- New Zealand

- /

- Hospitality

- /

- NZSE:CCC

Should Shareholders Worry About Cooks Global Foods Limited's (NZSE:CGF) CEO Compensation Package?

Performance at Cooks Global Foods Limited (NZSE:CGF) has not been particularly rosy recently and shareholders will likely be holding CEO Graeme Jackson and the board accountable for this. The next AGM coming up on 28 September 2021 will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

View our latest analysis for Cooks Global Foods

Comparing Cooks Global Foods Limited's CEO Compensation With the industry

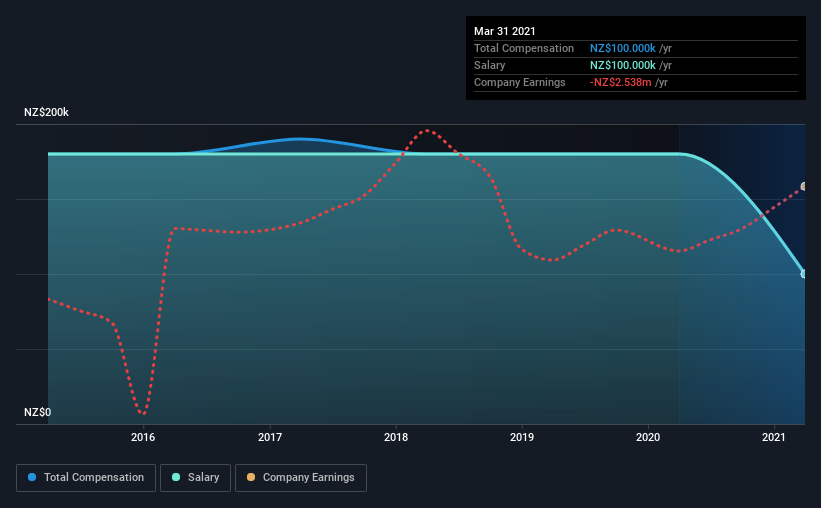

According to our data, Cooks Global Foods Limited has a market capitalization of NZ$27m, and paid its CEO total annual compensation worth NZ$100k over the year to March 2021. We note that's a decrease of 44% compared to last year. Notably, the salary of NZ$100k is the entirety of the CEO compensation.

In comparison with other companies in the industry with market capitalizations under NZ$284m, the reported median total CEO compensation was NZ$177k. In other words, Cooks Global Foods pays its CEO lower than the industry median. Furthermore, Graeme Jackson directly owns NZ$2.5m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | NZ$100k | NZ$180k | 100% |

| Other | - | - | - |

| Total Compensation | NZ$100k | NZ$180k | 100% |

Speaking on an industry level, nearly 31% of total compensation represents salary, while the remainder of 69% is other remuneration. Speaking on a company level, Cooks Global Foods prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Cooks Global Foods Limited's Growth

Cooks Global Foods Limited has reduced its earnings per share by 3.5% a year over the last three years. Its revenue is down 54% over the previous year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Cooks Global Foods Limited Been A Good Investment?

Few Cooks Global Foods Limited shareholders would feel satisfied with the return of -49% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Cooks Global Foods pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 4 warning signs for Cooks Global Foods (of which 2 are a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Important note: Cooks Global Foods is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:CCC

Cooks Coffee

Operates a network of cafes in the New Zealand and internationally.

Slight with acceptable track record.

Market Insights

Community Narratives