- New Zealand

- /

- Capital Markets

- /

- NZSE:NZX

Global Penny Stocks With Market Caps Larger Than US$200M

Reviewed by Simply Wall St

Global markets have recently experienced a downturn, with U.S. stocks facing significant declines amid trade policy uncertainties and inflation concerns. Despite these challenges, certain investment opportunities remain appealing, particularly in niche areas like penny stocks. Though often seen as a relic of past trading days, penny stocks can offer growth potential at lower price points when they come with strong financial health and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ★★★★★★ |

| NEXG Berhad (KLSE:DSONIC) | MYR0.255 | MYR709.45M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.33 | SGD9.2B | ★★★★★☆ |

| Bosideng International Holdings (SEHK:3998) | HK$4.15 | HK$48.71B | ★★★★★★ |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.24 | MYR625.03M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.61 | A$74.53M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.65 | £415.17M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.26 | HK$806.18M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.955 | £293.89M | ★★★★☆☆ |

Click here to see the full list of 5,731 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

NZX (NZSE:NZX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NZX Limited operates a stock exchange in New Zealand with a market capitalization of NZ$523.24 million.

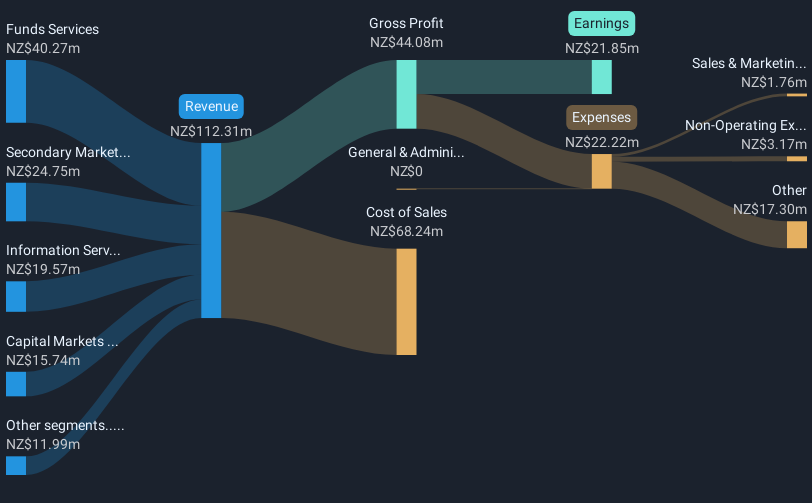

Operations: The company's revenue is derived from several segments: Regulation (NZ$3.996 million), Wealth Technology (NZ$9.73 million), Funds Services (NZ$44.01 million), Secondary Markets (NZ$25.99 million), Corporate Services (NZ$0.10 million), Information Services (NZ$19.91 million), and Capital Markets Origination (NZ$17.02 million).

Market Cap: NZ$523.24M

NZX Limited, with a market cap of NZ$523.24 million, has shown significant financial strength and growth. Recent earnings for 2024 were NZ$25.49 million, up from NZ$13.55 million the previous year, reflecting an 88.1% increase in profit growth that surpasses industry averages. The company's debt to equity ratio has decreased over five years to 48.4%, indicating improved financial health, while interest payments are well covered by EBIT at 8.5 times coverage. Despite a large one-off gain affecting past earnings quality, its net profit margin improved to 21.1%. Additionally, the company declared a final dividend of $0.031 per share for April 2025 distribution and recently transitioned auditors from KPMG to PwC following a formal review process.

- Click here to discover the nuances of NZX with our detailed analytical financial health report.

- Examine NZX's earnings growth report to understand how analysts expect it to perform.

Gohigh NetworksLtd (SZSE:000851)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gohigh Networks Co., Ltd. operates in the digital intelligence application, information service, and IT sales sectors in China with a market capitalization of CN¥2.78 billion.

Operations: The company generates CN¥3.38 billion in revenue from its operations within China.

