- New Zealand

- /

- Food

- /

- NZSE:FCG

Fonterra Co-operative Group (NZSE:FCG) Takes On Some Risk With Its Use Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Fonterra Co-operative Group Limited (NZSE:FCG) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Fonterra Co-operative Group

What Is Fonterra Co-operative Group's Debt?

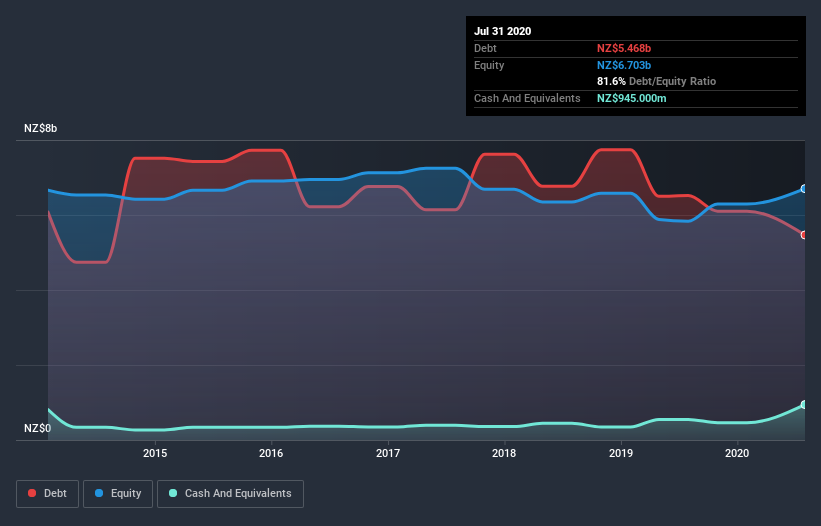

The image below, which you can click on for greater detail, shows that Fonterra Co-operative Group had debt of NZ$5.47b at the end of July 2020, a reduction from NZ$6.52b over a year. However, because it has a cash reserve of NZ$945.0m, its net debt is less, at about NZ$4.52b.

A Look At Fonterra Co-operative Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Fonterra Co-operative Group had liabilities of NZ$5.31b due within 12 months and liabilities of NZ$5.90b due beyond that. Offsetting this, it had NZ$945.0m in cash and NZ$1.82b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NZ$8.45b.

Given this deficit is actually higher than the company's market capitalization of NZ$7.08b, we think shareholders really should watch Fonterra Co-operative Group's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Fonterra Co-operative Group's debt is 3.5 times its EBITDA, and its EBIT cover its interest expense 2.9 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably, Fonterra Co-operative Group's EBIT was pretty flat over the last year, which isn't ideal given the debt load. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Fonterra Co-operative Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Fonterra Co-operative Group recorded free cash flow worth 78% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Fonterra Co-operative Group's level of total liabilities and interest cover definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Taking the abovementioned factors together we do think Fonterra Co-operative Group's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Fonterra Co-operative Group has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Fonterra Co-operative Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:FCG

Fonterra Co-operative Group

Fonterra Co-operative Group Limited, together with its subsidiaries, collects, manufactures, and sells milk and milk-derived products.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives