- New Zealand

- /

- Telecom Services and Carriers

- /

- NZSE:CNU

Don't Race Out To Buy Chorus Limited (NZSE:CNU) Just Because It's Going Ex-Dividend

It looks like Chorus Limited (NZSE:CNU) is about to go ex-dividend in the next four days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Chorus' shares before the 16th of September in order to be eligible for the dividend, which will be paid on the 8th of October.

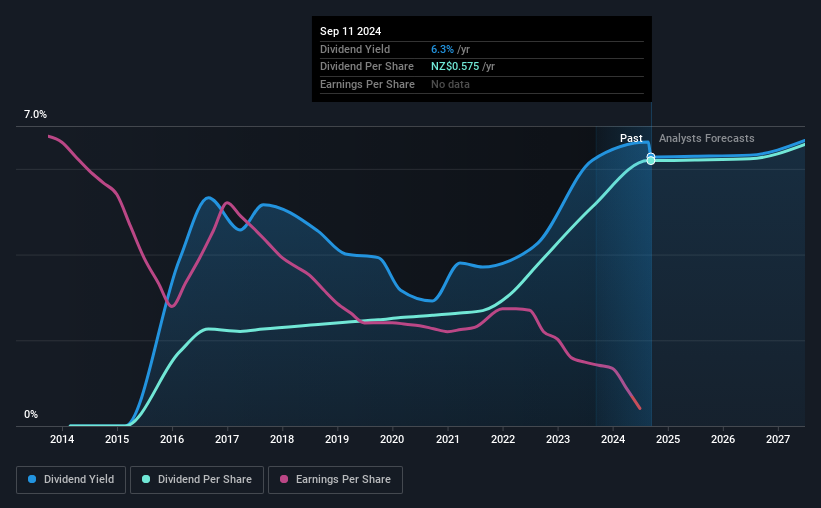

The company's next dividend payment will be NZ$0.285 per share, and in the last 12 months, the company paid a total of NZ$0.57 per share. Last year's total dividend payments show that Chorus has a trailing yield of 6.3% on the current share price of NZ$9.16. If you buy this business for its dividend, you should have an idea of whether Chorus's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Chorus

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Chorus's dividend is not well covered by earnings, as the company lost money last year. This is not a sustainable state of affairs, so it would be worth investigating if earnings are expected to recover. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If Chorus didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Over the last year, it paid out dividends equivalent to 276% of what it generated in free cash flow, a disturbingly high percentage. It's pretty hard to pay out more than you earn, so we wonder how Chorus intends to continue funding this dividend, or if it could be forced to cut the payment.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Chorus was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Chorus has delivered 15% dividend growth per year on average over the past nine years.

Get our latest analysis on Chorus's balance sheet health here.

To Sum It Up

Has Chorus got what it takes to maintain its dividend payments? We're a bit uncomfortable with it paying a dividend while being loss-making, especially given that the dividend was not well covered by free cash flow. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Chorus.

So if you're still interested in Chorus despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. For example - Chorus has 2 warning signs we think you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:CNU

Chorus

Engages in the provision of fixed line communications infrastructure services in New Zealand.

Reasonable growth potential and fair value.