Amidst a backdrop of favorable trade deals and positive market sentiment, Asian markets have been buoyed by hopes for extended tariff truces and strengthening economic ties. As global indices reach new heights, investors are increasingly turning their attention to small-cap stocks in Asia that demonstrate resilience and growth potential in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Korea Ratings | NA | 0.72% | 2.33% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 8.20% | 44.45% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Qingmu Tec | 0.74% | 13.00% | -19.41% | ★★★★★★ |

| Center International GroupLtd | 18.20% | 0.69% | -31.63% | ★★★★★★ |

| Togami Electric Mfg | 3.09% | 4.88% | 16.96% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 18.14% | -7.58% | -3.26% | ★★★★★☆ |

| Hunan Investment GroupLtd | 4.50% | 25.84% | 15.32% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★☆☆

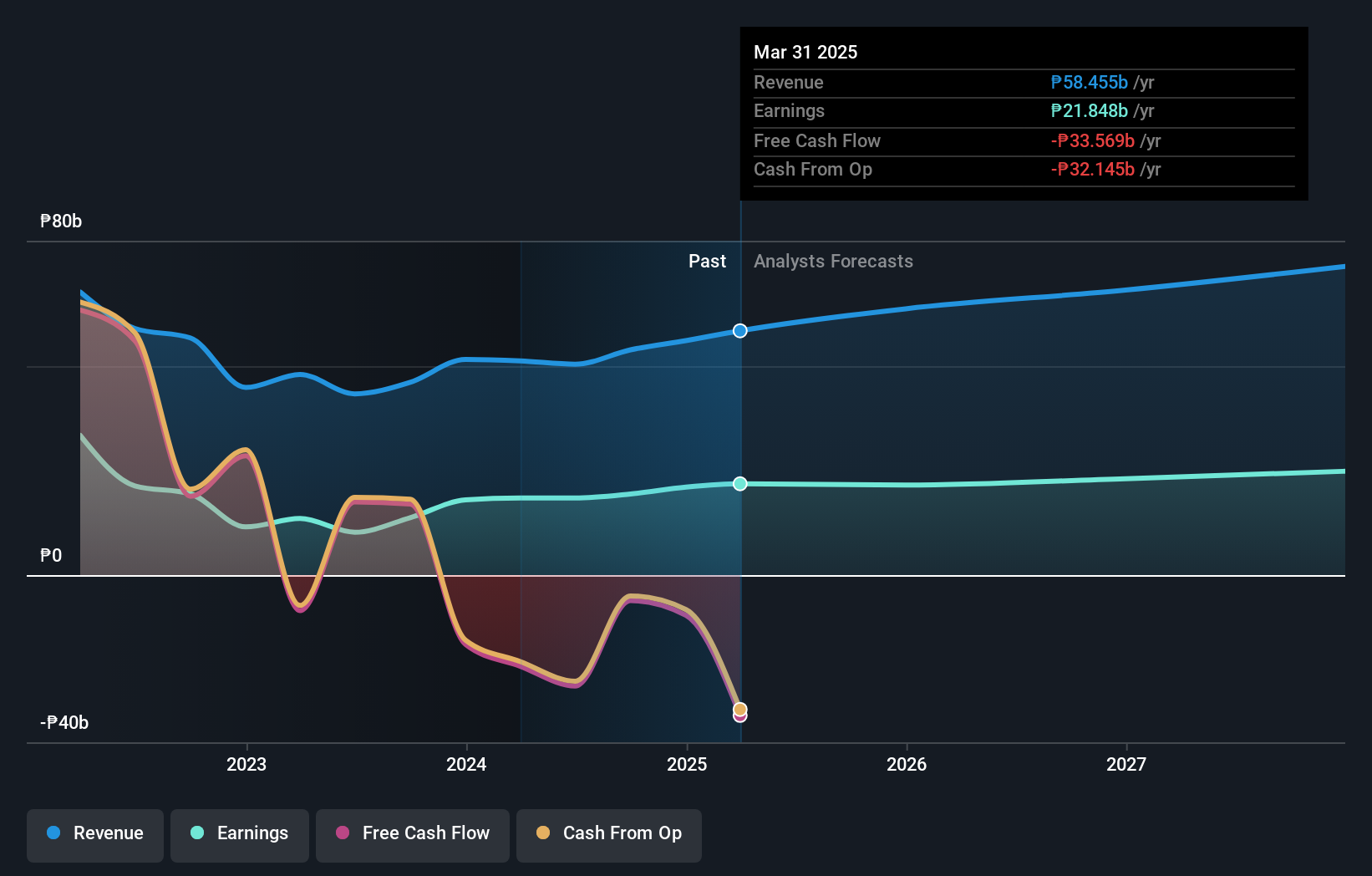

Overview: Philippine National Bank offers a range of banking and financial products and services, with a market capitalization of approximately ₱95.82 billion.

Operations: The bank's primary revenue streams include Retail Banking at ₱33.79 billion and Corporate Banking at ₱12.42 billion, with Treasury operations contributing ₱11.50 billion.

Philippine National Bank is a notable player with total assets of ₱1,279.3 billion and equity at ₱218.7 billion, reflecting its robust financial foundation. The bank's earnings growth of 18.5% outpaces the industry average of 10.9%, highlighting its competitive edge in the market. Despite trading at a value 35% below estimated fair value, it faces challenges with high bad loans at 6.9% and an insufficient allowance for these loans, currently only covering 91%. Recent leadership changes aim to bolster strategic areas like institutional banking and digital innovation, suggesting a proactive approach to future growth opportunities.

- Unlock comprehensive insights into our analysis of Philippine National Bank stock in this health report.

Learn about Philippine National Bank's historical performance.

Shanghai Xinhua Media (SHSE:600825)

Simply Wall St Value Rating: ★★★★★★

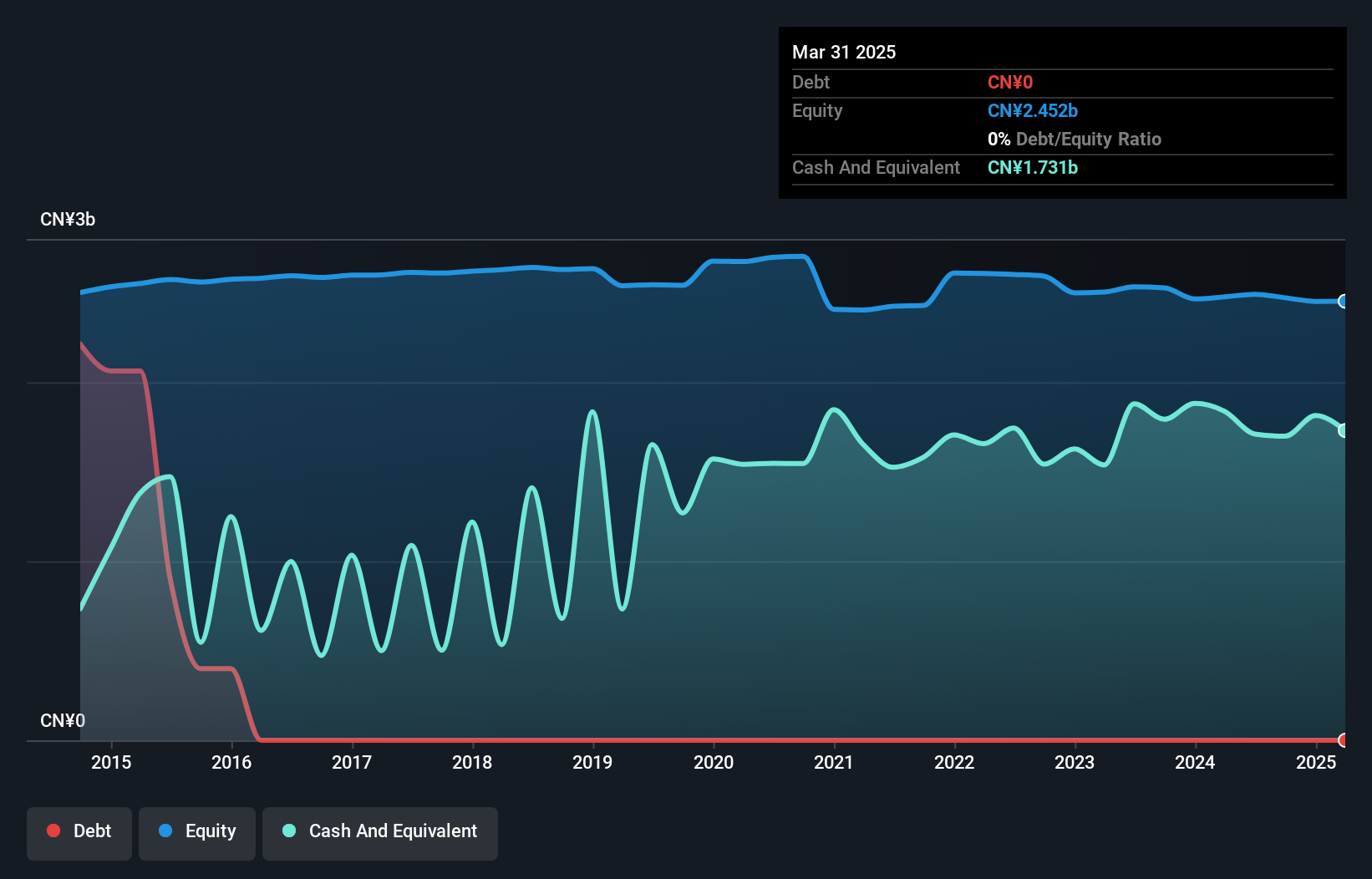

Overview: Shanghai Xinhua Media Co., Ltd. is a publishing and media enterprise operating in the cultural media sector in China, with a market cap of CN¥8.41 billion.

Operations: Shanghai Xinhua Media's primary revenue streams are derived from its publishing and media operations within China's cultural media sector. The company has a market capitalization of CN¥8.41 billion.

Shanghai Xinhua Media, a nimble player in the media sector, has shown impressive financial health with no debt on its books over the past five years. The company recorded an 18.6% earnings growth last year, outpacing the media industry's -20.1%, though this was influenced by a one-off gain of CN¥92M. Free cash flow remains positive, suggesting solid operational efficiency despite capital expenditures reaching CN¥121M recently. This performance hints at robust management and strategic positioning within its industry, potentially offering investors a compelling opportunity amidst broader market challenges in Asia's dynamic landscape.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Xinhua Media.

Evaluate Shanghai Xinhua Media's historical performance by accessing our past performance report.

AnHui Jinchun Nonwoven (SZSE:300877)

Simply Wall St Value Rating: ★★★★★☆

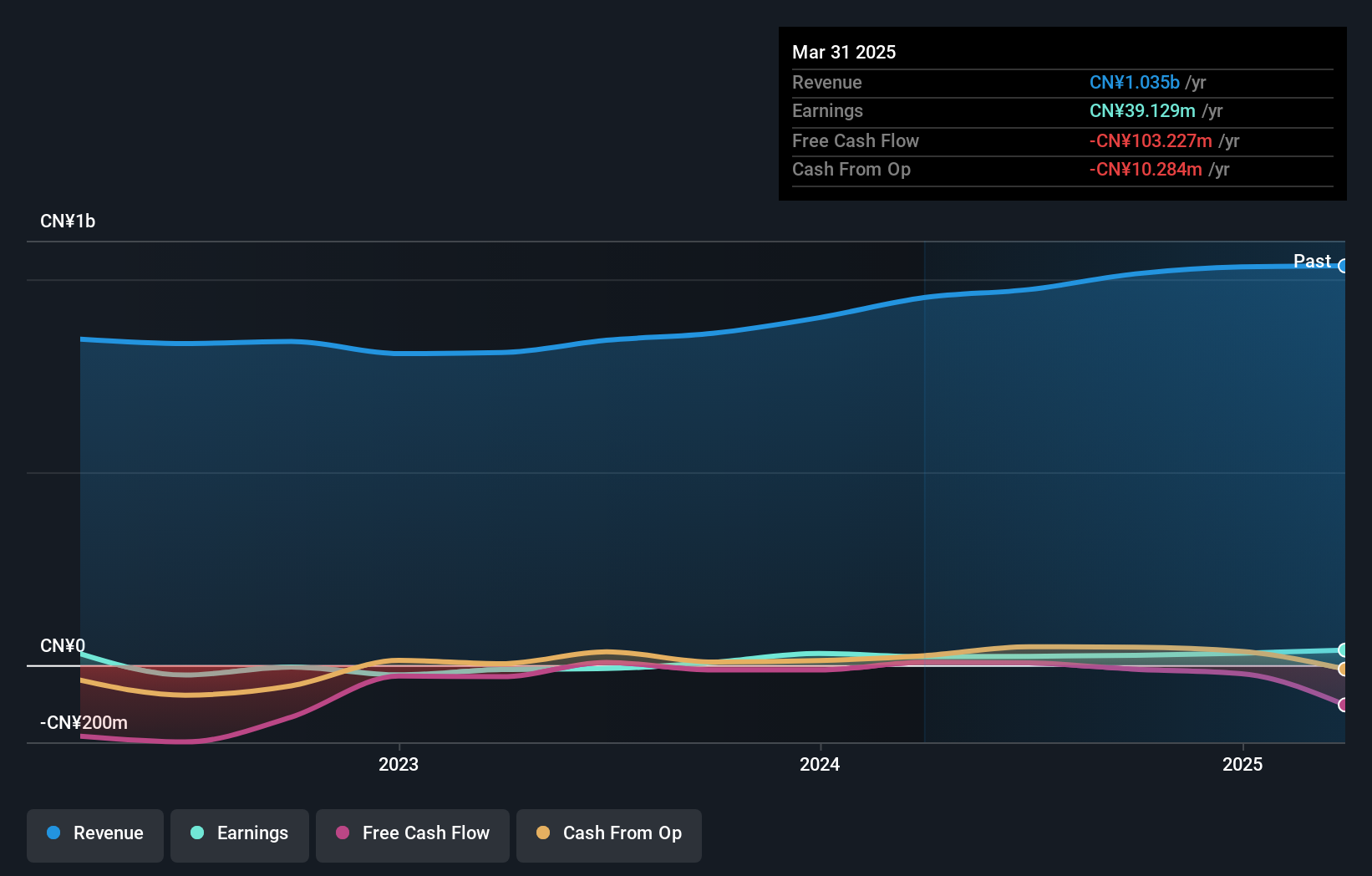

Overview: AnHui Jinchun Nonwoven Co., Ltd. specializes in the production and sale of nonwoven products, with a market capitalization of CN¥2.99 billion.

Operations: The company generates revenue primarily from the production and sale of nonwoven products. It has a market capitalization of CN¥2.99 billion.

AnHui Jinchun Nonwoven, a smaller player in the textile industry, has shown impressive earnings growth of 78.4% over the past year, outpacing its sector's -5.9%. Despite this growth, earnings have decreased by an average of 53.4% annually over five years. The company is financially sound with more cash than total debt and a reduced debt-to-equity ratio from 11.4% to 8.2% in five years. Recently, it completed a share buyback of 100,000 shares for CNY 1.52 million and announced a final cash dividend of CNY 1 per ten shares for shareholders as of May 2025.

- Click here and access our complete health analysis report to understand the dynamics of AnHui Jinchun Nonwoven.

Explore historical data to track AnHui Jinchun Nonwoven's performance over time in our Past section.

Taking Advantage

- Embark on your investment journey to our 2600 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600825

Shanghai Xinhua Media

A publishing and media enterprise, engages in the cultural media business in China.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives