- New Zealand

- /

- Medical Equipment

- /

- NZSE:FPH

Fisher & Paykel Healthcare Corporation Limited's (NZSE:FPH) Business Is Yet to Catch Up With Its Share Price

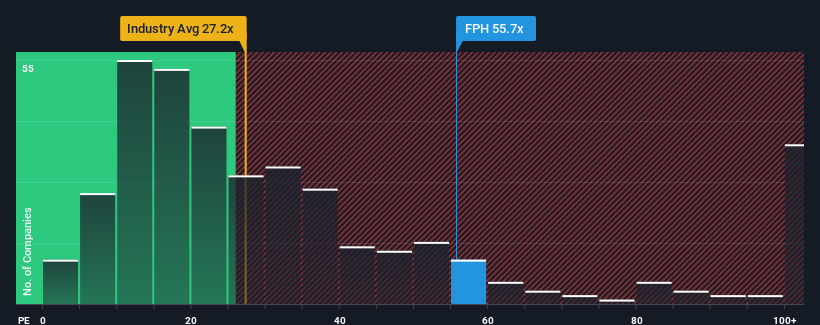

When close to half the companies in New Zealand have price-to-earnings ratios (or "P/E's") below 15x, you may consider Fisher & Paykel Healthcare Corporation Limited (NZSE:FPH) as a stock to avoid entirely with its 55.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Fisher & Paykel Healthcare as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Fisher & Paykel Healthcare

Is There Enough Growth For Fisher & Paykel Healthcare?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Fisher & Paykel Healthcare's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 3.8%. However, this wasn't enough as the latest three year period has seen an unpleasant 34% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 20% per annum over the next three years. With the market predicted to deliver 20% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Fisher & Paykel Healthcare is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Fisher & Paykel Healthcare currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Fisher & Paykel Healthcare with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Fisher & Paykel Healthcare. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:FPH

Fisher & Paykel Healthcare

Designs, manufactures, markets, and sells medical device products and systems in North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.