- Australia

- /

- Auto Components

- /

- ASX:PWH

Exploring 3 Undervalued Small Caps In Asian Markets With Insider Buying

Reviewed by Simply Wall St

Amidst a backdrop of easing trade tensions and mixed economic signals, Asian markets have experienced varied performances, with some small-cap indices showing resilience despite global uncertainties. As investors navigate these complex dynamics, identifying stocks that demonstrate strong fundamentals and potential insider confidence can be particularly compelling.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.5x | 1.0x | 39.39% | ★★★★★★ |

| Puregold Price Club | 8.7x | 0.4x | 30.66% | ★★★★★☆ |

| Atturra | 28.9x | 1.2x | 36.45% | ★★★★★☆ |

| Hansen Technologies | 286.6x | 2.8x | 24.29% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 26.18% | ★★★★★☆ |

| Dicker Data | 19.3x | 0.7x | -36.42% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.6x | 43.55% | ★★★★☆☆ |

| PWR Holdings | 35.9x | 5.0x | 24.29% | ★★★☆☆☆ |

| Integral Diagnostics | 155.2x | 1.8x | 44.61% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.7x | 40.91% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

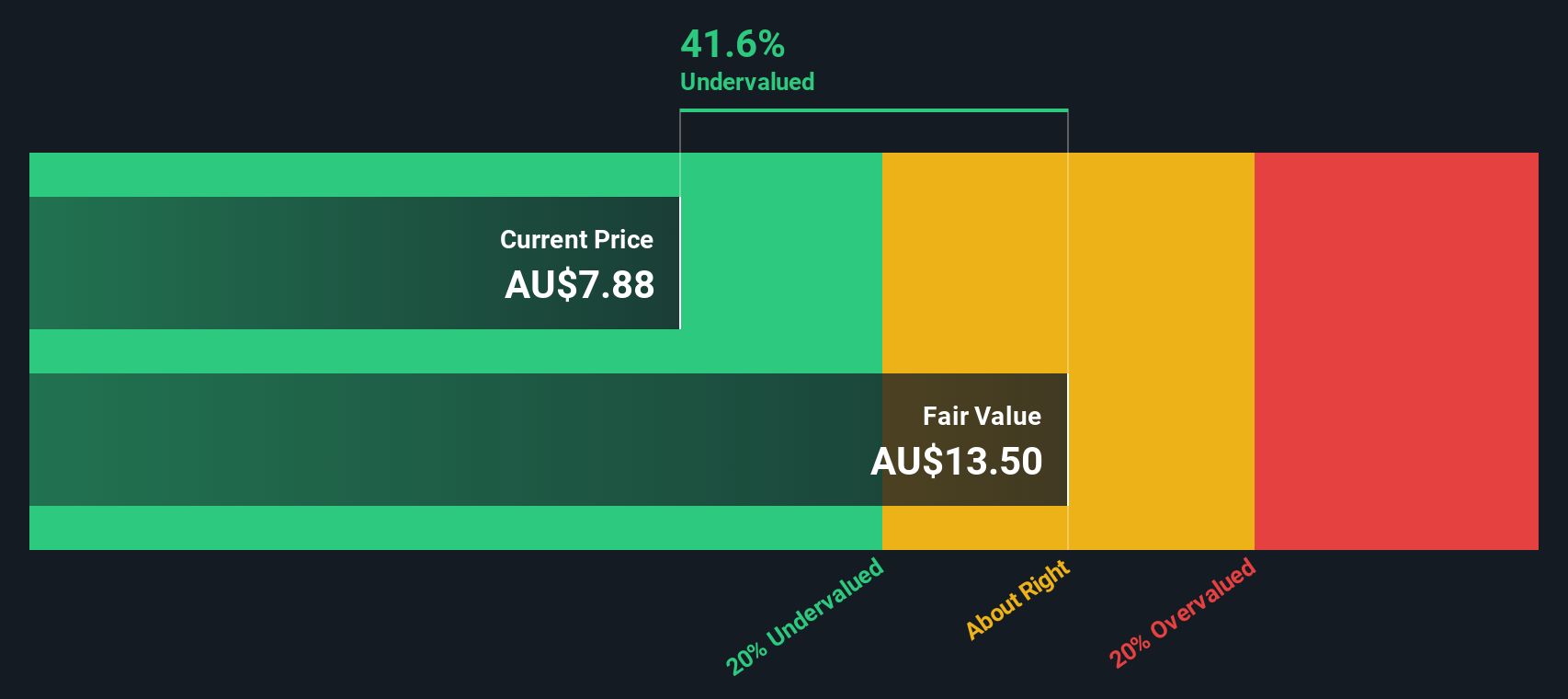

Amotiv (ASX:AOV)

Simply Wall St Value Rating: ★★★★★★

Overview: Amotiv focuses on manufacturing and distributing automotive components, including powertrain and undercar systems, lighting power and electrical products, as well as 4WD accessories and trailering solutions, with a market cap of A$2.45 billion.

Operations: The company's revenue streams are derived from Powertrain & Undercar, Lighting Power & Electrical, and 4WD Accessories & Trailering segments. Over recent periods, the gross profit margin has shown fluctuations, reaching 45.24% in December 2023 before decreasing to 43.92% by December 2024.

PE: 13.2x

Amotiv, a small company in Asia, is drawing attention due to its potential for growth despite some challenges. The company's earnings are forecasted to grow 13% annually, reflecting positive prospects. Recent insider confidence is evident with share purchases from January to March 2025. However, reliance on external borrowing poses higher risk compared to customer deposits. Sales increased slightly to A$503 million for the half-year ending December 2024, though net income dropped significantly from A$50 million to A$33 million.

- Delve into the full analysis valuation report here for a deeper understanding of Amotiv.

Understand Amotiv's track record by examining our Past report.

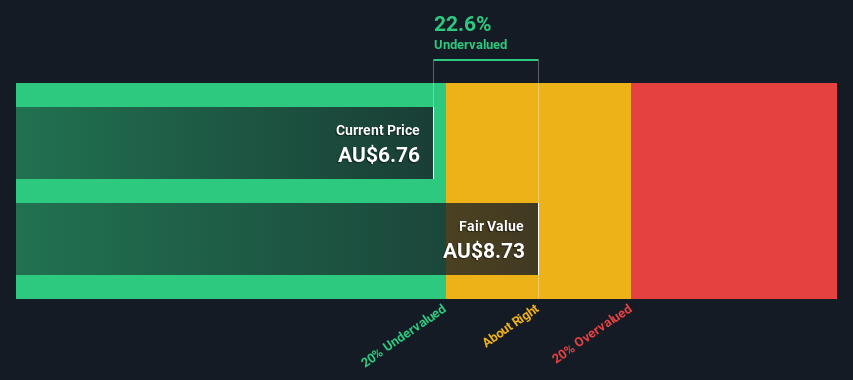

PWR Holdings (ASX:PWH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PWR Holdings is an Australian company specializing in the design and manufacture of advanced cooling solutions, with a market capitalization of approximately A$1.31 billion.

Operations: PWR Holdings generates revenue primarily from its PWR Performance Products segment, contributing A$109.04 million, and the PWR C&R segment with A$46.48 million. The company's gross profit margin has shown a trend of fluctuation, reaching 79.70% as of September 2024 before slightly decreasing to 79.69% by December 2024. Operating expenses are significant, with general and administrative expenses being the largest component at A$64.24 million in December 2024.

PE: 35.9x

PWR Holdings, a small company in Asia, has caught attention due to recent insider confidence with Kristen Podagiel purchasing 20,341 shares for A$128,897. Despite a decrease in net income from A$9.78 million to A$4.08 million for the half-year ending December 2024 and reduced sales of A$62.9 million compared to the previous year, earnings are projected to grow by 24.66% annually. The company faces higher risk funding due to reliance on external borrowing rather than customer deposits.

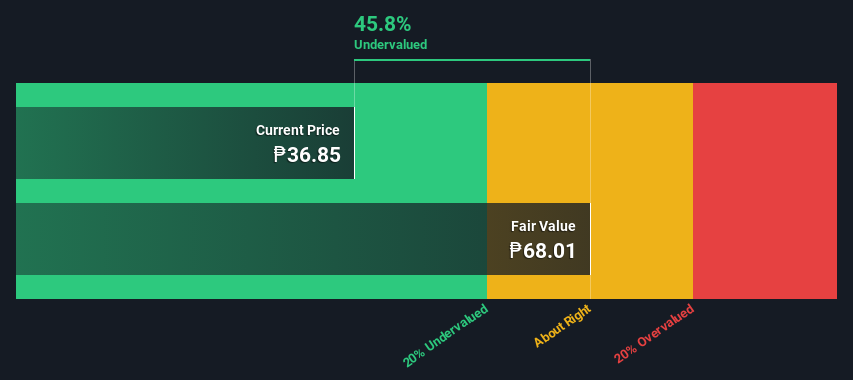

Robinsons Retail Holdings (PSE:RRHI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Robinsons Retail Holdings operates a diverse range of retail segments including food, department stores, specialty stores, drug stores, and DIY outlets with a market capitalization of ₱96.86 billion.

Operations: Robinsons Retail Holdings generates revenue primarily from its Food segment, contributing ₱122.52 billion, and the Drug Store Division with ₱36.79 billion, among other segments like Department Stores and Specialty Stores. The company's gross profit margin has shown an upward trend reaching 24.22% by March 2025 from earlier periods. Operating expenses are a significant component of costs, with general and administrative expenses being the largest portion within that category.

PE: 9.5x

Robinsons Retail Holdings, a smaller player in the Asian market, recently reported first-quarter sales of PHP 47.8 billion, up from PHP 45.9 billion last year. However, net income dropped significantly to PHP 760 million from PHP 5.1 billion previously, impacting earnings per share. Despite this dip in profitability and reliance on higher-risk external borrowing for funding, insider confidence remains strong with recent purchases by key figures within the company. Looking ahead, they anticipate modest same-store sales growth of 2% to 4% for 2025.

Where To Now?

- Unlock more gems! Our Undervalued Asian Small Caps With Insider Buying screener has unearthed 58 more companies for you to explore.Click here to unveil our expertly curated list of 61 Undervalued Asian Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PWH

PWR Holdings

Engages in the design, prototyping, production, testing, validation, and sale of cooling products and solutions in Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives