As global markets navigate the early days of President Donald Trump's administration, U.S. stocks are reaching record highs, buoyed by optimism around potential trade deals and advancements in artificial intelligence. In this context, penny stocks—often seen as a gateway to investing in smaller or emerging companies—remain a relevant area for those seeking growth opportunities. Despite their historical connotations, these stocks can offer substantial returns when backed by solid financials and strategic growth plans.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £791.31M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,717 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

CDL Investments New Zealand (NZSE:CDI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CDL Investments New Zealand Limited, along with its subsidiary CDL Land New Zealand Limited, focuses on the investment, development, management, and sale of residential land properties in New Zealand and has a market cap of NZ$231.99 million.

Operations: The company's revenue is derived from two segments: Investment Property, generating NZ$2.58 million, and Residential Land Development, contributing NZ$32.85 million.

Market Cap: NZ$232M

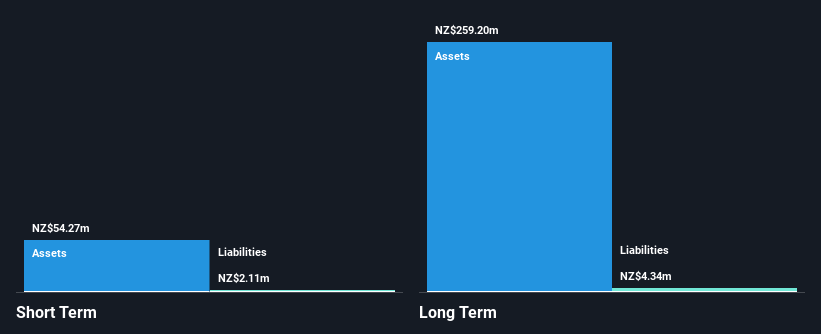

CDL Investments New Zealand has a market cap of NZ$231.99 million and operates debt-free, with short-term assets of NZ$54.3 million comfortably covering both its short-term (NZ$2.1 million) and long-term liabilities (NZ$4.3 million). Despite having high-quality earnings, the company faces challenges with declining profits over the past five years and negative earnings growth in the last year. The Return on Equity is low at 3.6%, and profit margins have decreased from 42.4% to 31.6%. Additionally, its dividend yield of 4.4% is not well supported by current earnings or free cash flows.

- Unlock comprehensive insights into our analysis of CDL Investments New Zealand stock in this financial health report.

- Gain insights into CDL Investments New Zealand's historical outcomes by reviewing our past performance report.

Acme International Holdings (SEHK:1870)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acme International Holdings Limited is an investment holding company that offers design and build solutions for building maintenance unit (BMU) system works in Hong Kong, Macau, and internationally, with a market capitalization of HK$1.06 billion.

Operations: The company's revenue is primarily derived from its BMU Systems Business, generating HK$194.18 million, and the Green New Energy Business, contributing HK$6.47 million.

Market Cap: HK$1.06B

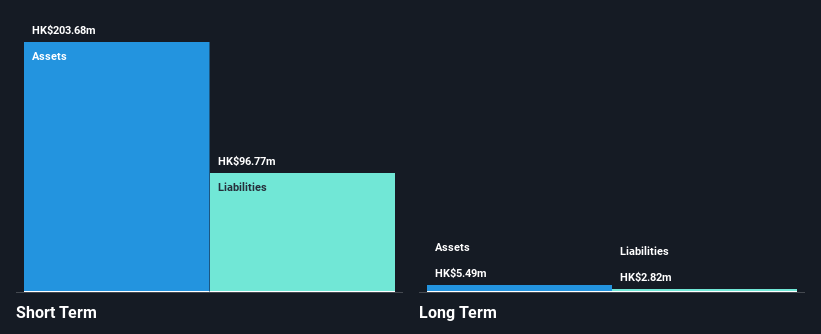

Acme International Holdings, with a market cap of HK$1.06 billion, primarily generates revenue from its BMU Systems Business (HK$194.18 million). Despite a seasoned management team and board, the company experienced negative earnings growth last year (-25.9%) and declining profit margins from 13.3% to 7.4%. Short-term assets (HK$203.7M) exceed both short-term (HK$96.8M) and long-term liabilities (HK$2.8M), indicating solid liquidity management, while debt is well covered by operating cash flow at 34.1%. Recent insider selling may raise concerns despite trading significantly below estimated fair value and satisfactory net debt to equity ratio of 11.4%.

- Get an in-depth perspective on Acme International Holdings' performance by reading our balance sheet health report here.

- Explore historical data to track Acme International Holdings' performance over time in our past results report.

Baoxiniao Holding (SZSE:002154)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baoxiniao Holding Co., Ltd. focuses on the research and development, production, and sale of branded men's and women's clothing products in China, with a market cap of CN¥6.04 billion.

Operations: The company generates its revenue primarily from the Textile and Apparel segment, amounting to CN¥4.98 billion.

Market Cap: CN¥6.04B

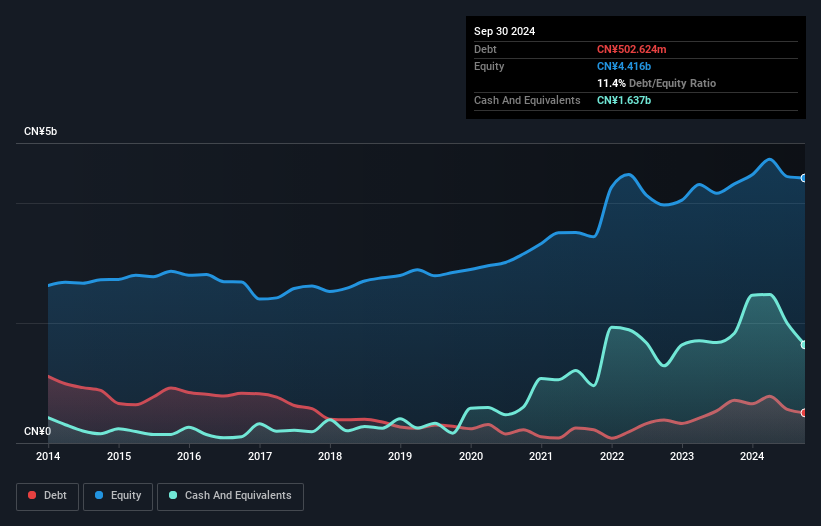

Baoxiniao Holding Co., Ltd. has a market cap of CN¥6.04 billion and reported revenue of CN¥3,535.79 million for the nine months ending September 2024, reflecting a decline from the previous year alongside reduced net income and profit margins. Despite these challenges, the company maintains strong liquidity with short-term assets exceeding both short-term and long-term liabilities. The debt is well covered by operating cash flow, though the debt-to-equity ratio has slightly increased over five years. While earnings growth was negative last year, forecasts suggest potential improvement at 15.85% annually amidst stable weekly volatility and experienced management oversight.

- Navigate through the intricacies of Baoxiniao Holding with our comprehensive balance sheet health report here.

- Understand Baoxiniao Holding's earnings outlook by examining our growth report.

Key Takeaways

- Jump into our full catalog of 5,717 Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baoxiniao Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002154

Baoxiniao Holding

Engages in the research and development, production, and sale of branded men and women clothing products in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives