- Philippines

- /

- Industrials

- /

- PSE:GTCAP

March 2025's Undervalued Asian Small Caps With Insider Activity

Reviewed by Simply Wall St

As of March 2025, the Asian markets have been navigating a complex landscape marked by mixed economic signals and geopolitical uncertainties. While China's economy shows signs of resilience with better-than-expected retail sales and industrial output, concerns persist over property investment declines and rising unemployment rates. In this environment, identifying promising small-cap stocks often involves looking for companies that demonstrate strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.8x | 1.1x | 35.73% | ★★★★★★ |

| Atturra | 26.6x | 1.1x | 41.65% | ★★★★★☆ |

| Hansen Technologies | 287.0x | 2.8x | 27.20% | ★★★★★☆ |

| Hong Leong Asia | 8.7x | 0.2x | 46.98% | ★★★★☆☆ |

| Puregold Price Club | 8.6x | 0.4x | 19.25% | ★★★★☆☆ |

| Dicker Data | 18.9x | 0.7x | -38.66% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 36.06% | ★★★★☆☆ |

| Viva Energy Group | NA | 0.1x | 17.84% | ★★★★☆☆ |

| Integral Diagnostics | 154.9x | 1.8x | 40.96% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.7x | 36.75% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Ramelius Resources (ASX:RMS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ramelius Resources is a mining company primarily engaged in the exploration and production of gold, with significant operations at Edna May and Mt Magnet, and has a market capitalization of approximately A$1.18 billion.

Operations: Edna May and Mt Magnet contribute significantly to the company's revenue, with a combined total of A$1.04 billion. The gross profit margin has shown an upward trend, reaching 46.03% as of December 2024, indicating improved cost management relative to revenue growth over time.

PE: 7.4x

Ramelius Resources, a smaller player in the mining sector, recently reported impressive half-year results with sales reaching A$507.96 million and net income soaring to A$170.37 million compared to the previous year. Their maiden interim dividend of A$0.03 per share signals potential shareholder value enhancement despite earnings forecasts predicting a 24.8% annual decline over three years. Insider confidence is evident with recent purchases, while strategic moves like acquiring Spartan Resources could reshape their growth trajectory amidst higher risk funding challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of Ramelius Resources.

Assess Ramelius Resources' past performance with our detailed historical performance reports.

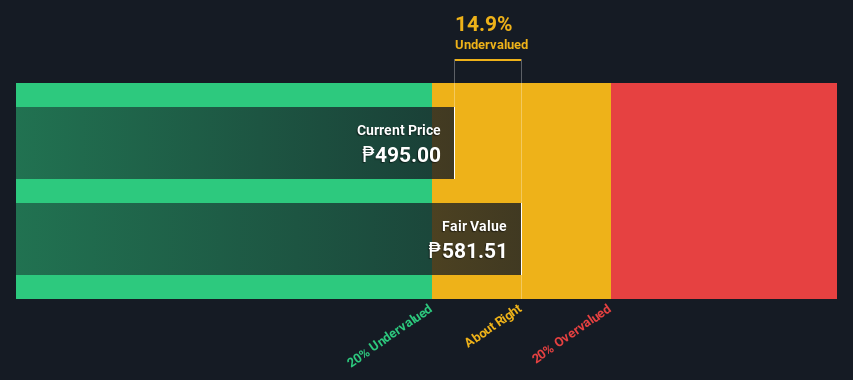

GT Capital Holdings (PSE:GTCAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GT Capital Holdings is a major Philippine conglomerate with diversified operations in sectors such as banking, automotive, property development, insurance, and infrastructure, boasting a market capitalization of ₱118.56 billion.

Operations: GTCAP generates revenue primarily through its core business operations, with a notable gross profit margin trend peaking at 22.84% in the last reported period. The company incurs significant costs related to COGS and operating expenses, which include general and administrative expenses as well as sales and marketing outlays. Over recent periods, the net income margin has shown variability but reached 9.33% in Q2 2024, indicating effective cost management relative to revenue growth.

PE: 4.0x

GT Capital Holdings, a notable player among smaller Asian stocks, recently demonstrated insider confidence with key figures purchasing shares over the past six months. Their financial strategy relies entirely on external borrowing, which carries higher risk compared to customer deposits. The company's earnings are projected to grow at 9.12% annually, suggesting potential for value appreciation. Recent board decisions include a PHP 3.00 regular and PHP 2.00 special dividend per share payable in April 2025, reflecting solid shareholder returns amidst their growth trajectory.

- Click to explore a detailed breakdown of our findings in GT Capital Holdings' valuation report.

Evaluate GT Capital Holdings' historical performance by accessing our past performance report.

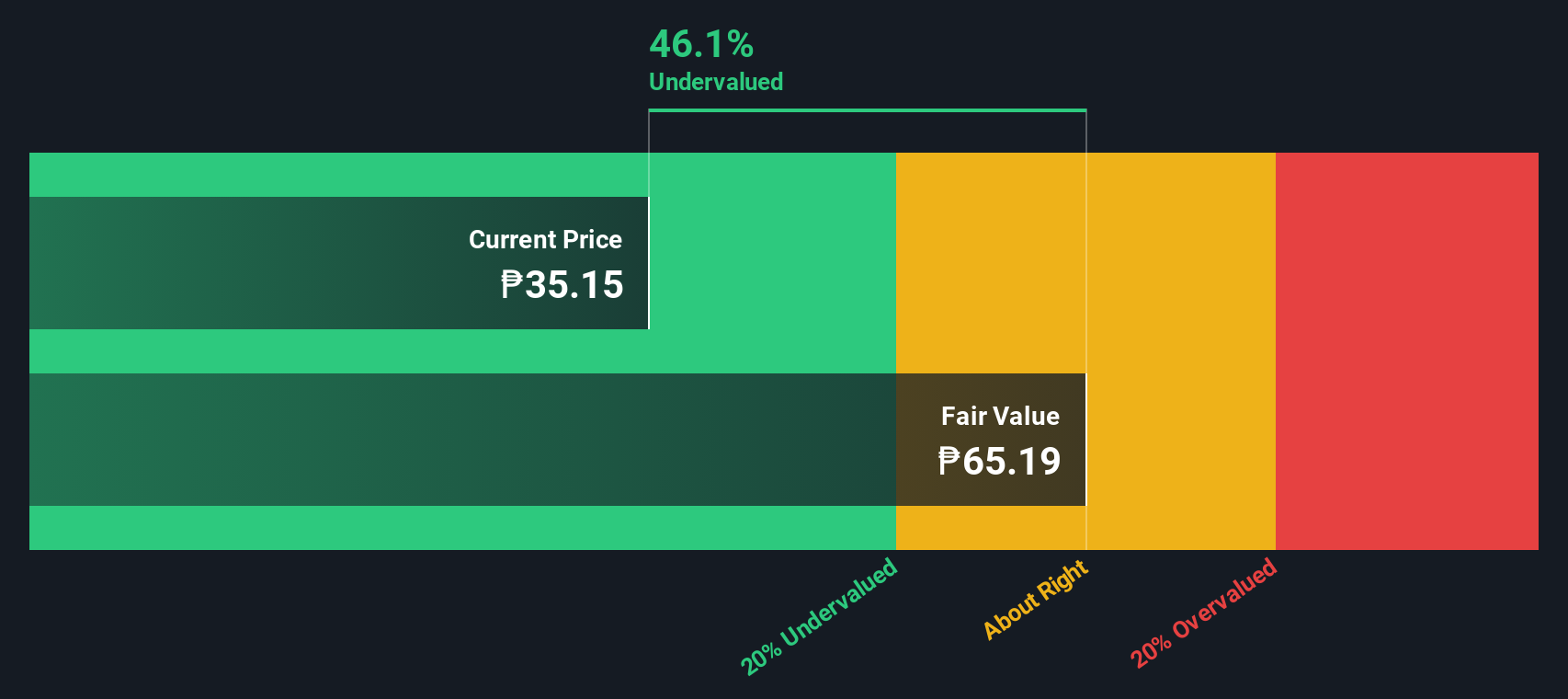

Puregold Price Club (PSE:PGOLD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Puregold Price Club operates a retailing business with a focus on grocery and consumer goods, and it has a market capitalization of ₱125.65 billion.

Operations: The company generates its revenue primarily from retailing, with the most recent reported figure being ₱211.71 billion. Cost of Goods Sold (COGS) significantly impacts its gross profit, which was ₱36.32 billion in the latest period. The gross profit margin has shown fluctuations over time, reaching 17.16% in the most recent quarter. Operating expenses are a substantial part of expenditures, with general and administrative expenses being a major component within that category.

PE: 8.6x

Puregold Price Club, a notable player among undervalued stocks in Asia, has recently seen insider confidence with Executive Director Leonardo Dayao purchasing 20,000 shares valued at approximately ₱525,520. This move suggests belief in future growth prospects as earnings are forecasted to grow by 10.8% annually. However, the company's reliance on external borrowing for funding poses higher risks compared to customer deposits. Recent board meetings have focused on strategic appointments and management plans for 2025, indicating proactive governance amidst financial challenges.

Seize The Opportunity

- Reveal the 58 hidden gems among our Undervalued Asian Small Caps With Insider Buying screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:GTCAP

GT Capital Holdings

A conglomerate, engages in the banking, automotive assembly, importation, distribution, dealership and financing, property development, life and non-life insurance, and infrastructure and utilities in the Philippines and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)