- New Zealand

- /

- Food

- /

- NZSE:LIC

Investors Don't See Light At End Of Livestock Improvement Corporation Limited's (NZSE:LIC) Tunnel

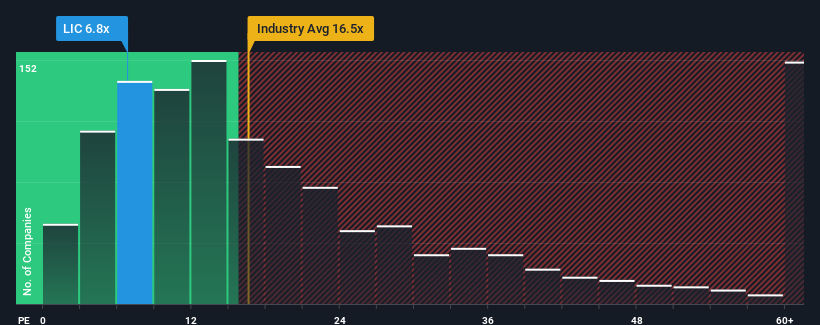

With a price-to-earnings (or "P/E") ratio of 6.8x Livestock Improvement Corporation Limited (NZSE:LIC) may be sending very bullish signals at the moment, given that almost half of all companies in New Zealand have P/E ratios greater than 16x and even P/E's higher than 31x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for Livestock Improvement as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Livestock Improvement

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Livestock Improvement's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 188% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 2.5% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 5.4% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Livestock Improvement's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Livestock Improvement's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Livestock Improvement maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Livestock Improvement (2 make us uncomfortable!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:LIC

Livestock Improvement

Engages in the development, production and marketing of artificial breeding, genetics, farm software, and herd testing services in the dairy industry.

Flawless balance sheet and good value.

Market Insights

Community Narratives