- Philippines

- /

- Hospitality

- /

- PSE:LOTO

3 Penny Stocks With Market Caps At Least US$80M To Watch

Reviewed by Simply Wall St

As global markets approach record highs with broad-based gains, investors are increasingly turning their attention to smaller-cap stocks, which have been outperforming their larger counterparts. Penny stocks, a term that may seem outdated but remains relevant, typically refer to shares of smaller or newer companies that offer potential growth opportunities at lower price points. When these stocks are supported by strong financial health and solid fundamentals, they can present unique opportunities for investors seeking under-the-radar companies with promising prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.21 | £832.65M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.36 | £173.2M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.21 | £418.71M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$147.7M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,782 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pacific Online Systems (PSE:LOTO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pacific Online Systems Corporation, with a market cap of ₱2.48 billion, designs, develops, and manages online computer systems, terminals, and software for the gaming industry in the Philippines.

Operations: The company generates revenue of ₱520.19 million from its leasing activities.

Market Cap: ₱2.48B

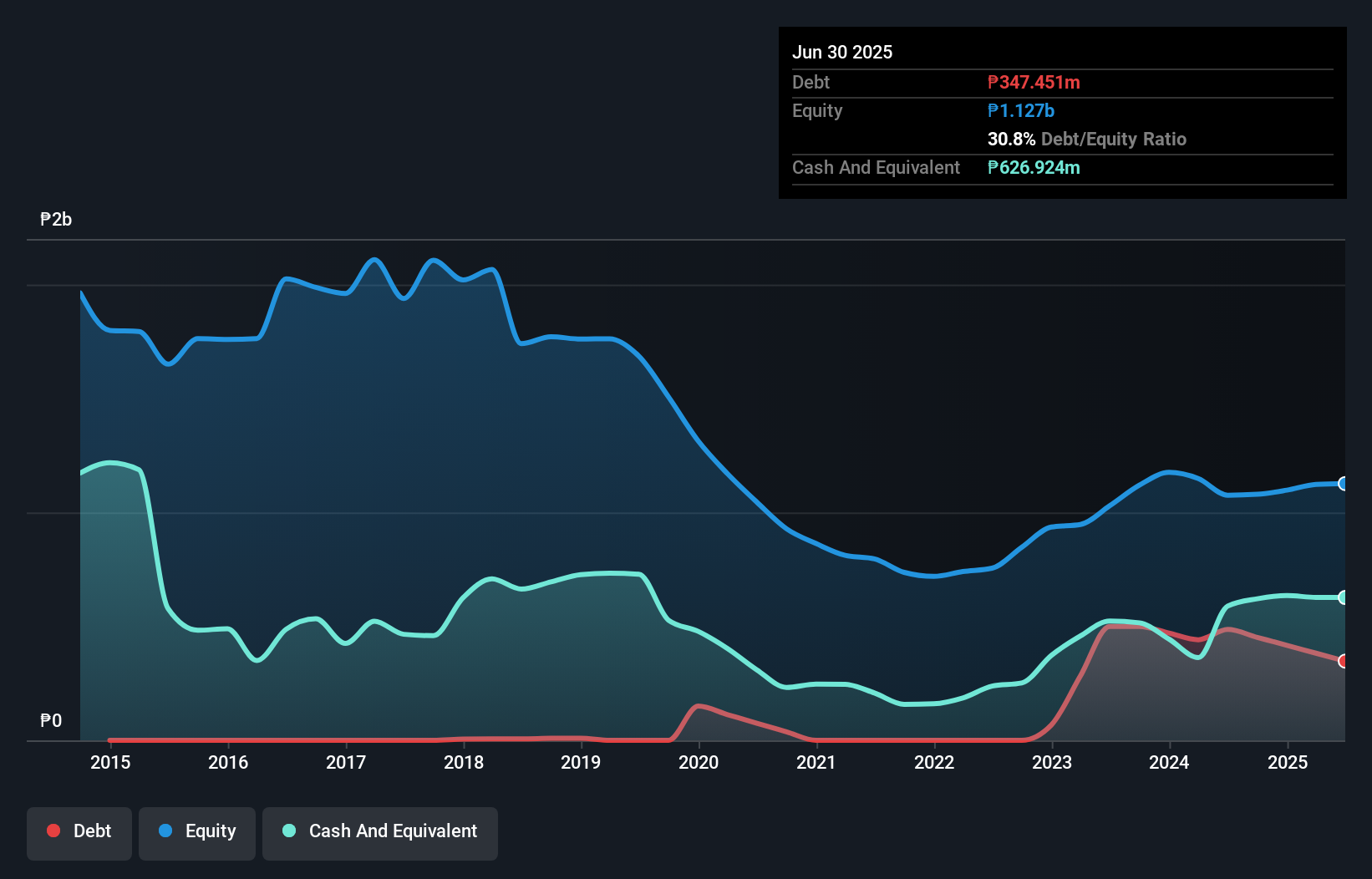

Pacific Online Systems Corporation, with a market cap of ₱2.48 billion, is currently trading significantly below its estimated fair value. Despite having more cash than total debt and short-term assets exceeding both short and long-term liabilities, the company's financial performance has been under pressure. Recent earnings reports show declining revenue and net income compared to the previous year, impacted by large one-off gains. The management team is experienced but faces challenges with low return on equity and negative earnings growth over the past year. Recent executive changes may influence future strategic direction as Ms. Dioville M. Villarias becomes CFO permanently.

- Get an in-depth perspective on Pacific Online Systems' performance by reading our balance sheet health report here.

- Understand Pacific Online Systems' track record by examining our performance history report.

Zhonghua Gas Holdings (SEHK:8246)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhonghua Gas Holdings Limited is an investment holding company that offers integrated energy services in the People's Republic of China, with a market cap of HK$689.38 million.

Operations: The company generates revenue primarily from its Energy Business, which accounts for CN¥123.07 million, and also has a smaller contribution from Property Investments at CN¥0.17 million.

Market Cap: HK$689.38M

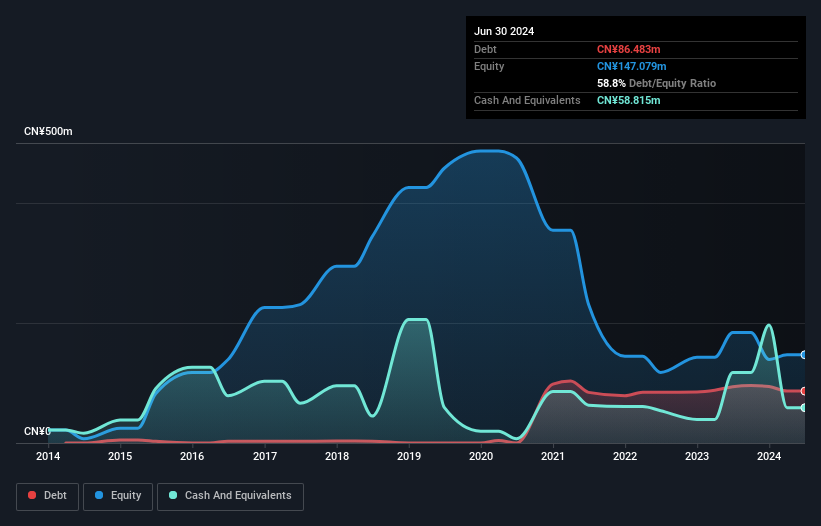

Zhonghua Gas Holdings Limited, with a market cap of HK$689.38 million, primarily generates revenue from its Energy Business (CN¥123.07 million) and has minimal contribution from Property Investments (CN¥0.17 million). The company is currently unprofitable, with losses increasing at 6.2% annually over the past five years. Despite this, its net debt to equity ratio is satisfactory at 18.8%, and it maintains a stable cash runway for over a year based on current free cash flow levels. Short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management amidst ongoing financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhonghua Gas Holdings.

- Gain insights into Zhonghua Gas Holdings' past trends and performance with our report on the company's historical track record.

Eureka Design (SET:UREKA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eureka Design Public Company Limited, along with its subsidiaries, is involved in the production and distribution of water and raw materials in Thailand and internationally, with a market cap of THB1 billion.

Operations: The company generates revenue from two main segments: producing and selling plastic pellets, which accounts for THB173.60 million, and producing and selling drinking and raw water, contributing THB96.71 million.

Market Cap: THB1B

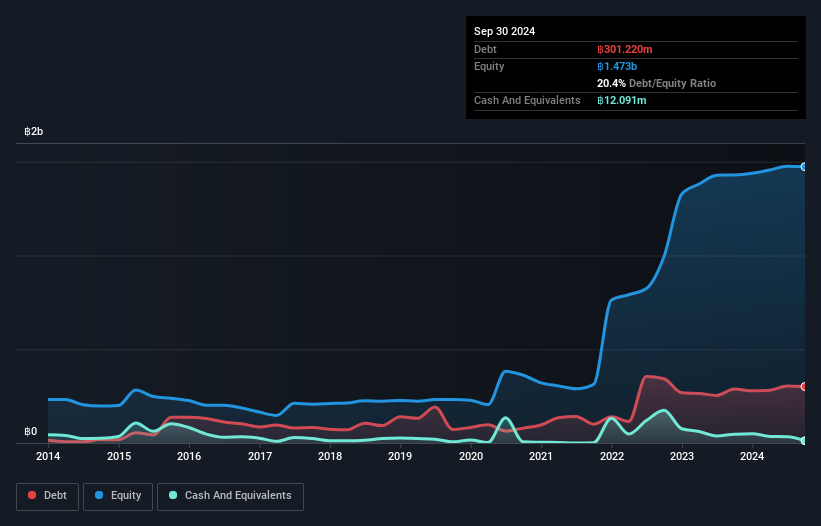

Eureka Design, with a market cap of THB1 billion, is experiencing financial challenges. Despite its stable short-term liquidity and satisfactory net debt to equity ratio of 19.6%, the company reported a third-quarter net loss of THB3.01 million, reversing from last year's profit. Revenue from plastic pellets and water sales totals THB270.31 million annually but has declined compared to the previous year, contributing to negative earnings growth of -13.2%. While its board and management team are experienced, return on equity remains low at 3.2%, indicating limited profitability improvements despite high-quality earnings in recent years.

- Click here to discover the nuances of Eureka Design with our detailed analytical financial health report.

- Learn about Eureka Design's historical performance here.

Key Takeaways

- Embark on your investment journey to our 5,782 Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:LOTO

Pacific Online Systems

Designs, develops, and manages online computer systems, terminals, and software for the gaming industry in the Philippines.

Adequate balance sheet slight.