- New Zealand

- /

- Airlines

- /

- NZSE:AIR

The Air New Zealand Limited (NZSE:AIR) Half-Yearly Results Are Out And Analysts Have Published New Forecasts

Investors in Air New Zealand Limited (NZSE:AIR) had a good week, as its shares rose 4.6% to close at NZ$1.59 following the release of its half-yearly results. Revenues came in at NZ$1.2b, an impressive 27% ahead of analyst forecasts. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Air New Zealand after the latest results.

See our latest analysis for Air New Zealand

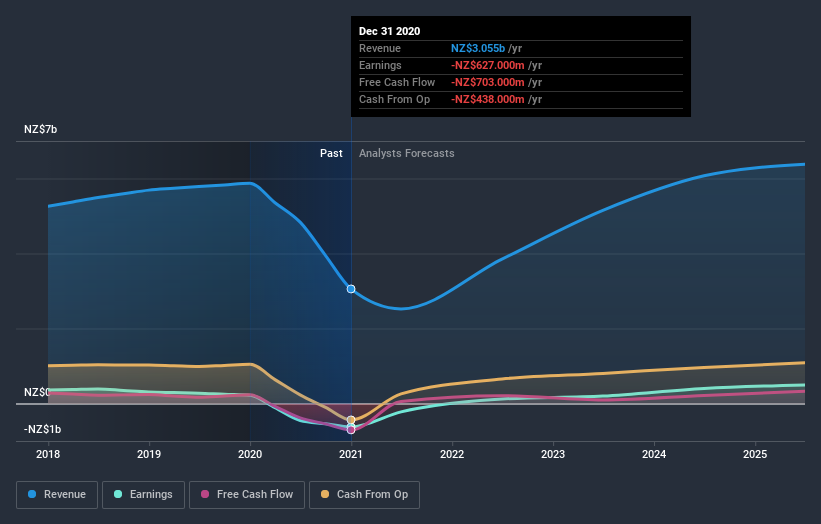

Taking into account the latest results, the six analysts covering Air New Zealand provided consensus estimates of NZ$2.52b revenue in 2021, which would reflect a definite 17% decline on its sales over the past 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 79% to NZ$0.11. Before this latest report, the consensus had been expecting revenues of NZ$2.56b and NZ$0.16 per share in losses. Although the revenue estimates have not really changed Air New Zealand'sfuture looks a little different to the past, with a considerable decrease in the loss per share forecasts in particular.

The average price target held steady at NZ$1.39, seeming to indicate that business is performing in line with expectations. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Air New Zealand at NZ$2.00 per share, while the most bearish prices it at NZ$0.65. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. One more thing stood out to us about these estimates, and it's the idea that Air New Zealand'sdecline is expected to accelerate, with revenues forecast to fall 17% next year, topping off a historical decline of 2.2% a year over the past five years. Compare this against analyst estimates for companies in the wider industry, which suggest that revenues (in aggregate) are expected to grow 29% next year. So it's pretty clear that, while it does have declining revenues, the analysts also expect Air New Zealand to suffer worse than the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Air New Zealand's revenues are expected to perform worse than the wider industry. The consensus price target held steady at NZ$1.39, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Air New Zealand. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Air New Zealand analysts - going out to 2025, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 1 warning sign for Air New Zealand you should be aware of.

If you decide to trade Air New Zealand, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:AIR

Air New Zealand

Provides air passenger and cargo transportation on scheduled airlines services in New Zealand, Australia, the Pacific Islands, Asia, the United Kingdom, Europe, and the Americas.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives