- New Zealand

- /

- Software

- /

- NZSE:SDL

Is It Smart To Buy Solution Dynamics Limited (NZSE:SDL) Before It Goes Ex-Dividend?

Solution Dynamics Limited (NZSE:SDL) stock is about to trade ex-dividend in four days. You will need to purchase shares before the 11th of March to receive the dividend, which will be paid on the 26th of March.

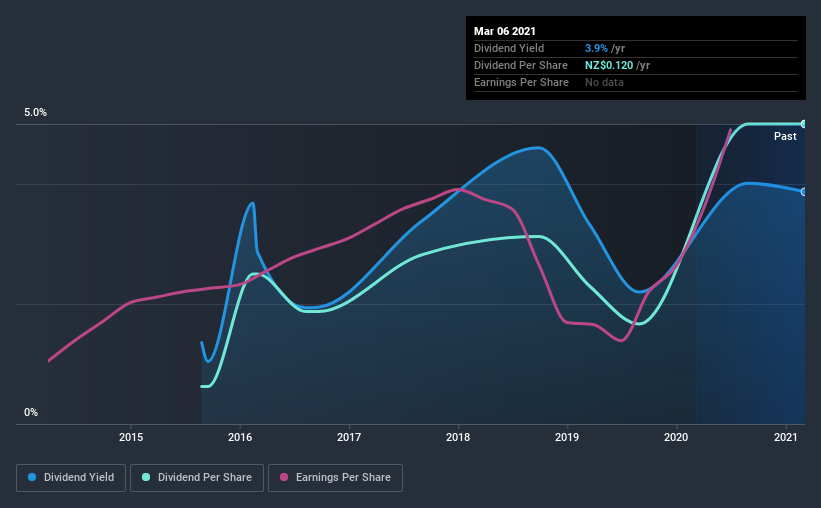

Solution Dynamics's upcoming dividend is NZ$0.07 a share, following on from the last 12 months, when the company distributed a total of NZ$0.12 per share to shareholders. Based on the last year's worth of payments, Solution Dynamics has a trailing yield of 3.9% on the current stock price of NZ$3.1. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Solution Dynamics

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Solution Dynamics paid out 71% of its earnings to investors last year, a normal payout level for most businesses. A useful secondary check can be to evaluate whether Solution Dynamics generated enough free cash flow to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 13% of its cash flow last year.

It's positive to see that Solution Dynamics's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Solution Dynamics paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. For this reason, we're glad to see Solution Dynamics's earnings per share have risen 17% per annum over the last five years. Solution Dynamics has an average payout ratio which suggests a balance between growing earnings and rewarding shareholders. This is a reasonable combination that could hint at some further dividend increases in the future.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last six years, Solution Dynamics has lifted its dividend by approximately 41% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

Final Takeaway

Should investors buy Solution Dynamics for the upcoming dividend? Solution Dynamics's growing earnings per share and conservative payout ratios make for a decent combination. We also like that it paid out a lower percentage of its cash flow. Overall we think this is an attractive combination and worthy of further research.

While it's tempting to invest in Solution Dynamics for the dividends alone, you should always be mindful of the risks involved. For example - Solution Dynamics has 3 warning signs we think you should be aware of.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Solution Dynamics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:SDL

Solution Dynamics

Provides customer communication solutions in New Zealand, Australia, the United States, and Europe.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)