- Philippines

- /

- Consumer Services

- /

- PSE:FEU

Discover 3 Dividend Stocks Yielding Up To 5.1%

Reviewed by Simply Wall St

In recent weeks, global markets have been navigating a complex landscape marked by tariff uncertainties and mixed economic data, with U.S. stocks experiencing some volatility due to trade tensions and labor market shifts. Amid these fluctuations, dividend stocks can offer investors a measure of stability and income potential, especially in times when market conditions are unpredictable. A good dividend stock typically combines a strong financial foundation with consistent payout histories, making them appealing for those seeking reliable returns in uncertain economic climates.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.31% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

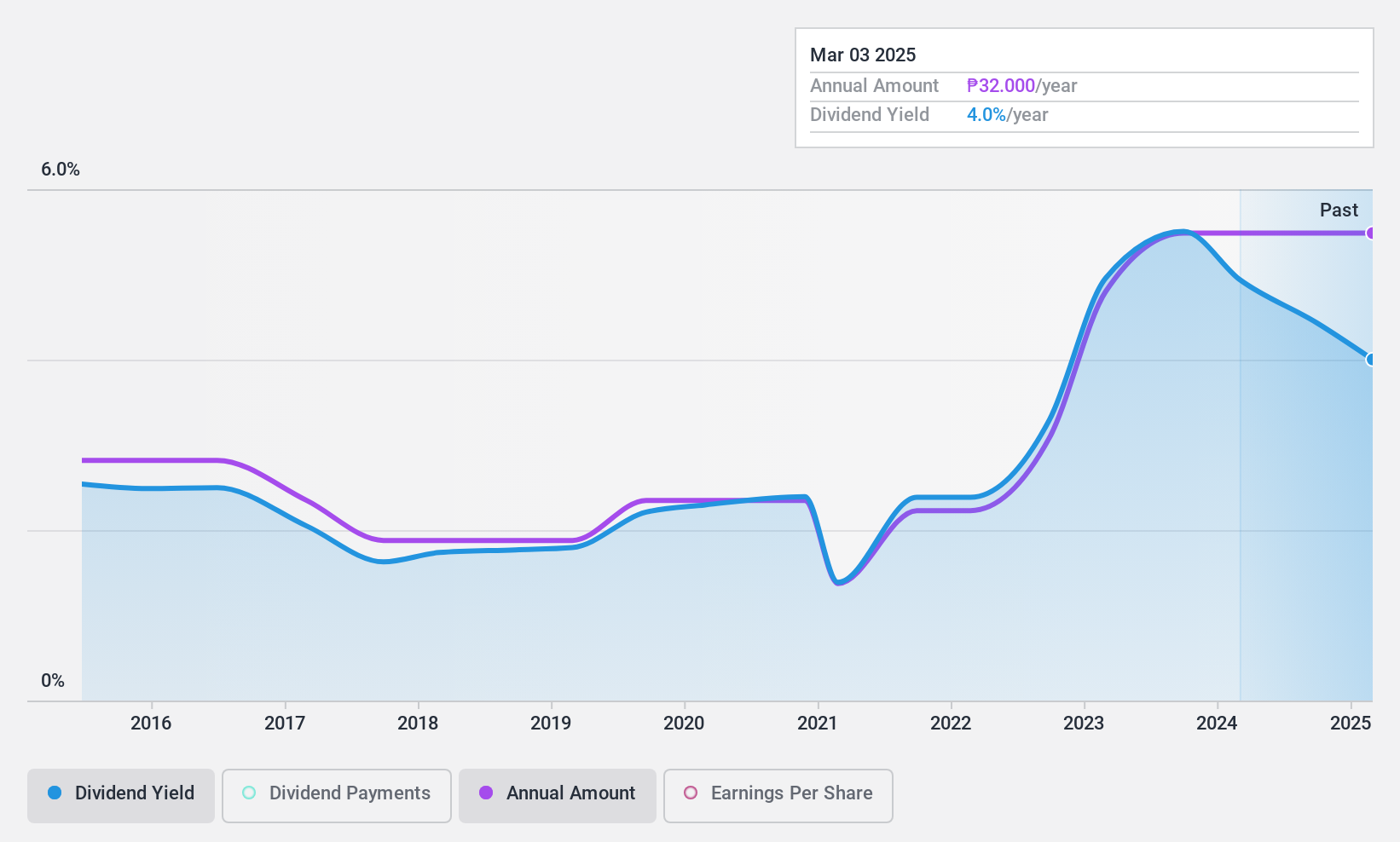

Far Eastern University (PSE:FEU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Far Eastern University, Incorporated operates the Far Eastern University in Manila, the Philippines, with a market cap of ₱18.64 billion.

Operations: Far Eastern University, Incorporated generates revenue primarily from its main campus (₱2.91 billion), other schools (₱907.22 million), and trimestral schools (₱1.80 billion).

Dividend Yield: 4.1%

Far Eastern University has demonstrated consistent earnings growth, with a 23.7% annual increase over the past five years, supporting its dividend payments. Despite trading at 18% below estimated fair value and having a low payout ratio of 38.7%, its dividend yield of 4.1% remains below the top tier in the Philippine market. The dividends are covered by earnings and cash flows but have been historically volatile, raising concerns about their reliability despite recent increases.

- Click here to discover the nuances of Far Eastern University with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Far Eastern University is priced lower than what may be justified by its financials.

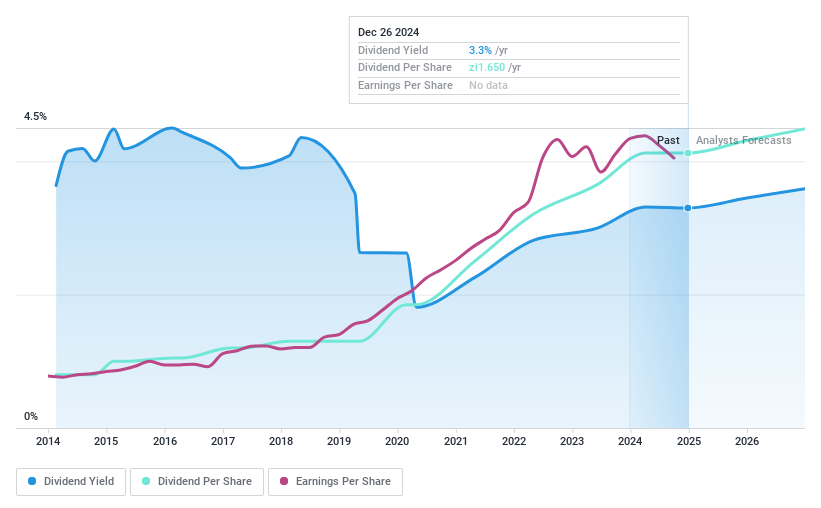

Asseco South Eastern Europe (WSE:ASE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asseco South Eastern Europe S.A., with a market cap of PLN2.59 billion, operates by selling its own and third-party software through its subsidiaries.

Operations: Asseco South Eastern Europe S.A.'s revenue is primarily derived from three segments: Banking Solutions (PLN311.90 million), Payment Solutions (PLN854.27 million), and Dedicated Solutions (PLN580.41 million).

Dividend Yield: 3.3%

Asseco South Eastern Europe offers a reliable dividend yield of 3.3%, although it falls short of the top tier in Poland. The dividends have been stable and growing over the past decade, supported by a manageable payout ratio of 45.8% and cash flow coverage at 58.1%. With a price-to-earnings ratio of 13.9x, below the IT industry average, ASE maintains sustainable dividend payments backed by consistent earnings and cash flow stability.

- Unlock comprehensive insights into our analysis of Asseco South Eastern Europe stock in this dividend report.

- The analysis detailed in our Asseco South Eastern Europe valuation report hints at an inflated share price compared to its estimated value.

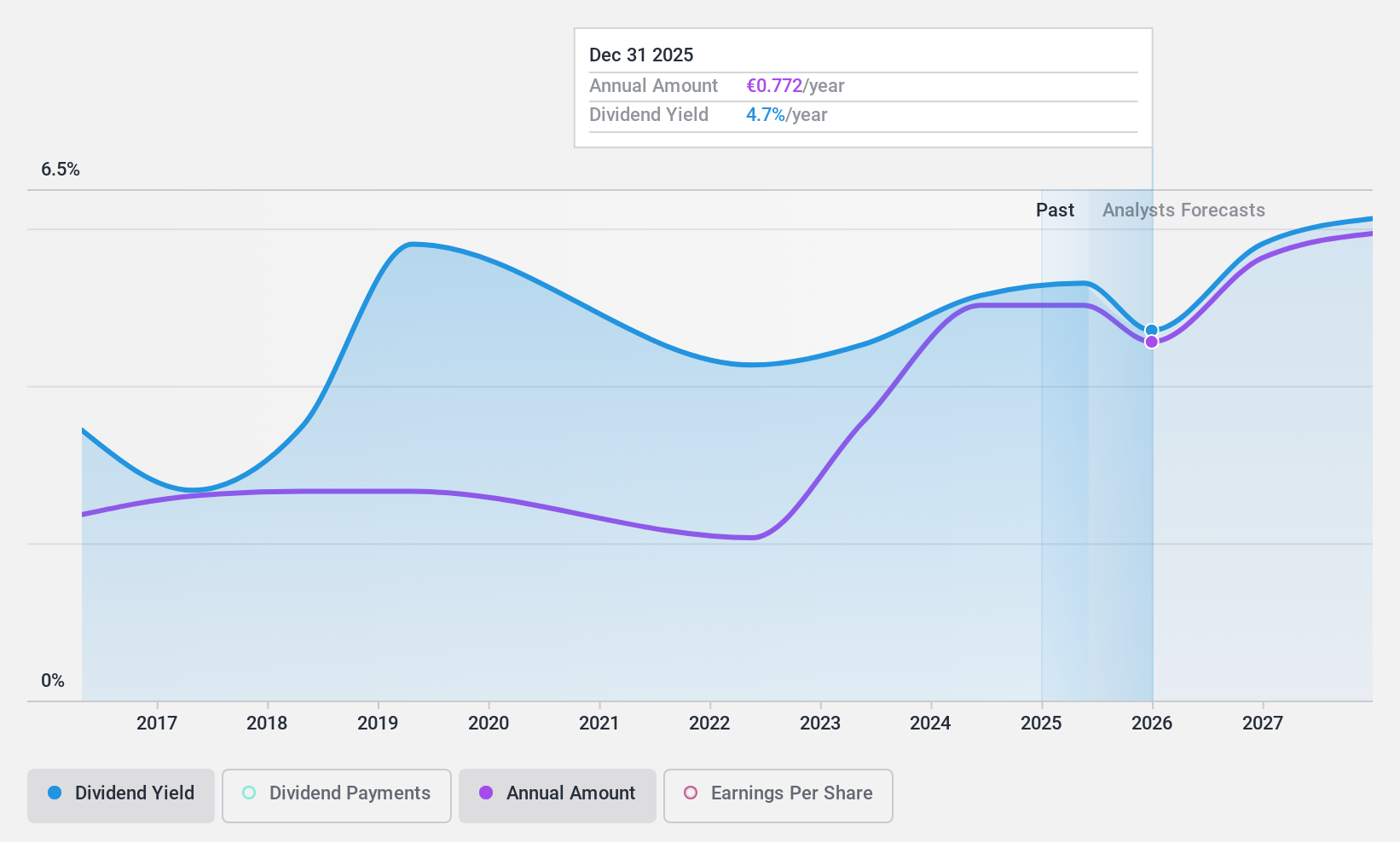

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses with a market cap of €748.10 million.

Operations: SAF-Holland SE generates its revenue from three primary segments: €798.85 million from the Americas, €256.11 million from Asia/Pacific (APAC)/China/India, and €914.68 million from Europe, the Middle East, and Africa (EMEA).

Dividend Yield: 5.2%

SAF-Holland's dividend yield of 5.16% ranks in the top 25% of German dividend payers, supported by a sustainable payout ratio of 50% and cash flow coverage at 31.4%. However, its dividend history is marked by volatility and unreliability over the past decade despite overall growth. Trading at a significant discount to estimated fair value, SAF-Holland's financial position is challenged by high debt levels, though earnings are expected to grow annually.

- Click here and access our complete dividend analysis report to understand the dynamics of SAF-Holland.

- Insights from our recent valuation report point to the potential undervaluation of SAF-Holland shares in the market.

Make It Happen

- Gain an insight into the universe of 1972 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:FEU

Far Eastern University

Operates the Far Eastern University in Manila, the Philippines.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives