- New Zealand

- /

- Airlines

- /

- NZSE:AIR

Air New Zealand Limited (NZSE:AIR) Investors Are Less Pessimistic Than Expected

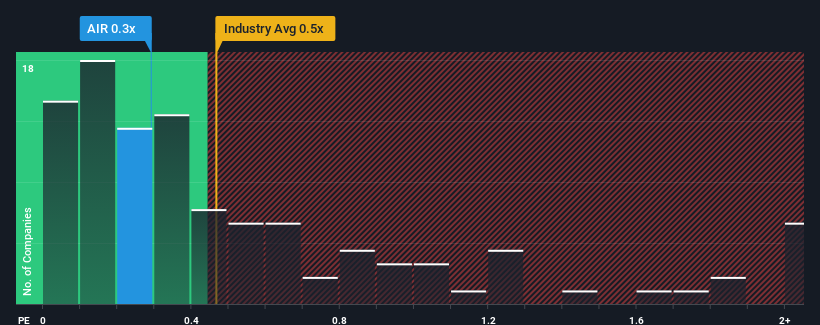

It's not a stretch to say that Air New Zealand Limited's (NZSE:AIR) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Airlines industry in New Zealand, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Air New Zealand

What Does Air New Zealand's P/S Mean For Shareholders?

Recent times have been advantageous for Air New Zealand as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Air New Zealand.Is There Some Revenue Growth Forecasted For Air New Zealand?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Air New Zealand's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 44%. The strong recent performance means it was also able to grow revenue by 120% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 1.4% each year as estimated by the five analysts watching the company. With the industry predicted to deliver 62% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Air New Zealand is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Air New Zealand's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of Air New Zealand's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Air New Zealand, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:AIR

Air New Zealand

Provides air passenger and cargo transportation on scheduled airlines services in New Zealand, Australia, the Pacific Islands, Asia, the United Kingdom, Europe, and the Americas.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives