- New Zealand

- /

- Food

- /

- NZSE:FCG

Fonterra Co-operative Group Limited's (NZSE:FCG) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Fonterra Co-operative Group's (NZSE:FCG) stock is up by a considerable 11% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. In this article, we decided to focus on Fonterra Co-operative Group's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Fonterra Co-operative Group

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Fonterra Co-operative Group is:

12% = NZ$803m ÷ NZ$6.7b (Based on the trailing twelve months to July 2020).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every NZ$1 of its shareholder's investments, the company generates a profit of NZ$0.12.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Fonterra Co-operative Group's Earnings Growth And 12% ROE

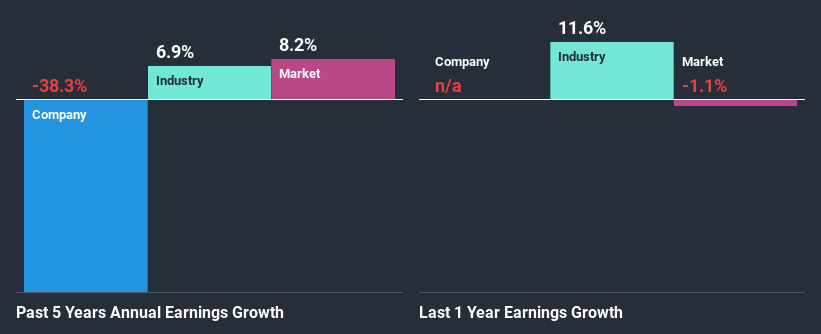

To start with, Fonterra Co-operative Group's ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 7.7%. Needless to say, we are quite surprised to see that Fonterra Co-operative Group's net income shrunk at a rate of 38% over the past five years. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

That being said, we compared Fonterra Co-operative Group's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 6.9% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Fonterra Co-operative Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Fonterra Co-operative Group Using Its Retained Earnings Effectively?

Fonterra Co-operative Group's low LTM (or last twelve month) payout ratio of 9.7% (implying that it retains the remaining 90% of its profits) comes as a surprise when you pair it with the shrinking earnings. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. So there might be other factors at play here which could potentially be hampering growth. For instance, the business has faced some headwinds.

In addition, Fonterra Co-operative Group has been paying dividends over a period of eight years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline.

Conclusion

On the whole, we do feel that Fonterra Co-operative Group has some positive attributes. However, given the high ROE and high profit retention, we would expect the company to be delivering strong earnings growth, but that isn't the case here. This suggests that there might be some external threat to the business, that's hampering its growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. To know the 3 risks we have identified for Fonterra Co-operative Group visit our risks dashboard for free.

When trading Fonterra Co-operative Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Fonterra Co-operative Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NZSE:FCG

Fonterra Co-operative Group

Fonterra Co-operative Group Limited, together with its subsidiaries, collects, manufactures, and sells milk and milk-derived products.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives