- Philippines

- /

- Renewable Energy

- /

- PSE:SPNEC

Discovering December 2024's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty marked by cautious Federal Reserve commentary and political tensions, smaller-cap indexes have felt the pressure more acutely, with broad-based declines reflecting investor caution. Amid these challenges, discerning investors may find opportunities in lesser-known stocks that exhibit resilience and potential for growth despite broader market headwinds. Identifying such undiscovered gems often involves looking for companies with strong fundamentals and innovative strategies that can weather economic fluctuations and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.27% | -7.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

SP New Energy (PSE:SPNEC)

Simply Wall St Value Rating: ★★★★★★

Overview: SP New Energy Corporation is engaged in electricity production with a market capitalization of approximately ₱51.58 billion.

Operations: SP New Energy generates revenue primarily from its Sp Tarlac segment, contributing ₱468.51 million. The company has adjustments amounting to ₱7.19 million and a significant segment adjustment of ₱811.77 million, which impacts its overall financial performance.

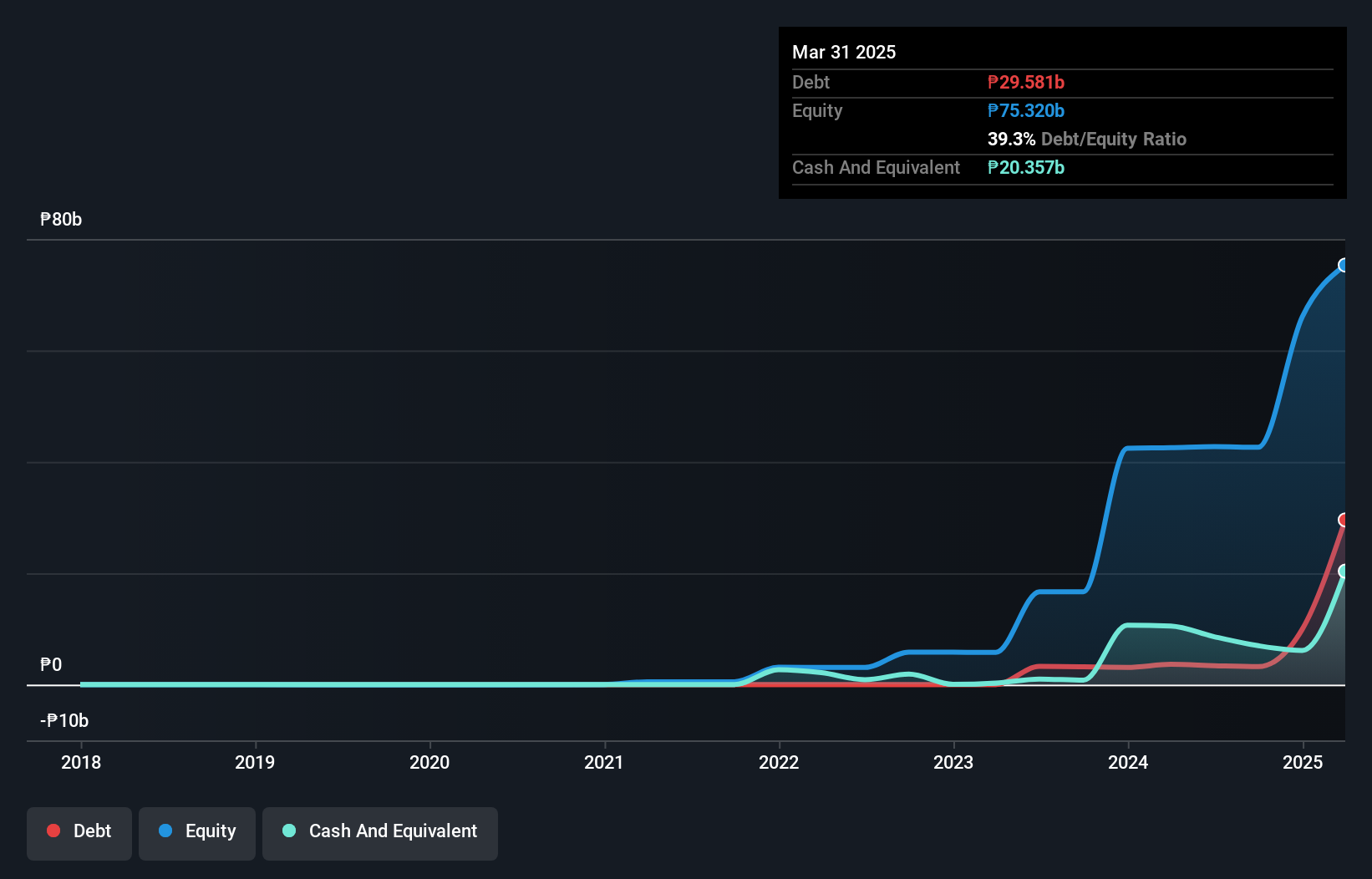

SP New Energy, a promising player in the renewable energy sector, has shown notable progress by becoming profitable this year, though its net loss for the recent quarter was PHP 252.28 million compared to a net income of PHP 14.45 million last year. With a price-to-earnings ratio of 9.2x below the industry average and high-quality earnings, it seems well-positioned financially despite shareholder dilution over the past year. The company has more cash than total debt and earns sufficient interest to cover payments, suggesting financial stability as it navigates strategic investments like those in Terra Solar Philippines and Terra Nueva Inc.

- Get an in-depth perspective on SP New Energy's performance by reading our health report here.

Assess SP New Energy's past performance with our detailed historical performance reports.

Universal Microwave Technology (TPEX:3491)

Simply Wall St Value Rating: ★★★★★☆

Overview: Universal Microwave Technology, Inc. operates in the microwave and millimeter wave wireless communication industry across Taiwan, China, Asia, Europe, the United States, and Oceania with a market capitalization of NT$21.06 billion.

Operations: The company's primary revenue streams are derived from Microwave/Millimeter Wave Products and Radio Frequency Products, contributing NT$1.26 billion and NT$1.06 billion respectively. Communications Network Engineering Services add an additional NT$214.58 million to the revenue mix.

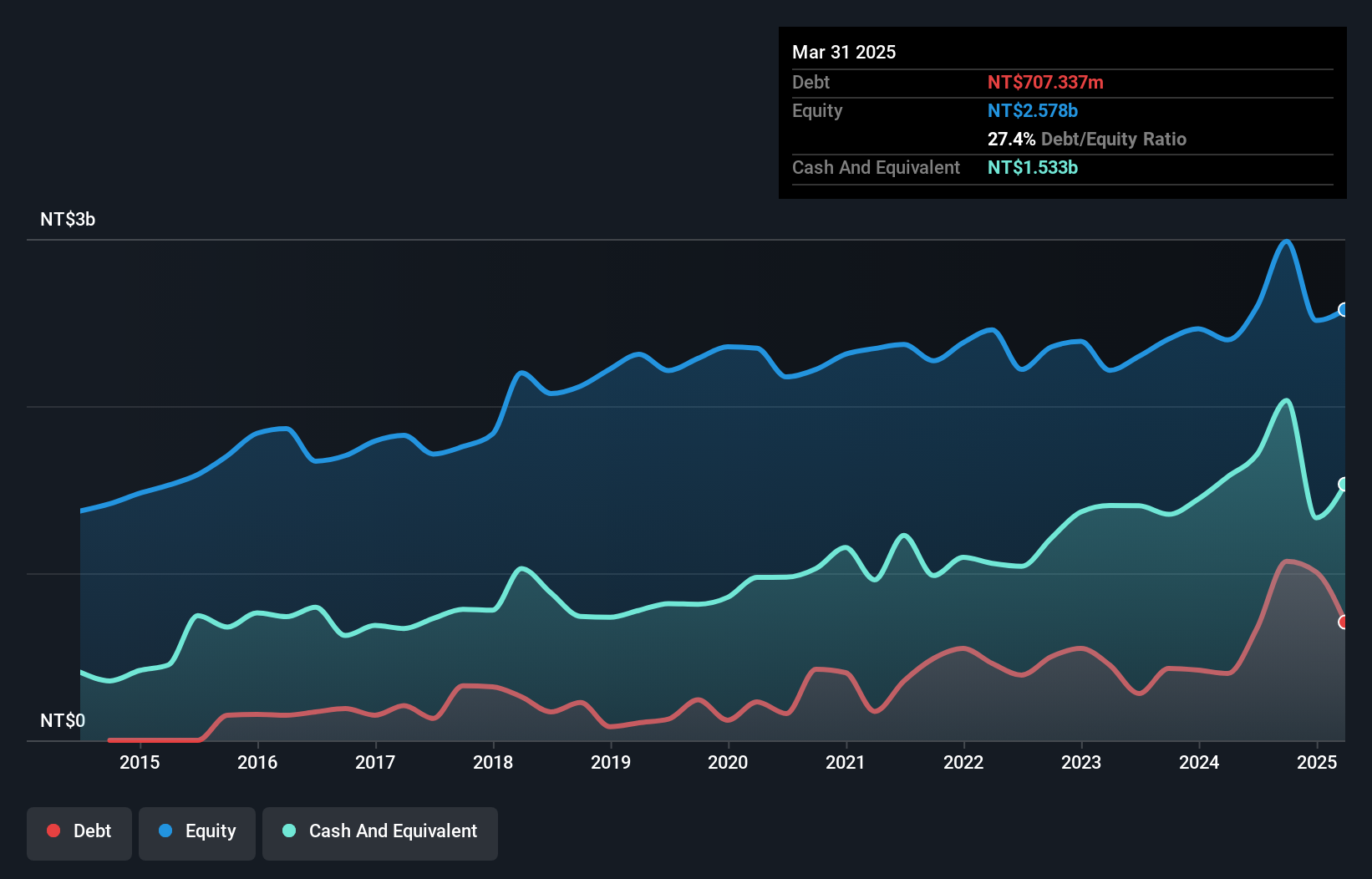

Universal Microwave Technology, a smaller player in the electronics sector, has shown impressive growth with earnings surging by 108.7% over the past year, outpacing the industry's 6.6%. The company reported third-quarter sales of TWD 639.64 million, significantly up from TWD 375.53 million last year, and net income jumped to TWD 132.43 million from TWD 45.94 million previously. With more cash than total debt and positive free cash flow, financial stability seems solid despite a rising debt-to-equity ratio now at 35.9%. Earnings per share also improved to TWD 2.07 from TWD 0.73 year-on-year for basic EPS.

Ace Pillar (TWSE:8374)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ace Pillar Co., Ltd. is an industrial automation company that distributes automatic mechatronics components both in Taiwan and internationally, with a market capitalization of NT$16.84 billion.

Operations: The company's revenue streams are primarily driven by its Mainland Operations Department, contributing NT$1.07 billion, and the Taiwan Operations Department, adding NT$950.44 million. The Energy Saving/Storage Department and Semiconductor Equipment Sales and Service Division generate NT$451.09 million and NT$528.54 million respectively.

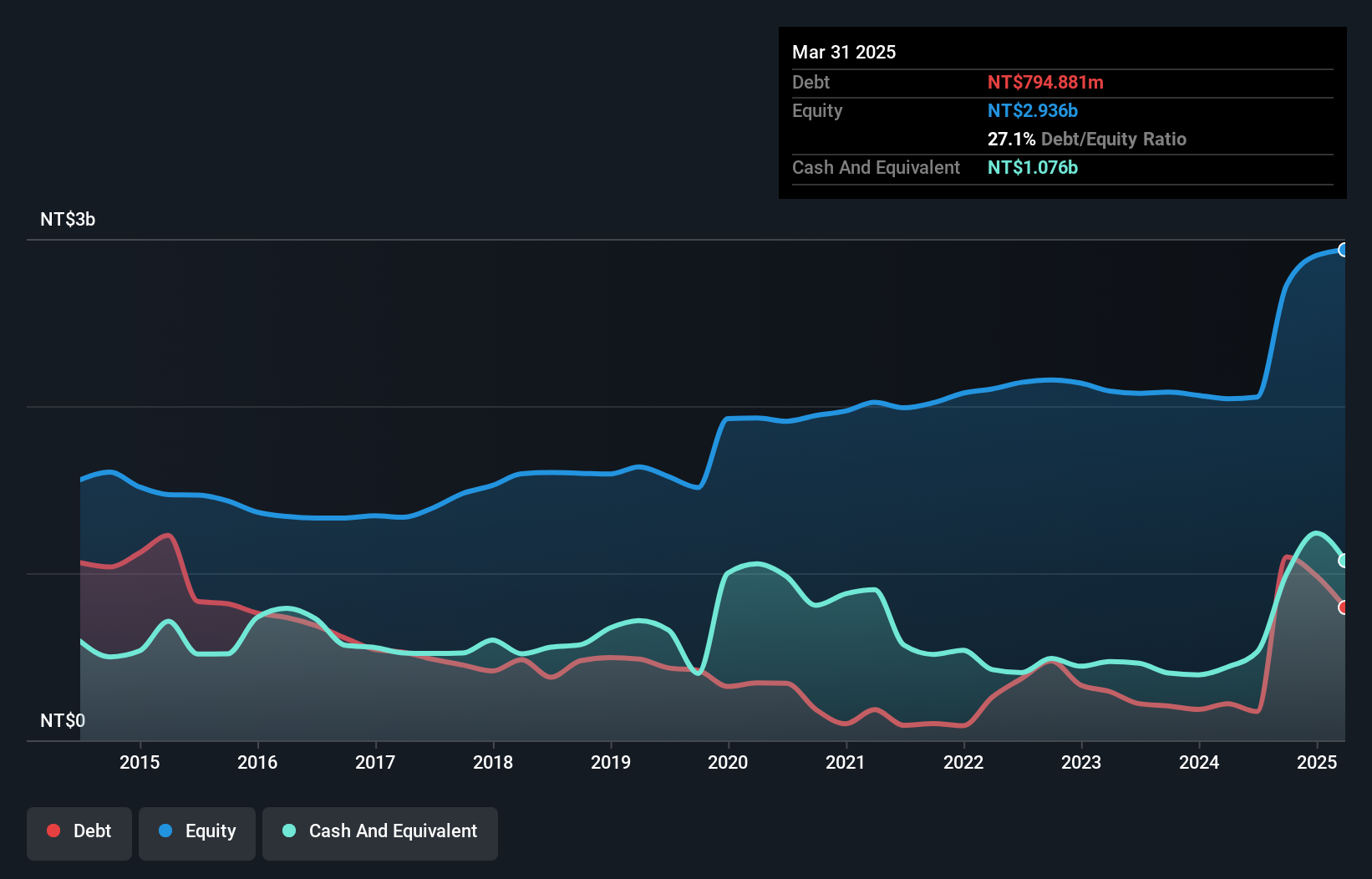

Ace Pillar has made strides in profitability, evident from its recent earnings report. For the third quarter of 2024, sales reached TWD 995.8 million, a notable increase from TWD 780.09 million the previous year. The company turned around its net income to TWD 16.23 million compared to a net loss of TWD 17.57 million last year, showcasing improved financial health with basic earnings per share at TWD 0.15 versus a loss per share of TWD 0.16 previously. Despite recent volatility in its stock price and executive changes, Ace Pillar's performance suggests resilience and adaptability in challenging market conditions.

- Take a closer look at Ace Pillar's potential here in our health report.

Review our historical performance report to gain insights into Ace Pillar's's past performance.

Taking Advantage

- Click here to access our complete index of 4633 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SPNEC

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives