- New Zealand

- /

- Pharma

- /

- NZSE:BLT

BLIS Technologies (NZSE:BLT) Is In A Strong Position To Grow Its Business

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for BLIS Technologies (NZSE:BLT) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out the opportunities and risks within the NZ Pharmaceuticals industry.

Does BLIS Technologies Have A Long Cash Runway?

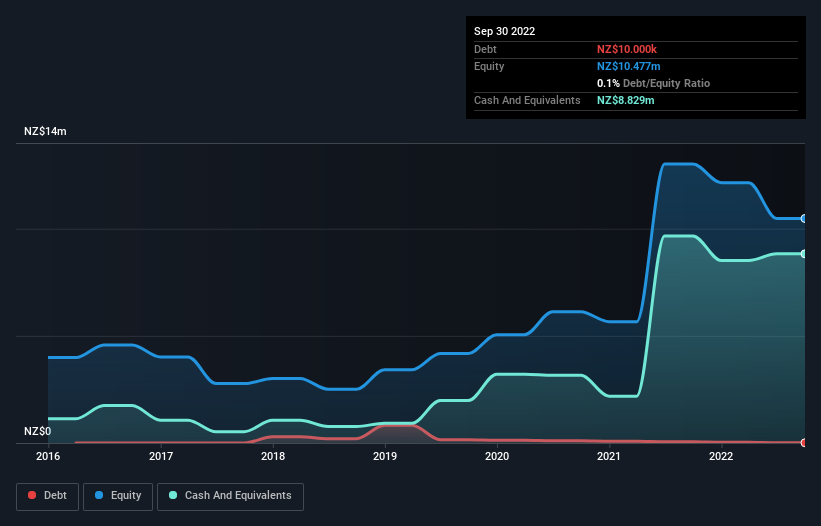

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2022, BLIS Technologies had cash of NZ$8.8m and such minimal debt that we can ignore it for the purposes of this analysis. In the last year, its cash burn was NZ$693k. So it had a very long cash runway of many years from September 2022. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

How Well Is BLIS Technologies Growing?

BLIS Technologies managed to reduce its cash burn by 71% over the last twelve months, which suggests it's on the right flight path. And while hardly exciting, it was still good to see revenue growth of 7.5% during that time. We think it is growing rather well, upon reflection. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how BLIS Technologies has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For BLIS Technologies To Raise More Cash For Growth?

There's no doubt BLIS Technologies seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of NZ$36m, BLIS Technologies' NZ$693k in cash burn equates to about 1.9% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About BLIS Technologies' Cash Burn?

As you can probably tell by now, we're not too worried about BLIS Technologies' cash burn. For example, we think its cash runway suggests that the company is on a good path. On this analysis its revenue growth was its weakest feature, but we are not concerned about it. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Taking a deeper dive, we've spotted 3 warning signs for BLIS Technologies you should be aware of, and 1 of them is a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if BLIS Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:BLT

BLIS Technologies

Develops and sells healthcare products based on strains of bacteria that produce bacteriocin activity in New Zealand, Asia Pacific, Europe Middle East and Africa, and North America.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026