- New Zealand

- /

- Electric Utilities

- /

- NZSE:MCY

We Ran A Stock Scan For Earnings Growth And Mercury NZ (NZSE:MCY) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Mercury NZ (NZSE:MCY), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Mercury NZ

How Fast Is Mercury NZ Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Mercury NZ managed to grow EPS by 8.9% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

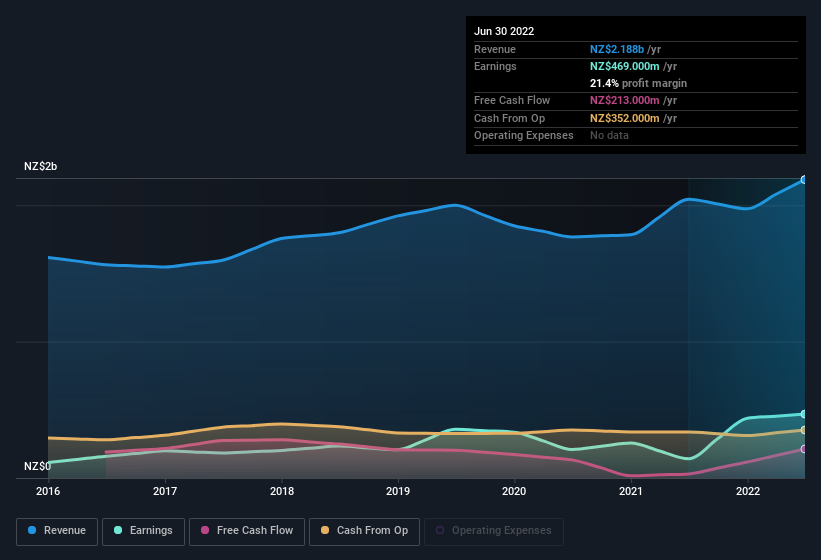

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Mercury NZ achieved similar EBIT margins to last year, revenue grew by a solid 7.0% to NZ$2.2b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Mercury NZ?

Are Mercury NZ Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Mercury NZ insiders spent NZ$91k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading.

Recent insider purchases of Mercury NZ stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Mercury NZ, with market caps between NZ$3.5b and NZ$11b, is around NZ$3.1m.

Mercury NZ's CEO took home a total compensation package worth NZ$1.8m in the year leading up to June 2021. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Mercury NZ Deserve A Spot On Your Watchlist?

One important encouraging feature of Mercury NZ is that it is growing profits. And that's not all. We've also seen insiders buying stock, and noted modest executive pay. All things considered, Mercury NZ is certainly displaying its merits and is worthy of taking research to the next step. Still, you should learn about the 3 warning signs we've spotted with Mercury NZ (including 1 which doesn't sit too well with us).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Mercury NZ, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:MCY

Mercury NZ

Engages in the production, trading, and sale of electricity and related activities in New Zealand.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives