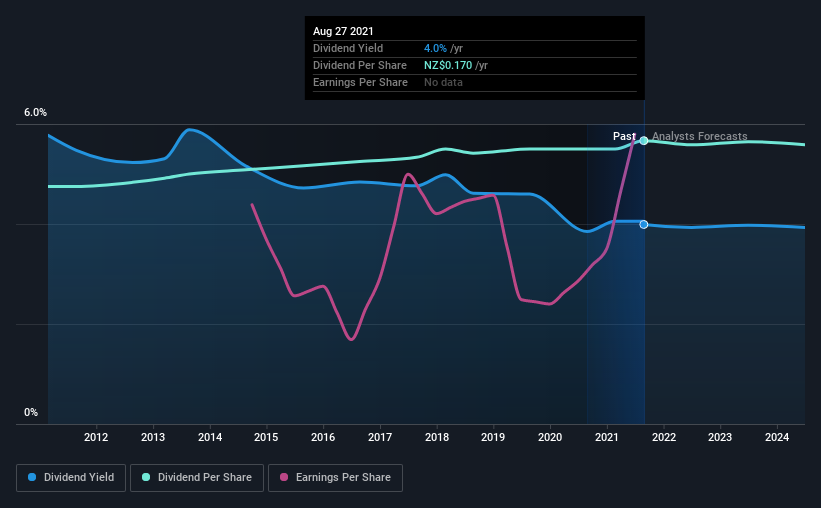

The board of Vector Limited (NZSE:VCT) has announced that it will be increasing its dividend by 3.0% on the 16th of September to NZ$0.09. This will take the dividend yield from 4.0% to 4.1%, providing a nice boost to shareholder returns.

Check out our latest analysis for Vector

Vector Doesn't Earn Enough To Cover Its Payments

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, Vector's dividend was making up a very large proportion of earnings, and the company was also not generating any cash flow to offset this. This is a pretty unsustainable practice, and could be risky if continued for the long term.

Looking forward, earnings per share is forecast to fall by 7.6% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 100%, which could put the dividend in jeopardy if the company's earnings don't improve.

Vector Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2011, the dividend has gone from NZ$0.14 to NZ$0.17. This implies that the company grew its distributions at a yearly rate of about 1.8% over that duration. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth Could Be Constrained

Investors could be attracted to the stock based on the quality of its payment history. Vector has impressed us by growing EPS at 28% per year over the past five years. Fast growing earnings are great, but this can rarely be sustained without some reinvestment into the business, which Vector hasn't been doing.

Our Thoughts On Vector's Dividend

Overall, we always like to see the dividend being raised, but we don't think Vector will make a great income stock. Although they have been consistent in the past, we think the payments are a little high to be sustained. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for Vector you should be aware of, and 2 of them can't be ignored. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:VCT

Vector

Engages in electricity and gas distribution, telecommunication and new energy solutions businesses in New Zealand.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)