- New Zealand

- /

- Food

- /

- NZSE:SML

Synlait Milk Limited's (NZSE:SML) 25% Cheaper Price Remains In Tune With Revenues

Unfortunately for some shareholders, the Synlait Milk Limited (NZSE:SML) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 79% loss during that time.

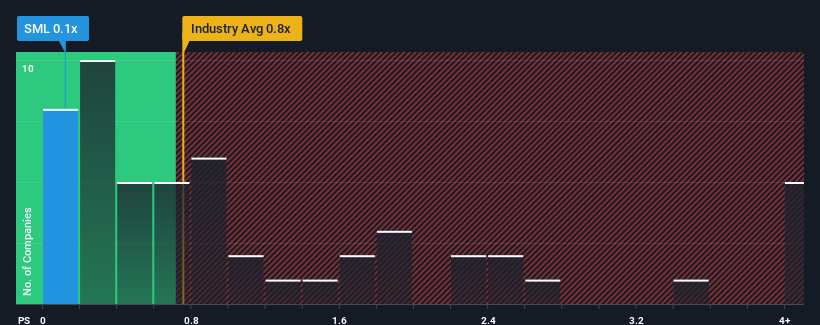

In spite of the heavy fall in price, there still wouldn't be many who think Synlait Milk's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in New Zealand's Food industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Synlait Milk

How Has Synlait Milk Performed Recently?

Synlait Milk could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Synlait Milk.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Synlait Milk's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.5%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 7.1% each year during the coming three years according to the five analysts following the company. That's shaping up to be similar to the 6.0% each year growth forecast for the broader industry.

With this in mind, it makes sense that Synlait Milk's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Synlait Milk's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Synlait Milk's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Synlait Milk (of which 1 is potentially serious!) you should know about.

If you're unsure about the strength of Synlait Milk's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Synlait Milk, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:SML

Synlait Milk

Manufactures, markets, sells, and exports dairy products under the Dairyworks, Rolling Meadow, and Alpine brands in China, rest of Asia, the Middle East, Africa, New Zealand, Australia, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives