- Japan

- /

- Tech Hardware

- /

- TSE:6413

Uncovering None's Hidden Gems Three Promising Small Caps

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by geopolitical tensions and competitive pressures in the technology sector, with the U.S. Federal Reserve maintaining steady interest rates amidst solid economic activity and persistent inflation. Amid these broader market dynamics, small-cap stocks often present unique opportunities for growth as they can be more agile and responsive to changing economic environments, making them potential hidden gems for investors looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Ningbo Sinyuan Zm Technology | NA | 18.08% | 9.75% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 19.07% | 20.23% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Philippine Seven (PSE:SEVN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Philippine Seven Corporation operates convenience stores in the Philippines with a market capitalization of approximately ₱98.33 billion.

Operations: Philippine Seven generates revenue primarily from store operations, totaling approximately ₱88.61 billion.

Philippine Seven, a notable player in the consumer retail sector, has demonstrated robust financial performance. Its earnings growth of 26% over the past year outpaced the industry average of 8.8%, highlighting its competitive edge. The company's debt management appears strong, with a debt-to-equity ratio dropping from 12.4% to just 1% over five years and interest payments well-covered at 6.3x EBIT. Recent earnings reports show revenue climbing to PHP 22 billion for Q3 2024 from PHP 19.54 billion previously, while net income increased to PHP 813 million from PHP 720 million, indicating solid profitability and operational efficiency improvements.

- Click here to discover the nuances of Philippine Seven with our detailed analytical health report.

Understand Philippine Seven's track record by examining our Past report.

Sakata INX (TSE:4633)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sakata INX Corporation manufactures and sells a range of printing inks and auxiliary agents both in Japan and internationally, with a market cap of ¥85.72 billion.

Operations: Sakata INX generates revenue primarily from the sale of printing inks and auxiliary agents. The company's financial performance includes a focus on managing costs associated with production and distribution, impacting its profitability metrics.

With a market position that seems undervalued, Sakata INX offers a compelling case for exploration. Trading at 66.7% below its estimated fair value, it presents an attractive opportunity in the chemicals sector. Despite earnings growth of 13.3% over the past year not surpassing the industry average of 13.7%, its five-year annual growth rate stands at a robust 14.9%. The company's net debt to equity ratio is satisfactory at 8.1%, indicating sound financial health, while interest payments are well-covered by EBIT with a coverage ratio of 57x, suggesting strong operational efficiency and potential resilience in future market conditions.

- Delve into the full analysis health report here for a deeper understanding of Sakata INX.

Explore historical data to track Sakata INX's performance over time in our Past section.

Riso Kagaku (TSE:6413)

Simply Wall St Value Rating: ★★★★★☆

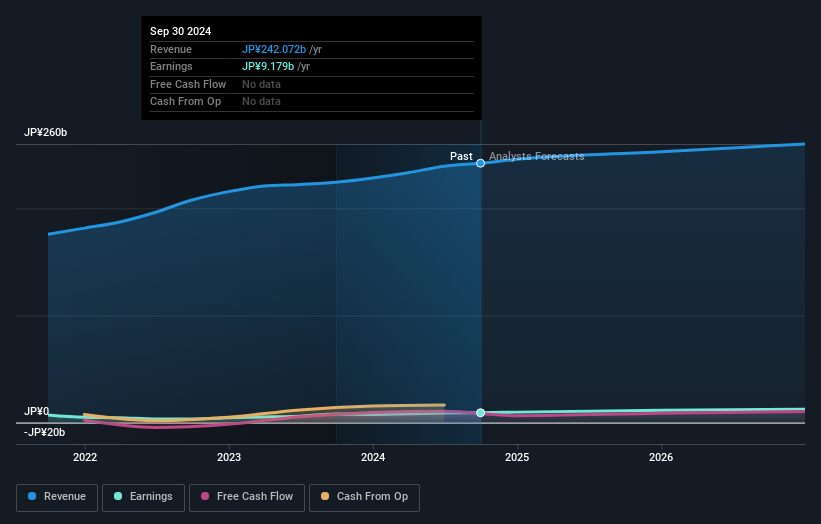

Overview: Riso Kagaku Corporation engages in the printing equipment and real estate sectors, among other businesses, both domestically and internationally, with a market cap of ¥88.69 billion.

Operations: Riso Kagaku generates revenue primarily from its printing equipment and real estate sectors. The company has a market cap of ¥88.69 billion, reflecting its diversified business operations both in Japan and internationally.

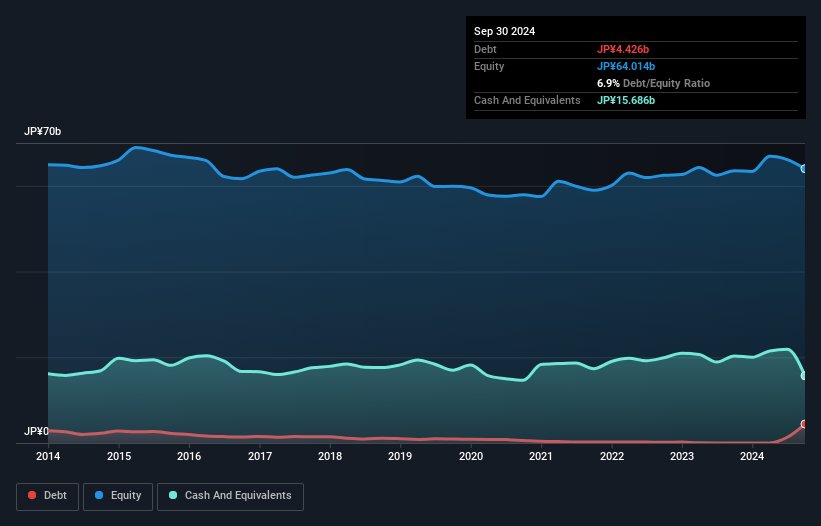

Riso Kagaku, a smaller player in the market, has recently announced a share repurchase program worth ¥800 million to buy back up to 660,000 shares or 1.02% of its issued capital. This move aims to adapt its capital policy and reward shareholders amidst changing business conditions. Over the past five years, the company's debt-to-equity ratio climbed from 1.5 to 6.8, indicating increased leverage but still maintaining more cash than total debt. Additionally, Riso’s earnings growth of 1.3% last year slightly surpassed the tech industry average of 1.1%, highlighting its steady performance within the sector.

- Unlock comprehensive insights into our analysis of Riso Kagaku stock in this health report.

Evaluate Riso Kagaku's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 4668 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6413

Riso Kagaku

Operates in the printing equipment, real estate, and other businesses in Japan and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives