- New Zealand

- /

- Food

- /

- NZSE:SML

Synlait Milk Limited (NZSE:SML) Shares Slammed 30% But Getting In Cheap Might Be Difficult Regardless

Synlait Milk Limited (NZSE:SML) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

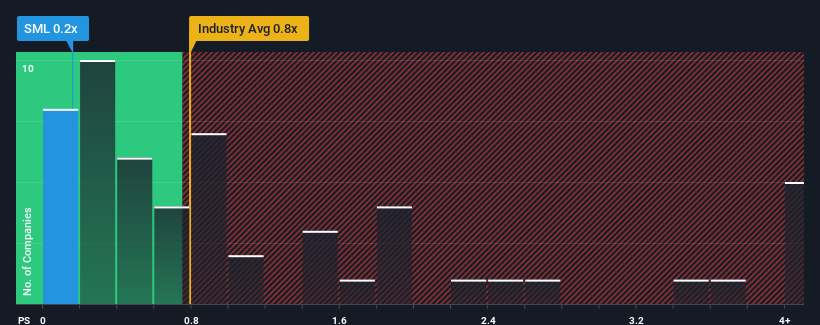

Although its price has dipped substantially, it's still not a stretch to say that Synlait Milk's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Food industry in New Zealand, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Synlait Milk

How Synlait Milk Has Been Performing

While the industry has experienced revenue growth lately, Synlait Milk's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Synlait Milk's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Synlait Milk's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.5%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.8% each year during the coming three years according to the five analysts following the company. That's shaping up to be similar to the 5.8% per year growth forecast for the broader industry.

With this in mind, it makes sense that Synlait Milk's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Synlait Milk's P/S?

Synlait Milk's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Synlait Milk's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Synlait Milk (2 are concerning) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:SML

Synlait Milk

Manufactures, markets, sells, and exports dairy products under the Dairyworks, Rolling Meadow, and Alpine brands in China, rest of Asia, the Middle East, Africa, New Zealand, Australia, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives