- Philippines

- /

- Real Estate

- /

- PSE:SLI

Uncovering 3 Undiscovered Gems For A Stronger Portfolio

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced notable challenges, with indices like the S&P 600 experiencing pressures from cautious Federal Reserve commentary and broader economic uncertainties. Despite these hurdles, opportunities remain for investors to enhance their portfolios by identifying lesser-known stocks that possess strong fundamentals and growth potential. In this context, a good stock is often characterized by its resilience in volatile markets and its ability to capitalize on emerging trends or sectors poised for recovery.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sta. Lucia Land (PSE:SLI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sta. Lucia Land, Inc. is involved in real estate development in the Philippines and has a market capitalization of ₱24.06 billion.

Operations: Sta. Lucia Land generates revenue primarily from residential development, contributing ₱8.68 billion, and leasing activities, which add ₱745.38 million to its income stream.

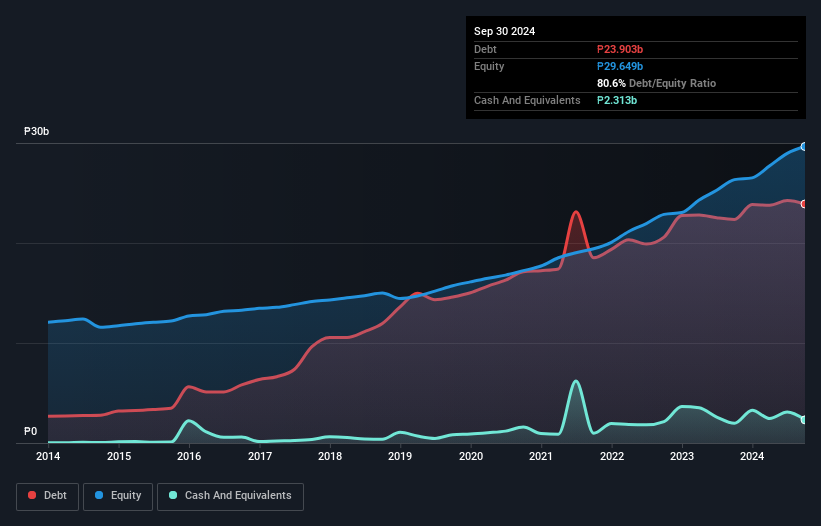

Sta. Lucia Land, a notable player in the real estate sector, has shown steady growth with earnings increasing 19.7% annually over the past five years. The company features a favorable price-to-earnings ratio of 6.2x compared to the Philippine market's 9.2x, indicating potential value for investors. Despite high net debt to equity at 72.8%, interest payments are well covered by EBIT at 5.9x, suggesting manageable financial obligations. Recent results show mixed performance with third-quarter sales rising slightly to PHP 193 million but annual revenue growing significantly to PHP 9 billion from PHP 8 billion last year, reflecting robust operational capabilities amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Sta. Lucia Land's health report.

Understand Sta. Lucia Land's track record by examining our Past report.

Jiangsu Tongrun Equipment TechnologyLtd (SZSE:002150)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Tongrun Equipment Technology Co., Ltd specializes in the production and sale of metal tool cabinets in China, with a market capitalization of approximately CN¥4.68 billion.

Operations: Tongrun Equipment generates revenue primarily from the sale of metal tool cabinets in China. The company's net profit margin has shown variability, reflecting changes in production costs and market conditions.

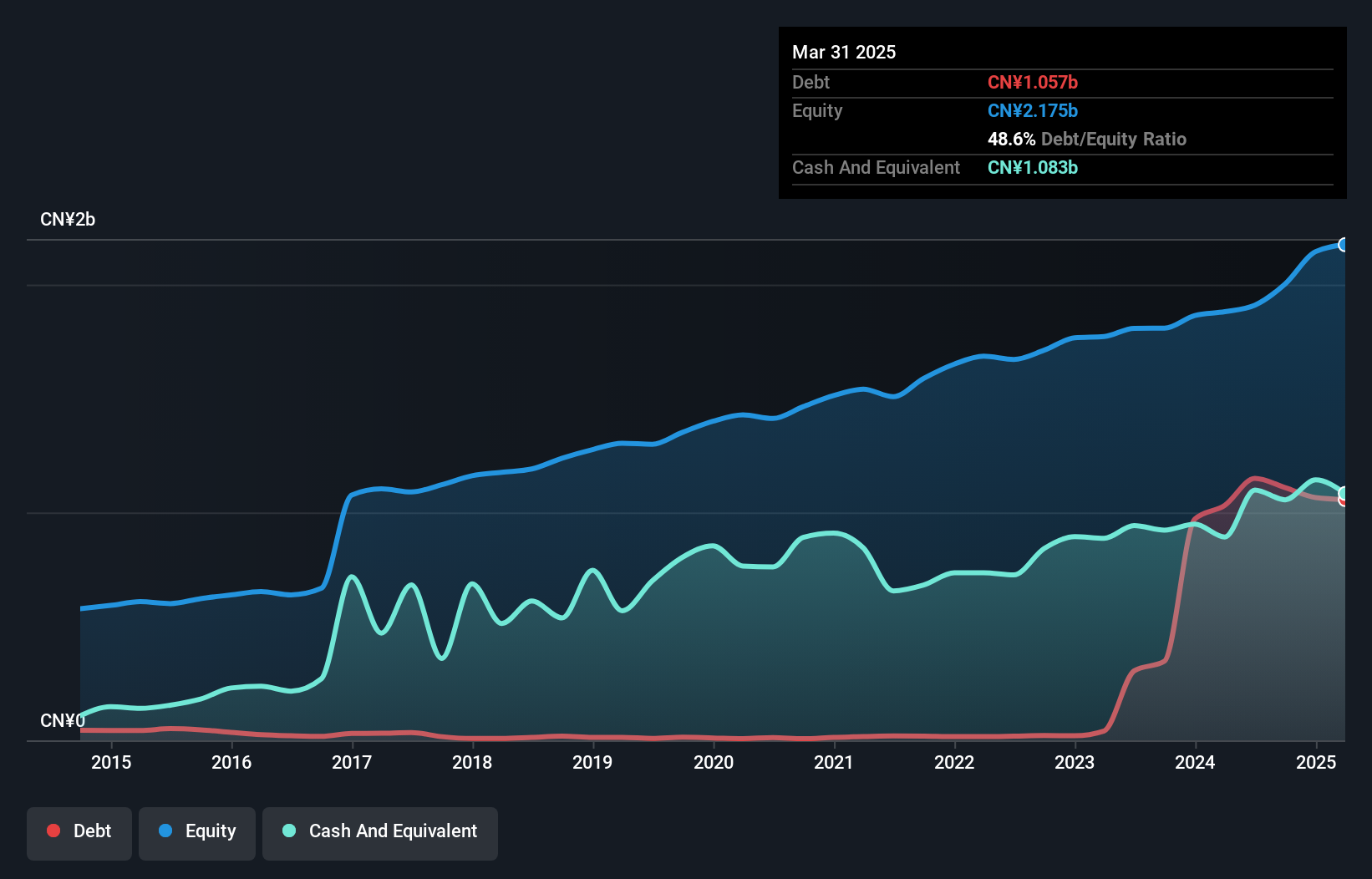

Jiangsu Tongrun has shown impressive growth, with earnings surging 90.8% over the past year, significantly outpacing the Consumer Durables industry. The company's net income for the first nine months of 2024 reached CN¥107.43 million, compared to CN¥42.72 million a year earlier, reflecting robust performance despite a one-off gain of CN¥222.7 million impacting results. While its debt to equity ratio increased from 1% to 55.4% over five years, interest payments are well covered by EBIT at 11.7 times coverage, indicating sound financial management amidst rising leverage concerns and ongoing investor activism efforts around related party transactions.

SeirenLtd (TSE:3569)

Simply Wall St Value Rating: ★★★★★★

Overview: Seiren Co., Ltd. is a company that produces and sells vehicle parts, textile products, industrial machines, and electronic parts both in Japan and globally, with a market cap of ¥166.72 billion.

Operations: Seiren Ltd. generates revenue through the sale of vehicle parts, textile products, industrial machines, and electronic parts in both domestic and international markets. The company's market capitalization stands at ¥166.72 billion.

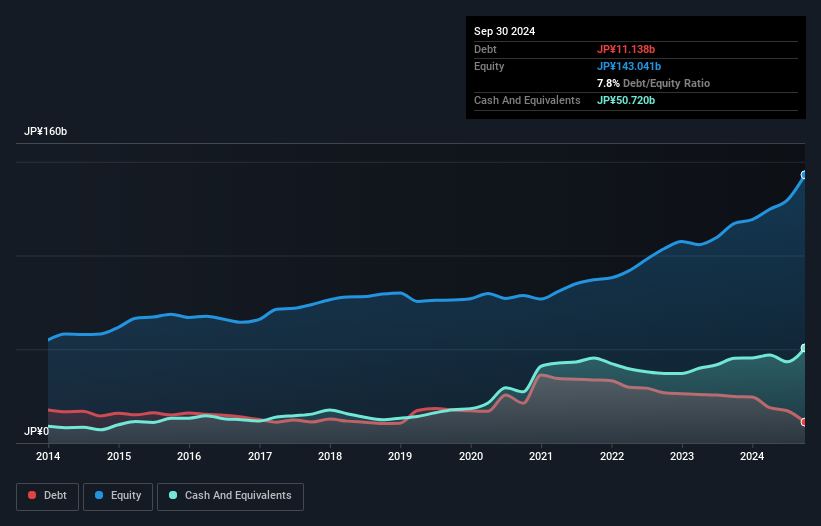

Seiren Ltd., a promising player in its sector, has demonstrated solid financial health with a debt to equity ratio decreasing from 23.1% to 7.8% over five years and more cash than total debt. The company is trading at 37% below its estimated fair value, suggesting potential undervaluation. Earnings have grown by 13%, outpacing the industry’s average of 3.8%. Recent news highlights include an increase in dividends to ¥30 per share and completion of a share buyback program worth ¥1,343.98 million for nearly 0.99% of shares, reflecting confidence in its financial stability and future prospects.

- Click here and access our complete health analysis report to understand the dynamics of SeirenLtd.

Gain insights into SeirenLtd's historical performance by reviewing our past performance report.

Taking Advantage

- Click this link to deep-dive into the 4625 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SLI

Sta. Lucia Land

Engages in the real estate development business in the Philippines.

Adequate balance sheet with acceptable track record.