As global markets navigate a landscape marked by rate cuts from the ECB and SNB, and with expectations mounting for a Federal Reserve rate cut, small-cap stocks have been under pressure, reflected in the Russell 2000's recent underperformance compared to larger indices. Amidst this backdrop of economic shifts and market volatility, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and potential growth despite broader sector challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Hong Tai Electric Industrial | 0.03% | 11.52% | 12.52% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Pacific Construction | 21.40% | -3.50% | 26.25% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Lion Travel Service | 1.97% | -0.25% | 46.60% | ★★★★★☆ |

| Central Finance | 1.16% | 10.03% | 16.10% | ★★★★★☆ |

| Huang Hsiang Construction | 266.70% | 13.12% | 15.19% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Fiera Milano (BIT:FM)

Simply Wall St Value Rating: ★★★★☆☆

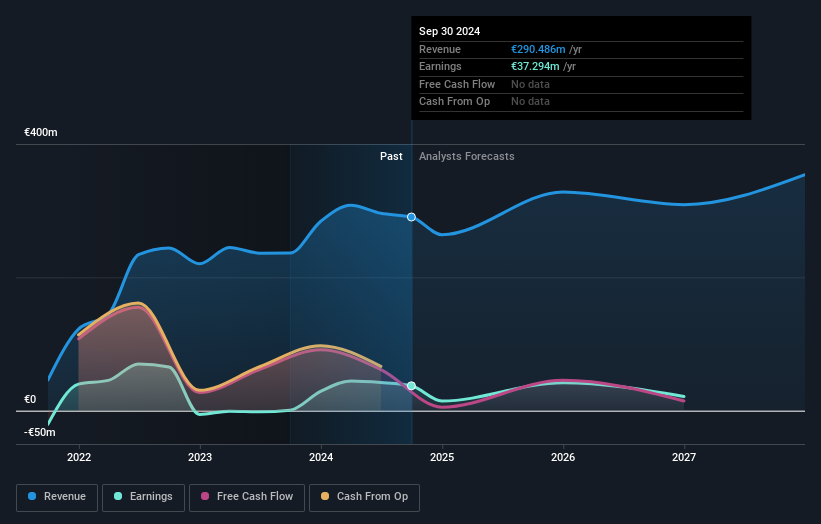

Overview: Fiera Milano SpA, along with its subsidiaries, specializes in organizing and hosting international events and fairs both in Italy and globally, with a market capitalization of approximately €313.02 million.

Operations: Fiera Milano generates revenue primarily from its Italian Exhibitions Business, contributing €245.29 million, and Congresses segment, adding €49.15 million. The company incurs costs associated with organizing these events, impacting its overall profitability.

Fiera Milano, a notable player in the events industry, has showcased impressive financial resilience despite recent challenges. Over the past year, its earnings skyrocketed by 4700%, surpassing the media industry's growth rate of 16%. The company's debt to equity ratio improved from 36% to 25% over five years, reflecting prudent financial management. With a price-to-earnings ratio of 8.4x against Italy's market average of 14.1x, Fiera Milano appears undervalued. However, recent results show a net loss of €7 million for Q3 compared to €2 million last year, indicating potential hurdles ahead despite high-quality past earnings and strong EBIT coverage (4.9x).

- Unlock comprehensive insights into our analysis of Fiera Milano stock in this health report.

Understand Fiera Milano's track record by examining our Past report.

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Value Rating: ★★★★★★

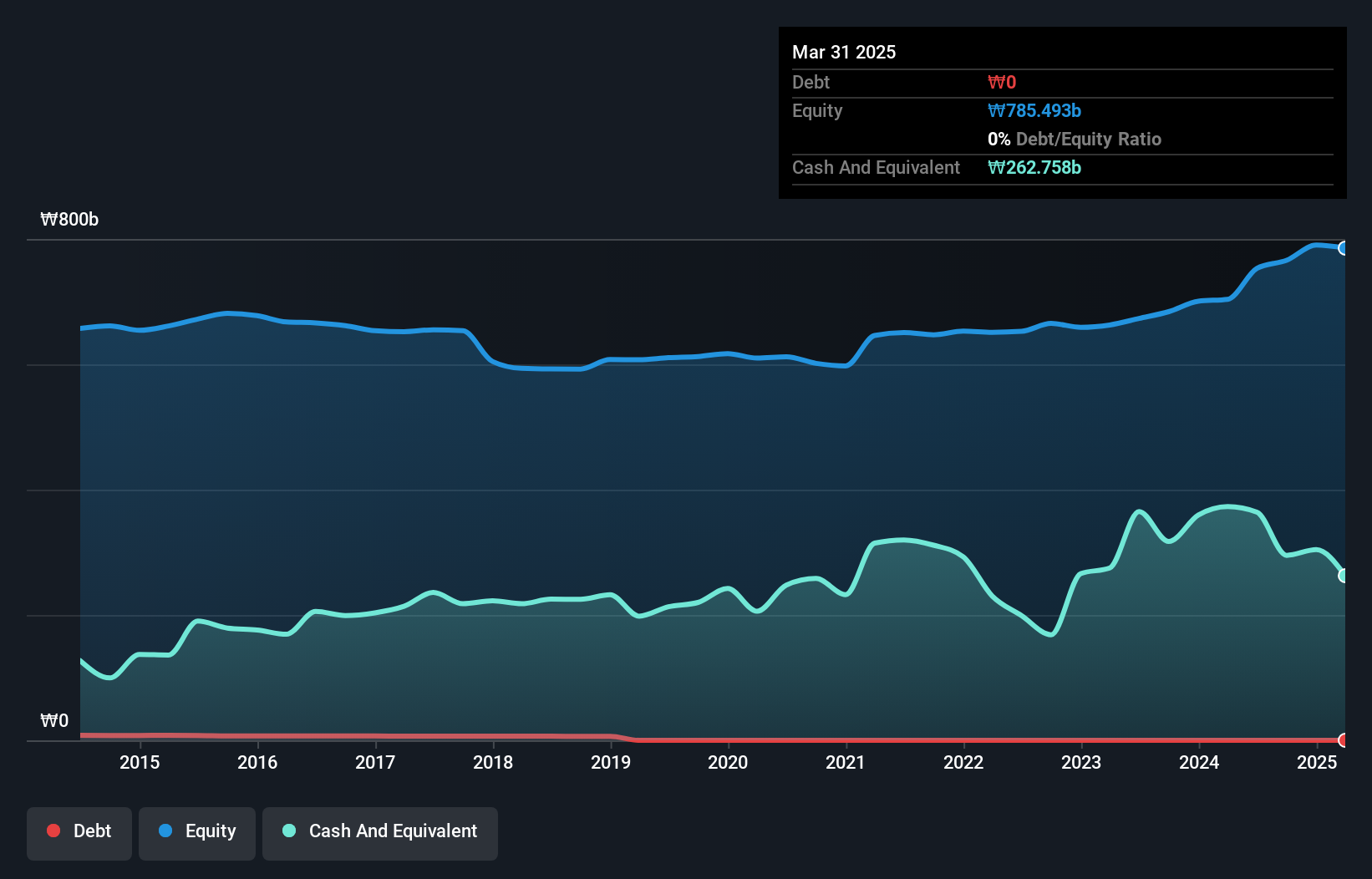

Overview: Snt Dynamics Co., Ltd. is engaged in the manufacturing and sale of precision machinery, with a market capitalization of approximately ₩427.95 billion.

Operations: Snt Dynamics generates revenue primarily from its Transportation Equipment Business, which accounts for ₩586.42 billion, while its Machinery Business contributes ₩4.97 billion.

Snt Dynamics, a promising player in the Aerospace & Defense sector, has shown impressive earnings growth of 139% over the past year, outpacing industry averages. The company is debt-free and enjoys high-quality non-cash earnings. Trading at 76% below its estimated fair value suggests it might be undervalued compared to peers. Despite recent volatility in share price, Snt Dynamics reported a substantial increase in net income for Q3 2024 at KRW 17 billion from KRW 13 billion last year, with basic earnings per share rising to KRW 779 from KRW 602. However, future projections indicate potential challenges with expected declines in earnings by nearly 20% annually over the next three years.

- Click here to discover the nuances of Snt DynamicsLtd with our detailed analytical health report.

Gain insights into Snt DynamicsLtd's past trends and performance with our Past report.

Keepers Holdings (PSE:KEEPR)

Simply Wall St Value Rating: ★★★★★★

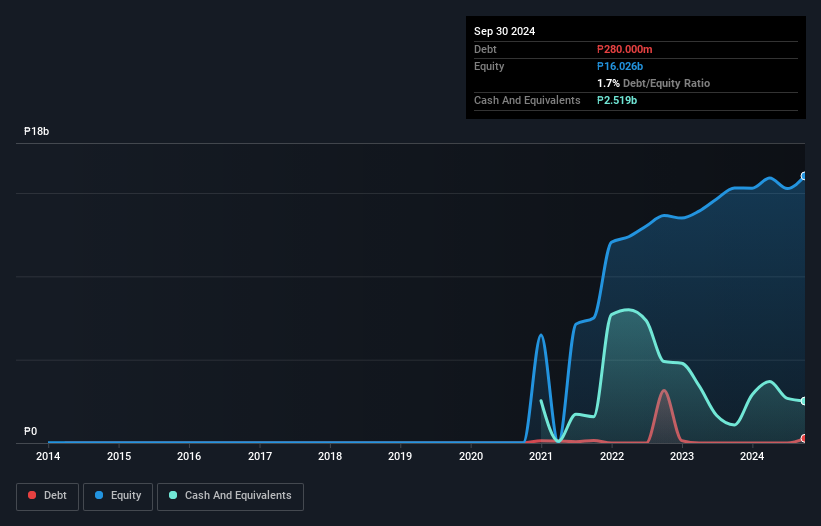

Overview: The Keepers Holdings, Inc. is an investment holding company that operates in the liquor, wine, and specialty beverage distribution sector in the Philippines with a market cap of ₱32.21 billion.

Operations: Keepers Holdings generates revenue primarily from the sale of spirits, wines, and specialty beverages, amounting to ₱17.80 billion.

Keepers Holdings is making waves with its impressive financial performance, showcasing earnings growth of 34.4% over the past year, outpacing the Consumer Retailing industry's 8.8%. The company reported net income of PHP 2.17 billion for the first nine months of 2024, up from PHP 1.81 billion a year earlier, highlighting its high-quality earnings potential. With a debt-to-equity ratio dropping from 43.5% to just 1.7% in five years and free cash flow standing positive at PHP 4069 million as of September, Keepers seems well-positioned financially while exploring strategic acquisitions like Booze On-Line Inc., potentially boosting future prospects further.

- Get an in-depth perspective on Keepers Holdings' performance by reading our health report here.

Review our historical performance report to gain insights into Keepers Holdings''s past performance.

Make It Happen

- Explore the 4625 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FM

Fiera Milano

Fiera Milano SpA, together with its subsidiaries, organizes and hosts shows and international events and fairs in Italy and internationally.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives