- New Zealand

- /

- Telecom Services and Carriers

- /

- NZSE:SPK

Did Upcoming Board and Auditor Votes at Spark New Zealand (NZSE:SPK) Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Spark New Zealand has announced details for its 2025 Annual Meeting, scheduled for November 7, 2025, at a new venue in Auckland, where shareholders will vote on key resolutions including director re-elections and auditor remuneration.

- This meeting brings the potential for shifts in leadership and governance that could influence the company's strategic direction and stakeholder confidence.

- Now, we’ll explore how the upcoming board and auditor decisions could shape Spark New Zealand's overall investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

What Is Spark New Zealand's Investment Narrative?

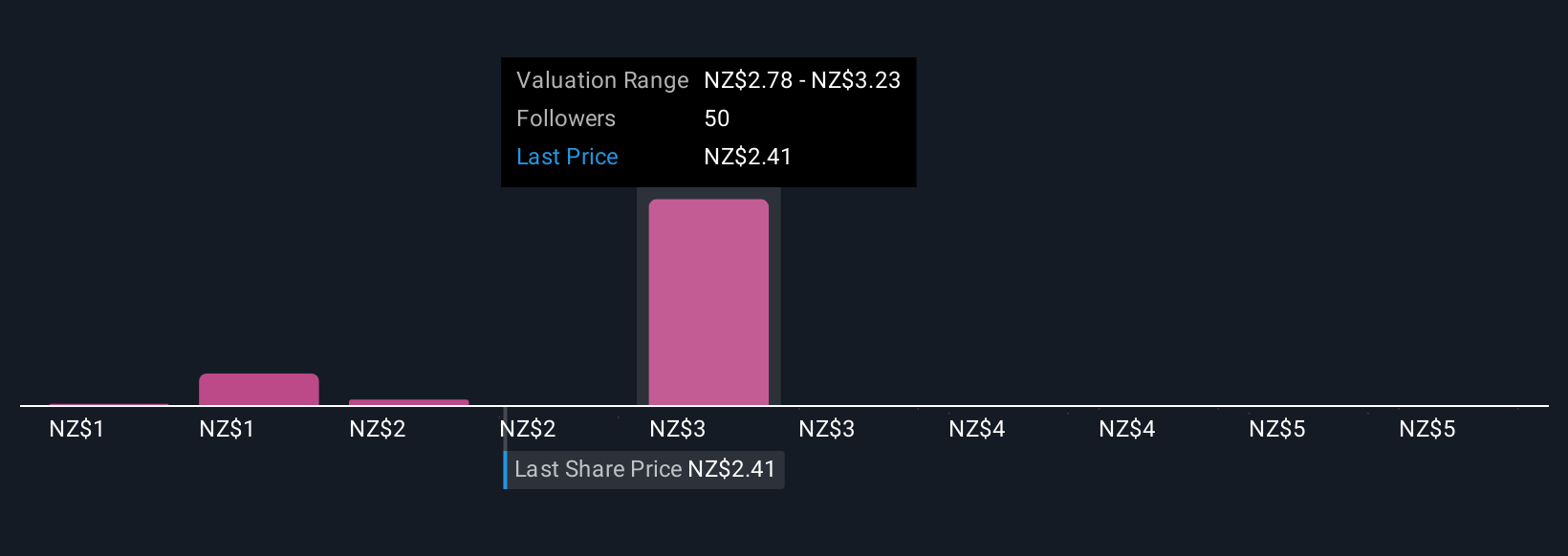

For anyone considering holding Spark New Zealand shares, the big picture comes down to belief in the company's ability to drive value from established telecom operations, lift earnings through new technology partnerships, and manage capital efficiently amid a highly competitive market. The upcoming annual meeting, with shareholder votes on director re-elections and auditor remuneration, follows closely on a series of leadership changes and partnerships. While these governance updates typically signal a vote of confidence in refreshed strategies, they don’t materially alter the main catalysts or risks facing Spark right now. The short-term story remains focused on the impact of M&A discussions around its data centers, modest projected earnings growth, and valuation disconnects. The biggest current risk continues to be slow revenue and earnings growth compared to sector peers, especially as dividend coverage remains stretched. The board and auditor decisions, though important, appear unlikely to change these core issues in the immediate term. On the other hand, the risk tied to Spark’s slower-than-market profit growth isn’t going away.

Spark New Zealand's shares have been on the rise but are still potentially undervalued by 24%. Find out what it's worth.Exploring Other Perspectives

Explore 28 other fair value estimates on Spark New Zealand - why the stock might be worth less than half the current price!

Build Your Own Spark New Zealand Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spark New Zealand research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Spark New Zealand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spark New Zealand's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SPK

Spark New Zealand

Provides telecommunications and digital services in New Zealand.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)