Global markets have been experiencing a mix of optimism and caution, with U.S. stock indexes nearing record highs despite inflationary pressures. For investors willing to explore beyond the large-cap landscape, penny stocks—often representing smaller or newer companies—remain an intriguing area for potential growth. Although the term 'penny stock' might seem outdated, these investments can still offer surprising value when backed by solid financials, presenting opportunities for those seeking hidden gems in the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.84 | MYR278.83M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR411.2M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.15 | £313.29M | ★★★★☆☆ |

Click here to see the full list of 5,690 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Millennium & Copthorne Hotels New Zealand (NZSE:MCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Millennium & Copthorne Hotels New Zealand Limited owns, operates, manages, leases, and franchises hotels in New Zealand and Australia with a market cap of NZ$342.81 million.

Operations: The company's revenue is primarily derived from hotel operations (NZ$109.52 million), with additional contributions from residential land development (NZ$32.85 million), residential property development (NZ$25.98 million), and investment property (NZ$2.58 million).

Market Cap: NZ$342.81M

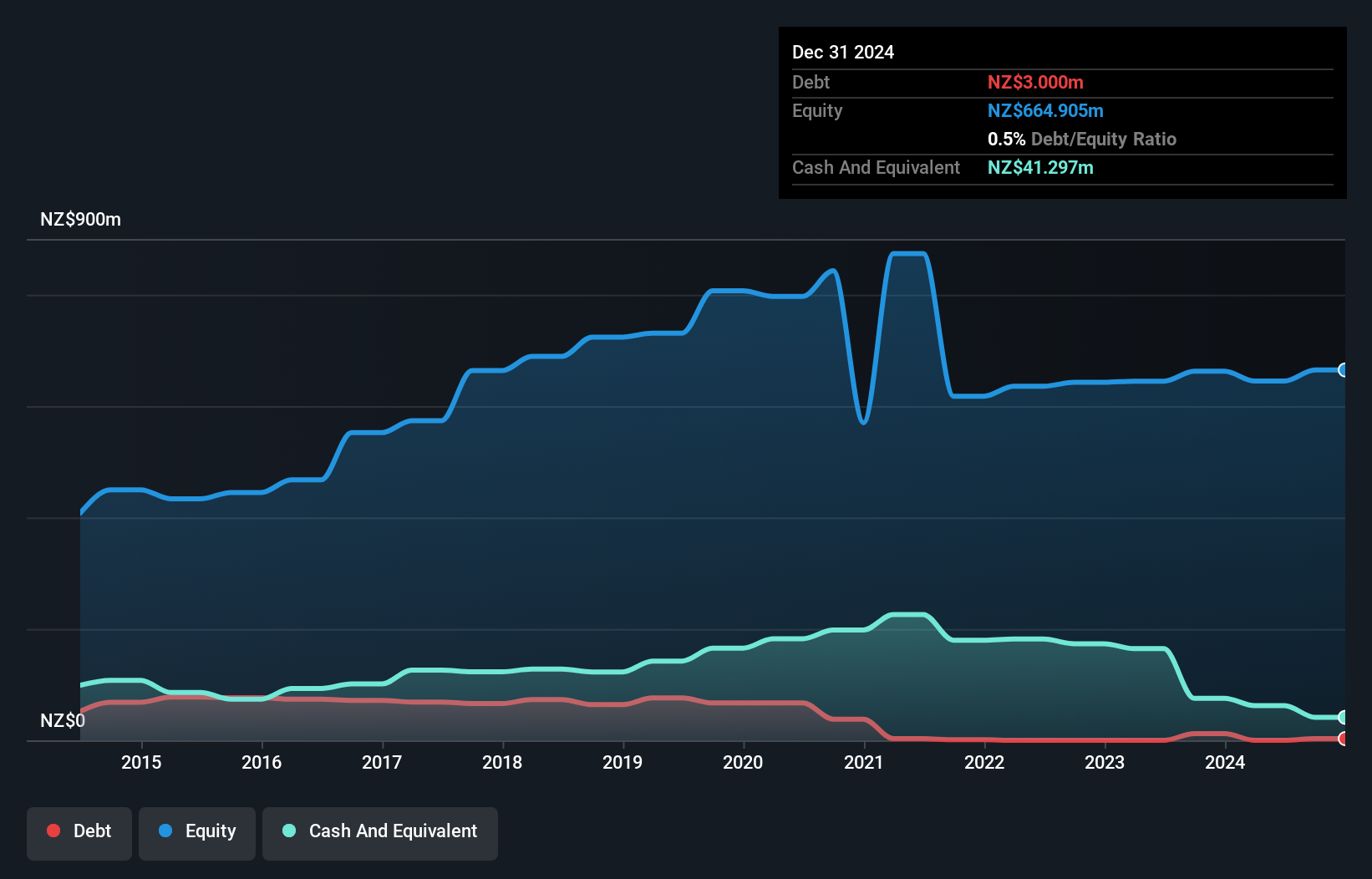

Millennium & Copthorne Hotels New Zealand Limited, with a market cap of NZ$342.81 million, generates revenue mainly from hotel operations and property development. Despite its stable asset coverage over liabilities and absence of debt, the company faces challenges such as declining earnings over the past five years and reduced profit margins (2.2% compared to last year's 10.4%). Its share price has been highly volatile recently. A significant development is CDL Hotels Holdings' proposal to acquire the remaining stake in MCK for NZD 57.2 million, aiming to delist and privatize it by May 2025, pending regulatory approvals.

- Jump into the full analysis health report here for a deeper understanding of Millennium & Copthorne Hotels New Zealand.

- Gain insights into Millennium & Copthorne Hotels New Zealand's past trends and performance with our report on the company's historical track record.

China Sunshine Paper Holdings (SEHK:2002)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Sunshine Paper Holdings Company Limited, along with its subsidiaries, is engaged in the production and sale of paper products both within the People's Republic of China and internationally, with a market cap of HK$2.40 billion.

Operations: The company's revenue is primarily derived from its paper products segment, including Coated-White TOP Linerboard (CN¥1.97 billion), Specialised Paper Products (CN¥1.71 billion), Corrugated Paper (CN¥1.81 billion), White Top Linerboard (CN¥1.57 billion), and Core Board (CN¥615.63 million), along with electricity and steam sales amounting to CN¥1.33 billion.

Market Cap: HK$2.4B

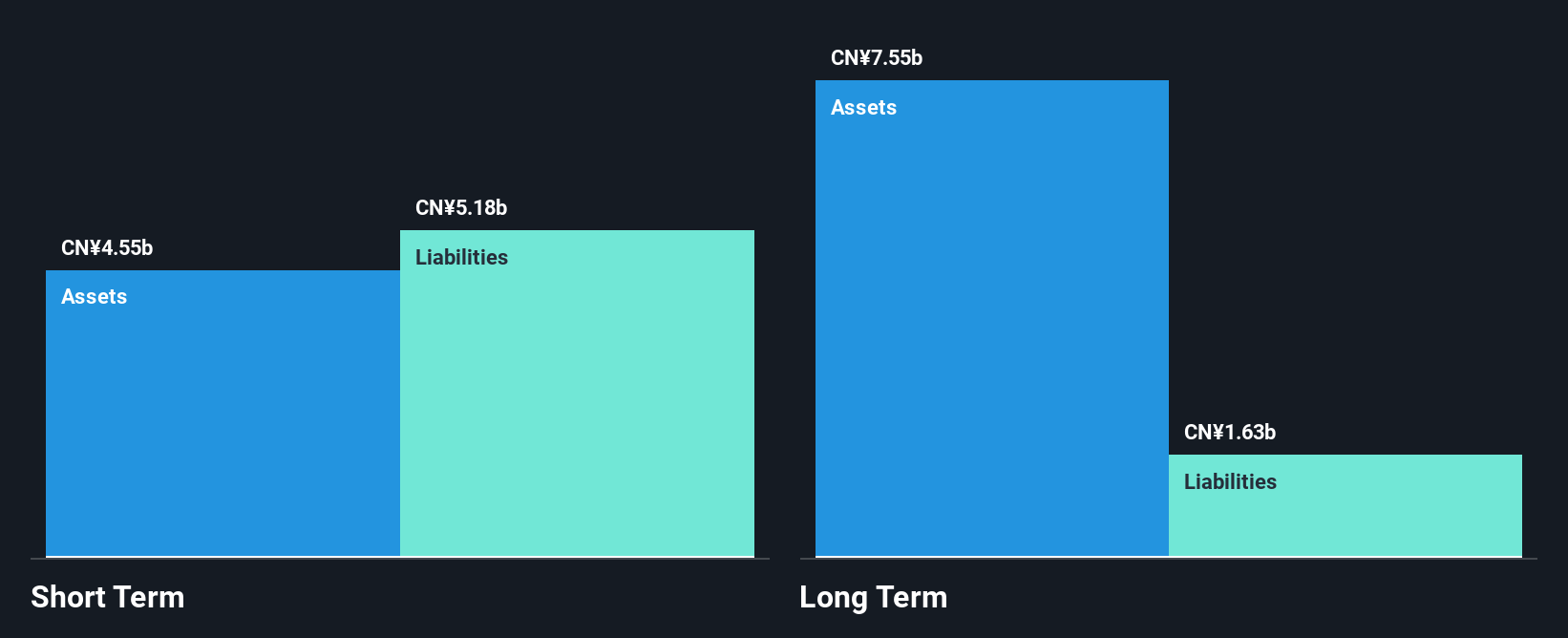

China Sunshine Paper Holdings, with a market cap of HK$2.40 billion, shows strengths in earnings growth and revenue diversification across its paper products segments. The company's earnings surged by 65.5% last year, surpassing the industry average, although its five-year trend shows a decline of 4.3% annually. Despite high debt levels (net debt to equity ratio at 62.8%), operating cash flow covers this well at 20.8%. The short-term assets fall short of covering liabilities but exceed long-term obligations significantly. Trading below estimated fair value suggests potential undervaluation; however, low return on equity and an inexperienced management team are concerns for investors.

- Click here to discover the nuances of China Sunshine Paper Holdings with our detailed analytical financial health report.

- Understand China Sunshine Paper Holdings' track record by examining our performance history report.

Peijia Medical (SEHK:9996)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Peijia Medical Limited focuses on the research and development of transcatheter valve therapeutic and neuro interventional procedural medical devices, with a market cap of HK$2.71 billion.

Operations: The company generates revenue from its Neurointerventional Business, which accounts for CN¥309.30 million, and its Transcatheter Valve Therapeutic Business, contributing CN¥208.16 million.

Market Cap: HK$2.71B

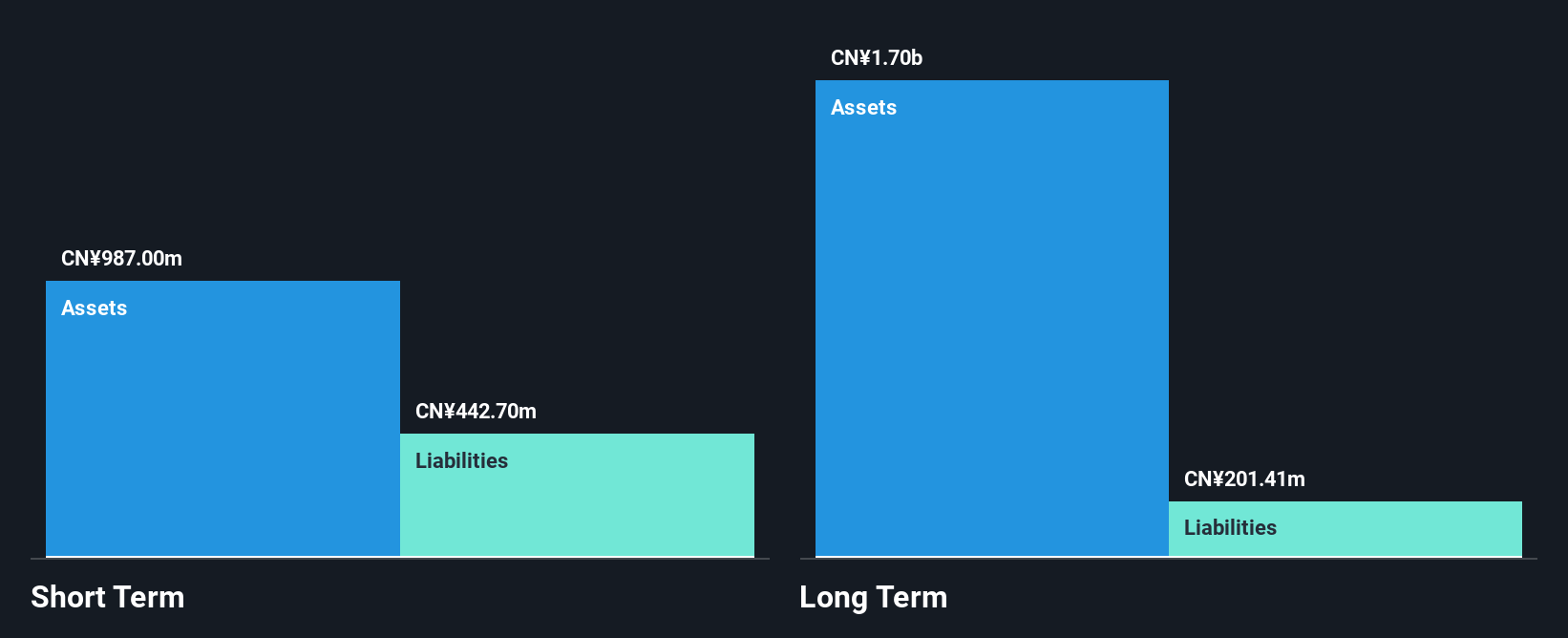

Peijia Medical Limited, with a market cap of HK$2.71 billion, is focused on growth within its neurointerventional and transcatheter valve therapeutic businesses. Despite being unprofitable with a negative return on equity of -11.54%, the company has reduced losses over five years and forecasts revenue growth of 29.16% annually. Recent guidance projects revenue between RMB 610 million to RMB 630 million for 2024, driven by product line expansion and increased market share in China’s TAVR sector. The firm benefits from strong cash reserves exceeding debt, stable weekly volatility, and no recent shareholder dilution, but profitability remains elusive in the near term.

- Navigate through the intricacies of Peijia Medical with our comprehensive balance sheet health report here.

- Evaluate Peijia Medical's prospects by accessing our earnings growth report.

Where To Now?

- Explore the 5,690 names from our Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2002

China Sunshine Paper Holdings

Produces and sells paper products in the People's Republic of China and internationally.

Good value with proven track record.

Market Insights

Community Narratives