Market Cap: CN¥2.78B

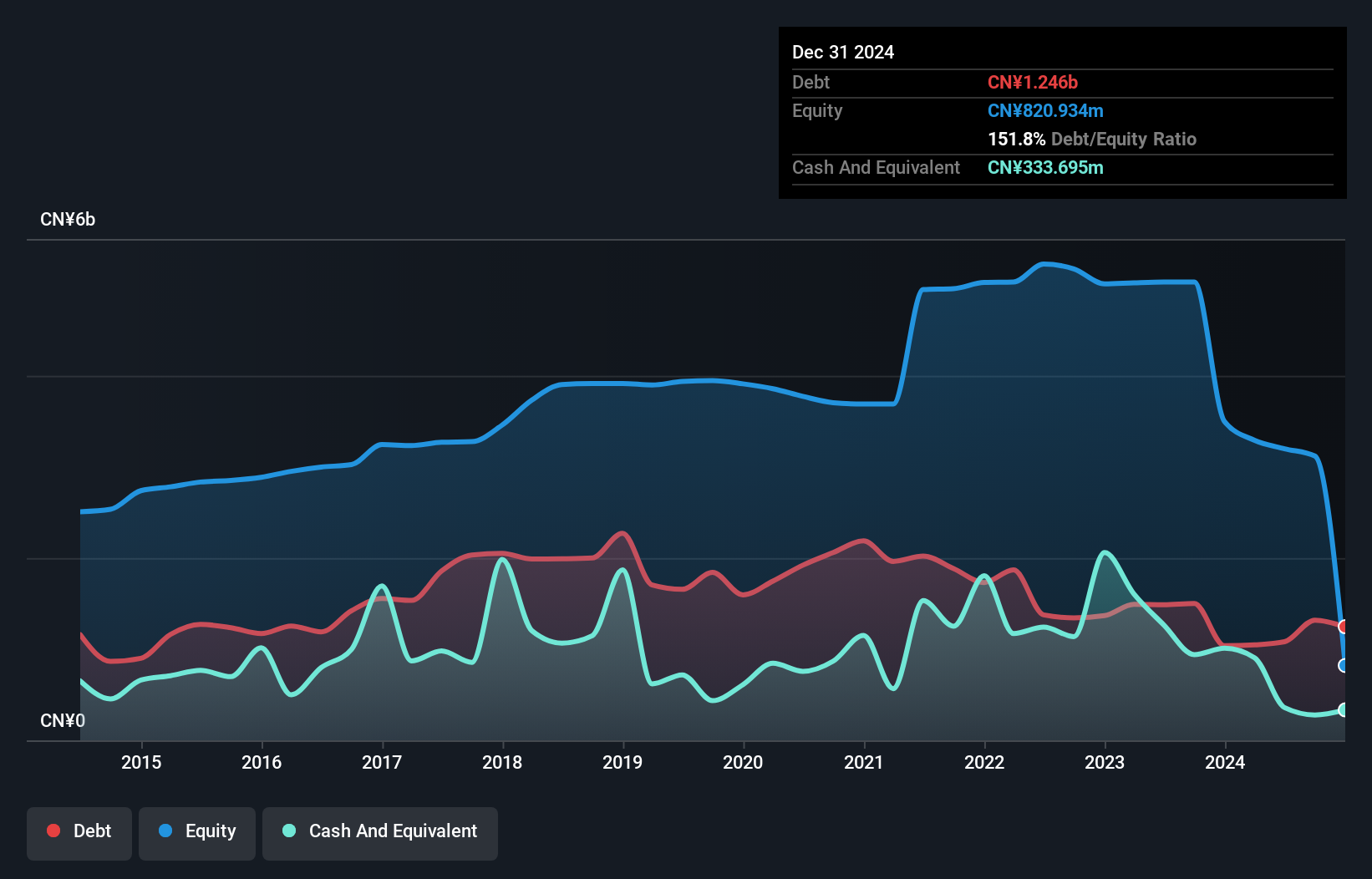

Gohigh Networks Co., Ltd., with a market cap of CN¥2.78 billion, operates in the digital intelligence sector in China. The company generates CN¥3.38 billion in revenue but remains unprofitable, with losses increasing at a significant rate over the past five years. Despite this, its short-term assets of CN¥3.8 billion exceed both short-term and long-term liabilities, suggesting a solid financial position overall. The net debt to equity ratio is satisfactory at 33.4%, although cash runway remains limited to less than one year based on current free cash flow trends. A recent shareholders meeting focused on reappointing audit firms for 2024 highlights ongoing governance activities amidst management and board changes.

- Click to explore a detailed breakdown of our findings in Gohigh NetworksLtd's financial health report.

- Understand Gohigh NetworksLtd's track record by examining our performance history report.

Zhejiang Kaier New MaterialsLtd (SZSE:300234)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Kaier New Materials Co., Ltd. focuses on the design, research, development, manufacture, promotion, and sale of functional enamel materials in China with a market cap of CN¥2.45 billion.

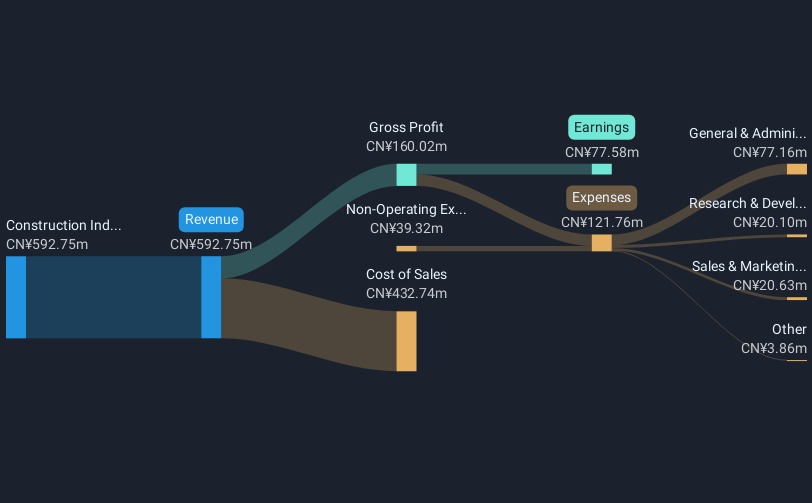

Operations: The company generates revenue of CN¥592.75 million from the construction industry segment.

Market Cap: CN¥2.45B

Zhejiang Kaier New Materials Co., Ltd. has shown moderate earnings growth of 3.5% over the past year, surpassing the Basic Materials industry's decline. The company's financial health appears solid, with short-term assets of CN¥792.5 million covering both short and long-term liabilities comfortably, and a debt-to-equity ratio reduced to 3.7% over five years. Although its Price-To-Earnings ratio is lower than the market average, indicating potential value, recent results were impacted by a significant one-off gain of CN¥39.7 million. While management is experienced with an average tenure of 6.5 years, board experience remains limited at 2.7 years on average.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Kaier New MaterialsLtd.

- Review our historical performance report to gain insights into Zhejiang Kaier New MaterialsLtd's track record.

Turning Ideas Into Actions

- Unlock our comprehensive list of 5,731 Global Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NZX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:NZX

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives