- New Zealand

- /

- Specialty Stores

- /

- NZSE:KMD

Benign Growth For KMD Brands Limited (NZSE:KMD) Underpins Stock's 27% Plummet

Unfortunately for some shareholders, the KMD Brands Limited (NZSE:KMD) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

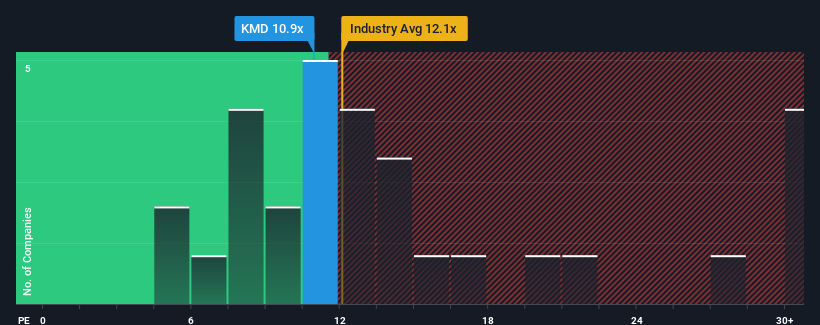

In spite of the heavy fall in price, given about half the companies in New Zealand have price-to-earnings ratios (or "P/E's") above 16x, you may still consider KMD Brands as an attractive investment with its 10.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

KMD Brands has been doing a reasonable job lately as its earnings haven't declined as much as most other companies. One possibility is that the P/E is low because investors think this relatively better earnings performance might be about to deteriorate significantly. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. But at the very least, you'd be hoping that earnings don't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

View our latest analysis for KMD Brands

Does Growth Match The Low P/E?

KMD Brands' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.6%. Even so, admirably EPS has lifted 199% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the seven analysts watching the company. That's shaping up to be materially lower than the 17% per year growth forecast for the broader market.

With this information, we can see why KMD Brands is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

KMD Brands' recently weak share price has pulled its P/E below most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of KMD Brands' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with KMD Brands, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if KMD Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:KMD

KMD Brands

Designs, markets, wholesales, and retails apparel, footwear, and equipment for surfing and the outdoors under the Kathmandu, Rip Curl, and Oboz brands in New Zealand, Australia, North America, Europe, Southeast Asia, and Brazil.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives