- Germany

- /

- Electronic Equipment and Components

- /

- XTRA:BKHT

High Growth Tech Stocks Qt Group Oyj and Two More with Promising Potential

Reviewed by Simply Wall St

Amidst a volatile global market landscape, U.S. stocks have experienced fluctuations influenced by AI competition concerns and mixed corporate earnings results, while European markets benefited from the ECB's interest rate cuts. As investors navigate these conditions, identifying high-growth tech stocks with robust innovation and adaptability becomes crucial for capitalizing on potential opportunities in this dynamic environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

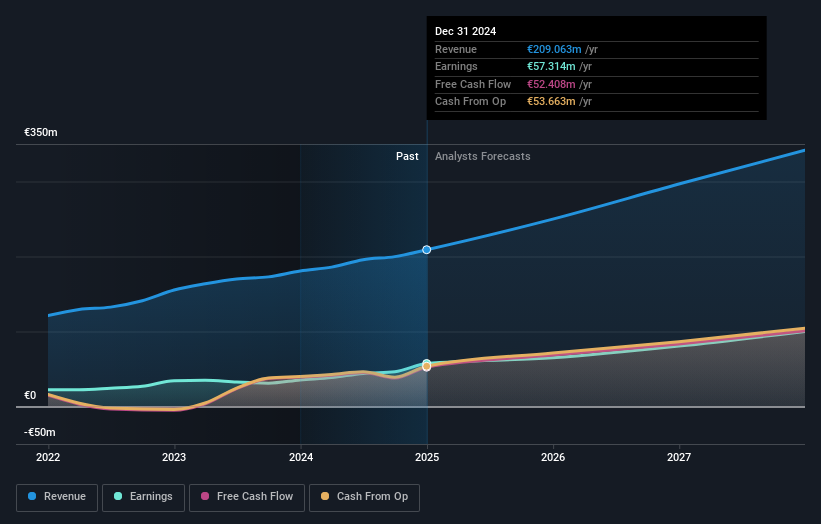

Qt Group Oyj (HLSE:QTCOM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qt Group Oyj provides cross-platform software development solutions across various countries including Finland, Norway, Germany, the United States, Japan, China, South Korea, France, the United Kingdom, and India with a market cap of €2.01 billion.

Operations: The company generates revenue primarily from its Software Development Tools segment, amounting to €199.85 million.

Qt Group Oyj, a trailblazer in software development frameworks, is demonstrating robust growth with an annual revenue increase of 16.7% and earnings surging by 21% per year. This performance surpasses the Finnish market's average, highlighting Qt's competitive edge in a dynamic tech landscape. The company's recent launch of the Qt AI Assistant underscores its commitment to innovation; this tool streamlines UI development across platforms by automating repetitive tasks and integrating advanced language models for enhanced coding efficiency. Additionally, despite a recent dip in expected revenue growth due to delayed negotiations, Qt continues to invest heavily in R&D with expenses marking significant yearly increases, ensuring sustained technological advancement and market relevance.

- Click to explore a detailed breakdown of our findings in Qt Group Oyj's health report.

Assess Qt Group Oyj's past performance with our detailed historical performance reports.

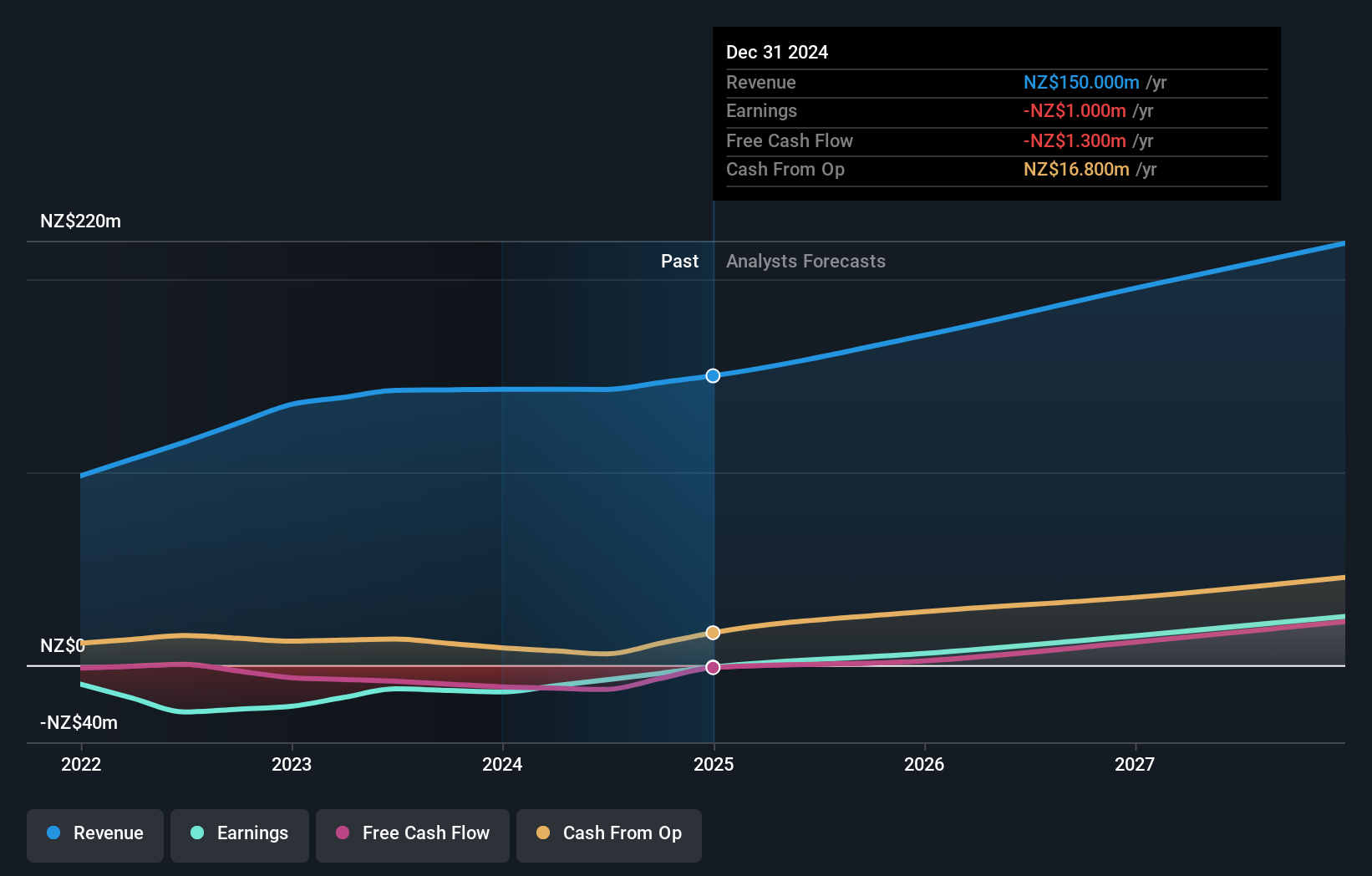

Vista Group International (NZSE:VGL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vista Group International Limited offers software and data analytics solutions to the global film industry, with a market capitalization of NZ$805.72 million.

Operations: Vista Group International generates revenue by providing specialized software and data analytics services tailored for the film industry across various global markets. The company's operations focus on enhancing cinema management, ticketing, and customer engagement through its technology solutions.

Vista Group International, navigating through the competitive software landscape, is poised for significant transformation with its revenue projected to grow at 12.9% annually, outpacing New Zealand's market average of 4.7%. Despite current unprofitability, the company shows promising signs with expected earnings growth of 47.8% per year, signaling a robust turnaround strategy. Investing heavily in innovation, Vista's R&D expenses are strategically allocated to foster advancements in technology and market adaptability. This focus on research and development not only underscores their commitment to growth but also positions them well for future profitability and industry leadership.

- Take a closer look at Vista Group International's potential here in our health report.

Understand Vista Group International's track record by examining our Past report.

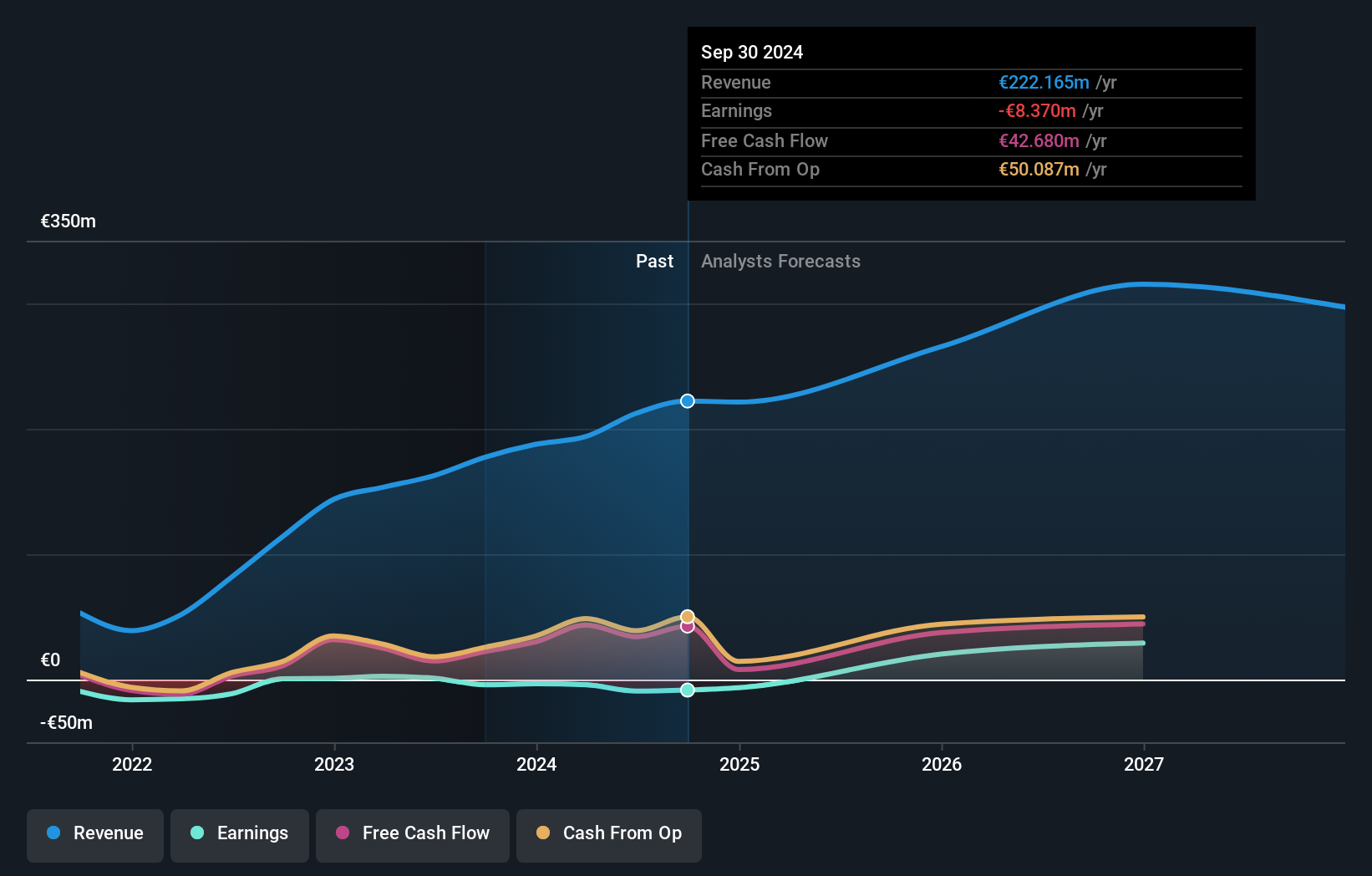

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm focused on investing in technology-driven businesses, with a market capitalization of €282.09 million.

Operations: The firm generates revenue primarily from its HR Benefit & Mobility Platform and Security Technologies, contributing €184.13 million and €35.20 million respectively. The business model is centered around leveraging technology-driven investments to drive growth in these segments.

Brockhaus Technologies, amidst a challenging fiscal period, reported a significant shift with its revenues escalating to EUR 178.29 million from EUR 143.6 million year-over-year, marking a 12.6% increase. Despite this growth, the company faced a net loss of EUR 2.31 million compared to a prior net income of EUR 2.72 million, reflecting ongoing investments and strategic shifts in operations highlighted during their recent presentation at the Deutsches Eigenkapitalforum. With an eye on future profitability, Brockhaus is channeling efforts into R&D which constituted a substantial part of their expenditure aimed at driving innovation and securing competitive advantage in the tech sector where rapid adaptation is crucial.

- Get an in-depth perspective on Brockhaus Technologies' performance by reading our health report here.

Gain insights into Brockhaus Technologies' past trends and performance with our Past report.

Make It Happen

- Investigate our full lineup of 1234 High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brockhaus Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BKHT

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)