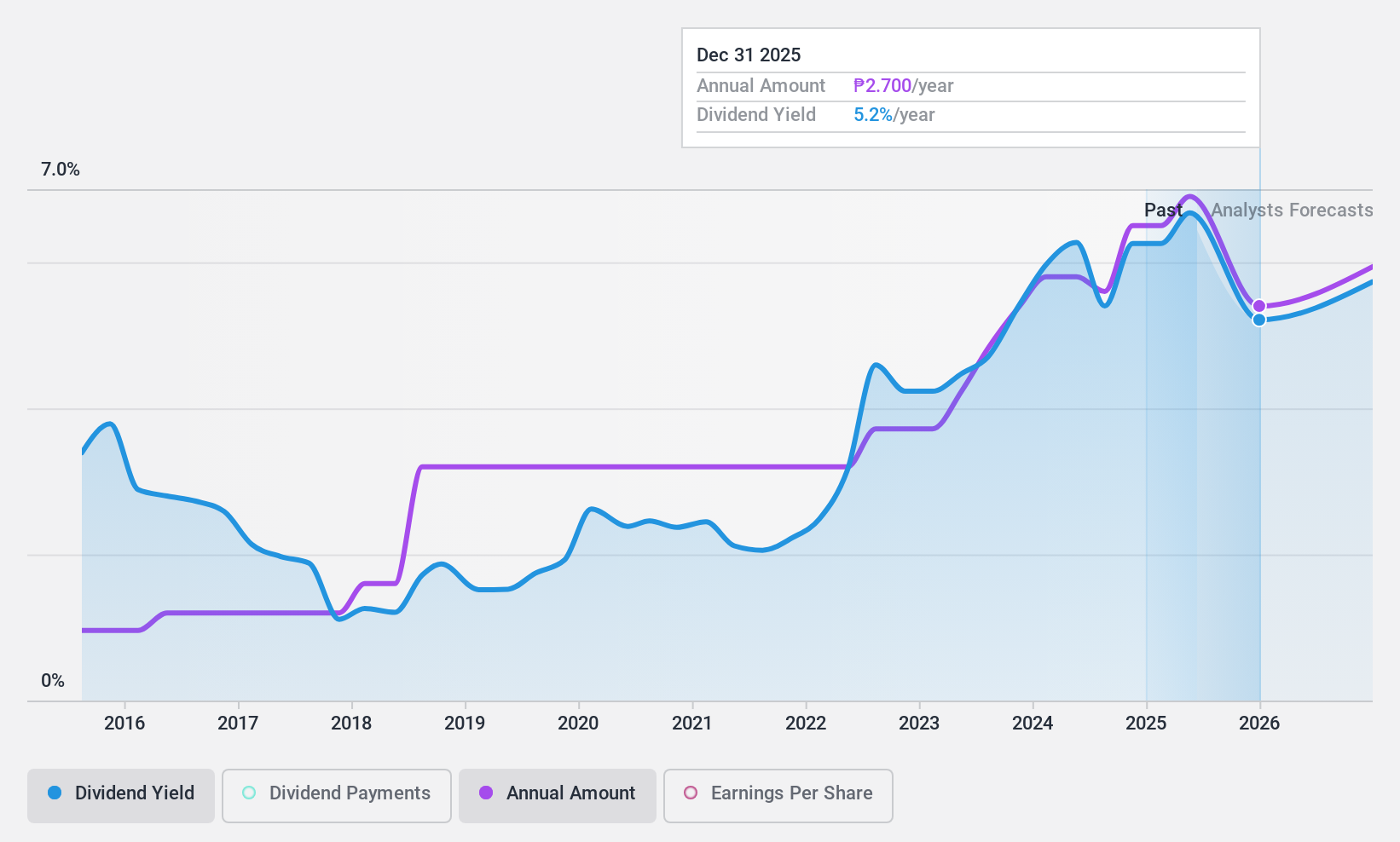

San Miguel Food and Beverage (PSE:FB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: San Miguel Food and Beverage, Inc. is a company that provides processed meat products with a market cap of ₱321.46 billion.

Operations: San Miguel Food and Beverage, Inc. generates its revenue from three main segments: Food with ₱181.60 billion, Spirits with ₱58.23 billion, and Beer and Non-Alcoholic Beverage with ₱148.30 billion.

Dividend Yield: 5.1%

San Miguel Food and Beverage has consistently increased its dividends over the past decade, supported by stable earnings growth of 20.2% last year. Its dividends are well-covered with a payout ratio of 41.9% and a cash payout ratio of 51.8%, indicating sustainability. Although its dividend yield of 5.15% is below the top tier in the Philippine market, recent approvals for regular and special cash dividends signal continued commitment to shareholder returns.

- Click here to discover the nuances of San Miguel Food and Beverage with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, San Miguel Food and Beverage's share price might be too pessimistic.

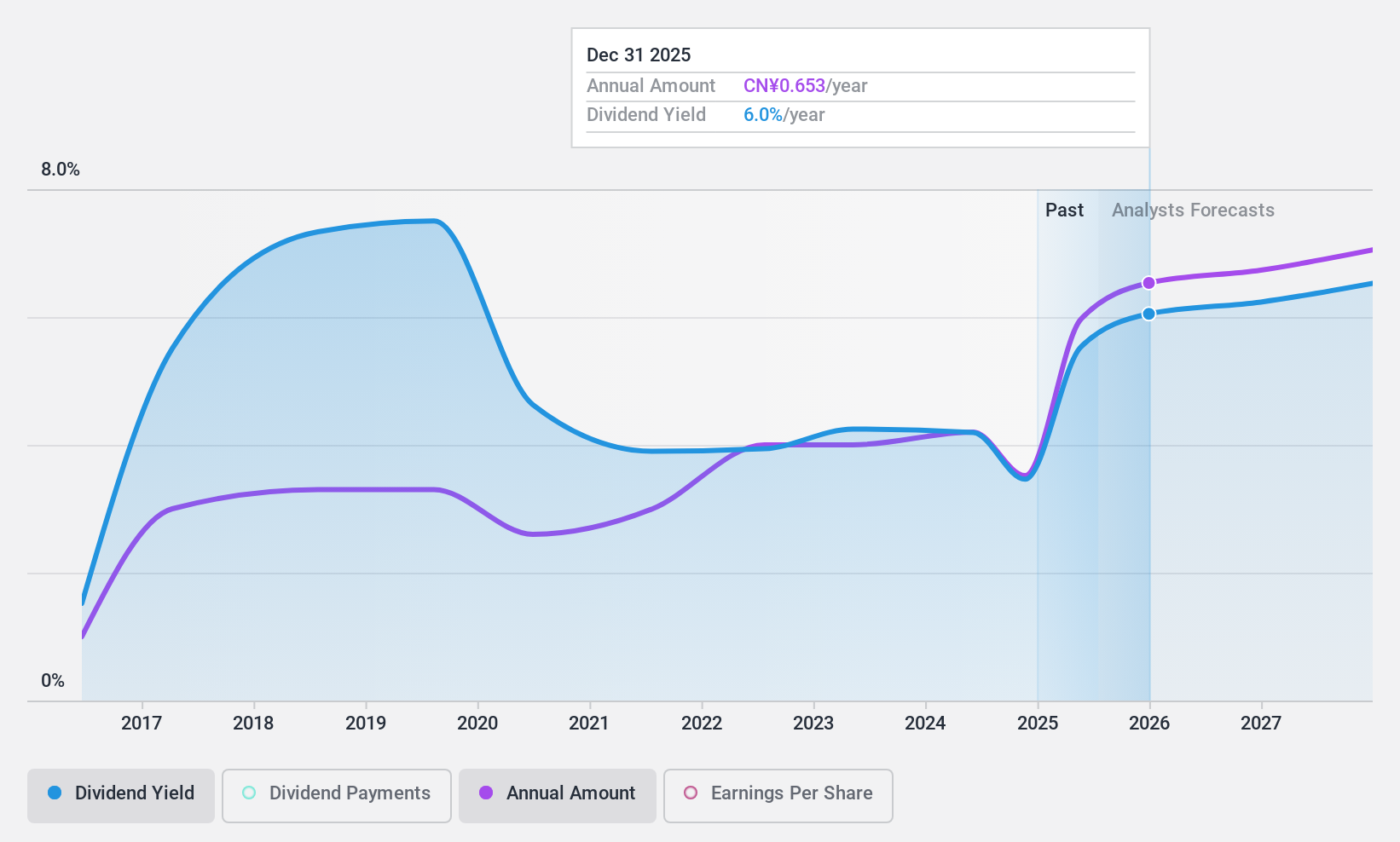

MeiHua Holdings GroupLtd (SHSE:600873)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MeiHua Holdings Group Co., Ltd is a synthetic biology company that offers amino acid nutrition and health solutions both in China and internationally, with a market cap of CN¥28.98 billion.

Operations: MeiHua Holdings Group Co., Ltd generates its revenue through the provision of amino acid nutrition and health solutions on a global scale.

Dividend Yield: 4.1%

MeiHua Holdings Group's dividend yield of 4.13% ranks in the top 25% of CN market payers, supported by a sustainable payout ratio of 40.8% and cash payout ratio of 44.7%. However, its dividend history has been volatile over the past decade. The company is trading at a significant discount to fair value and has announced a CNY 500 million share buyback program, reflecting an effort to enhance shareholder value amidst recent earnings declines.

- Click here and access our complete dividend analysis report to understand the dynamics of MeiHua Holdings GroupLtd.

- Our valuation report unveils the possibility MeiHua Holdings GroupLtd's shares may be trading at a discount.

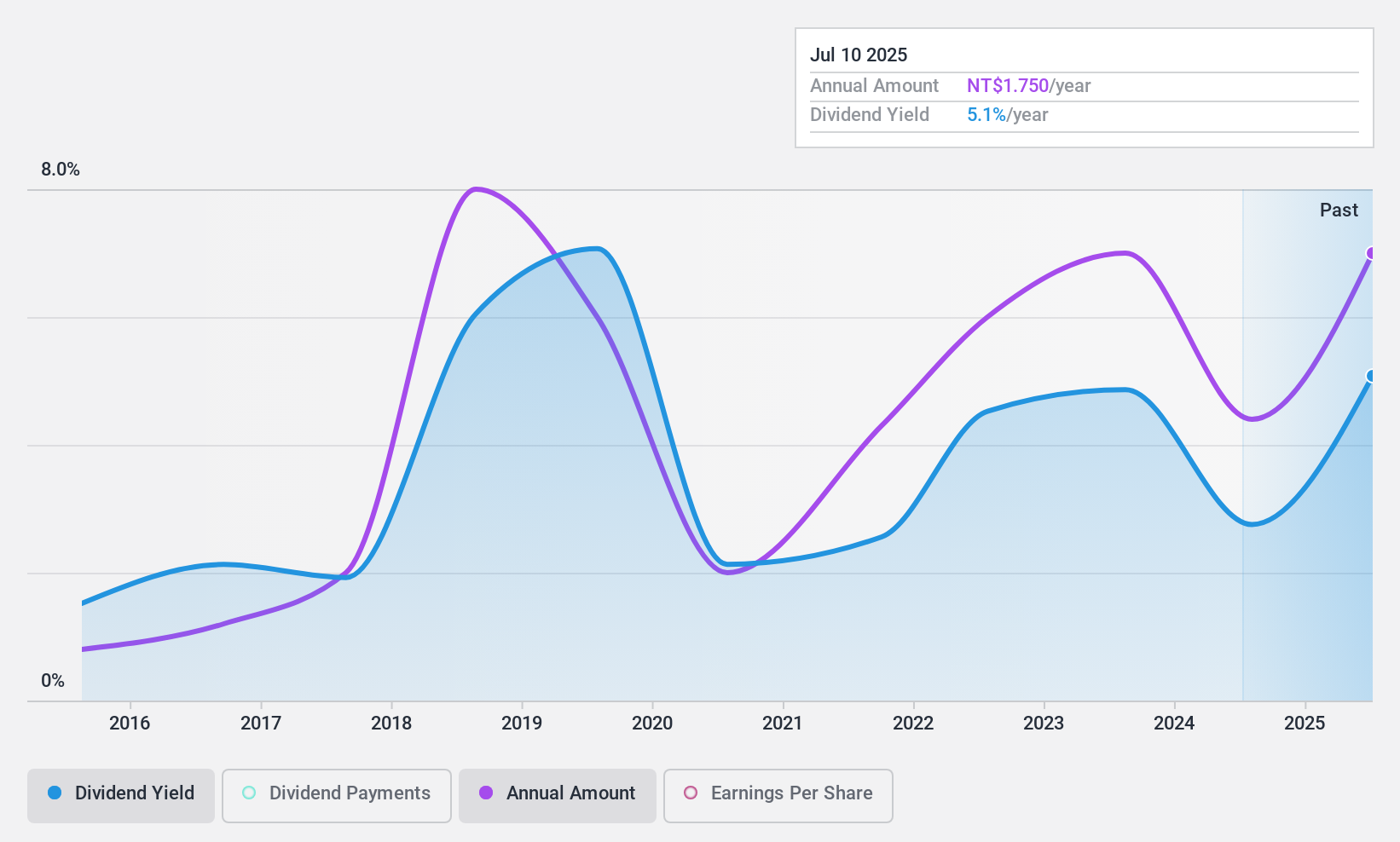

Liton Technology (TPEX:6175)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liton Technology Corp. manufactures and sells etched and formed aluminum foils across Taiwan, Mainland China, Europe, the Americas, Japan, Korea, India, and Southeast Asia with a market cap of NT$5.38 billion.

Operations: Liton Technology Corp.'s revenue is primarily derived from its operations in China (NT$4.57 billion) and Taiwan (NT$1.14 billion).

Dividend Yield: 3.1%

Liton Technology's dividend yield of 3.05% is below the top tier in Taiwan, with a payout ratio of 42.2% indicating earnings coverage, though cash flow coverage is tighter at 89.4%. Despite an increase in dividends over the past decade, payments have been volatile and unreliable. The company's price-to-earnings ratio of 15.3x suggests it is undervalued compared to the TW market average, potentially offering value for investors seeking growth amidst fluctuating dividend stability.

- Unlock comprehensive insights into our analysis of Liton Technology stock in this dividend report.

- Our expertly prepared valuation report Liton Technology implies its share price may be too high.

Where To Now?

- Delve into our full catalog of 1939 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6175

Liton Technology

Manufactures and sells etched and formed aluminum foils in Mainland China, Europe, the Americas, Japan, Korea, India, Southeast Asia, Malaysia, Indonesia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives