- New Zealand

- /

- Specialty Stores

- /

- NZSE:2CC

NZ Automotive Investments (NZSE:NZA) Has Announced That Its Dividend Will Be Reduced To NZ$0.0063

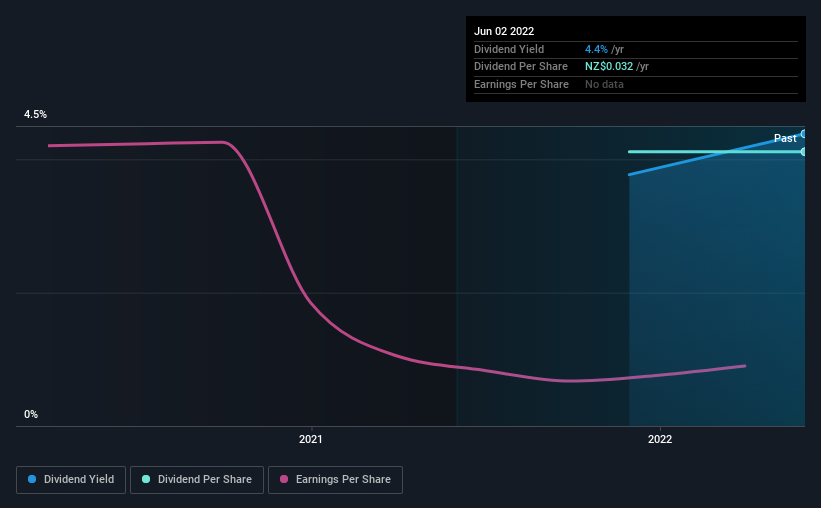

NZ Automotive Investments Limited (NZSE:NZA) has announced it will be reducing its dividend payable on the 23rd of June to NZ$0.0063. Based on this payment, the dividend yield will be 3.1%, which is lower than the average for the industry.

Check out our latest analysis for NZ Automotive Investments

NZ Automotive Investments' Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Before this announcement, NZ Automotive Investments was paying out 110% of what it was earning, and not generating any free cash flows either. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

Looking forward, EPS could fall by 28.6% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 60%, which is an improvement from where it is currently.

NZ Automotive Investments Is Still Building Its Track Record

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. NZ Automotive Investments' earnings per share has shrunk at 29% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

NZ Automotive Investments' Dividend Doesn't Look Great

To sum up, we don't like when dividends are cut, but in this case the dividend may have been too high to begin with. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, the dividend is not reliable enough to make this a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, NZ Automotive Investments has 5 warning signs (and 3 which are potentially serious) we think you should know about. Is NZ Automotive Investments not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:2CC

2 Cheap Cars Group

Engages in used automotive vehicle retailer and vehicle finance businesses in New Zealand.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives