- New Zealand

- /

- Office REITs

- /

- NZSE:PCT

Should Precinct Properties' Return to Profit and New Dividends Prompt Action From NZSE:PCT Investors?

Reviewed by Simply Wall St

- Precinct Properties NZ Ltd & Precinct Properties Investments Ltd recently announced their full year results, reporting sales of NZ$266.1 million and a net income of NZ$11 million for the year ended June 30, 2025, compared to a net loss in the prior year.

- This turnaround to profitability, coupled with the declaration of multiple upcoming cash dividends, highlights improved operational results for the company.

- With profitability restored after a prior year loss, we'll explore how Precinct's announced dividends shape its ongoing investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Precinct Properties NZ & Precinct Properties Investments' Investment Narrative?

For anyone considering Precinct Properties NZ & Precinct Properties Investments, the big picture is shaped by a shift back to profitability and the company’s ability to maintain or grow dividends. The recent move to a NZ$11 million net profit, reversing last year’s loss, is an important boost, directly addressing one of the most discussed short-term risks: ongoing earnings volatility due to one-off items. Multiple cash dividends recently affirmed and set for September offer further reassurance for those focused on steady returns, though low free cash flow coverage keeps dividend sustainability in the spotlight. The fresh results soften immediate concerns about operational weakness, though questions remain around projected revenue declines and low forecast return on equity. Overall, the latest announcement provides some positive momentum, but investors should stay alert to cash flow and earnings quality risks as the story continues to unfold.

Yet, with dividend coverage still stretched, one particular financial risk stands out for investors to watch.

Exploring Other Perspectives

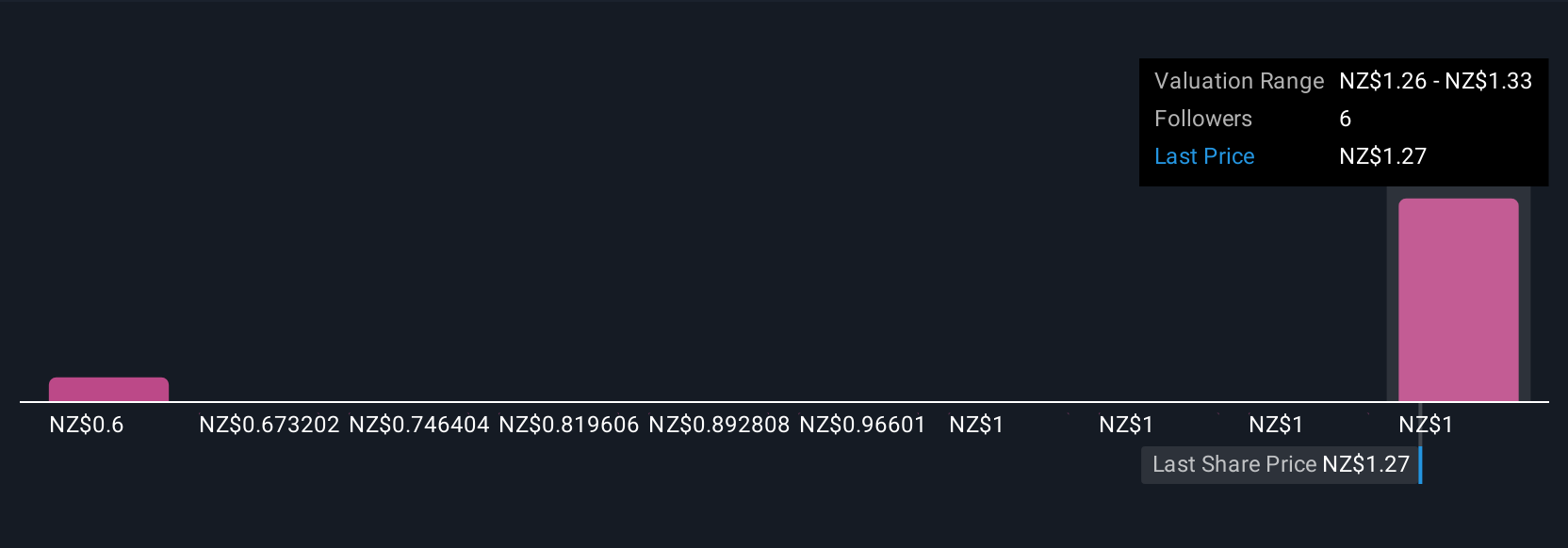

Explore 3 other fair value estimates on Precinct Properties NZ & Precinct Properties Investments - why the stock might be worth less than half the current price!

Build Your Own Precinct Properties NZ & Precinct Properties Investments Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precinct Properties NZ & Precinct Properties Investments research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Precinct Properties NZ & Precinct Properties Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precinct Properties NZ & Precinct Properties Investments' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:PCT

Precinct Properties NZ & Precinct Properties Investments

Listed on the NZX Main Board under the ticker code PCT and ranked in the NZX top 30, Precinct is the largest owner, manager and developer of premium city centre real estate in Auckland and Wellington.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives