- New Zealand

- /

- Building

- /

- NZSE:FBU

Most Shareholders Will Probably Find That The CEO Compensation For Fletcher Building Limited (NZSE:FBU) Is Reasonable

Key Insights

- Fletcher Building's Annual General Meeting to take place on 26th of October

- Salary of NZ$2.22m is part of CEO Ross Taylor's total remuneration

- Total compensation is similar to the industry average

- Fletcher Building's EPS grew by 65% over the past three years while total shareholder return over the past three years was 26%

Under the guidance of CEO Ross Taylor, Fletcher Building Limited (NZSE:FBU) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 26th of October. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Fletcher Building

Comparing Fletcher Building Limited's CEO Compensation With The Industry

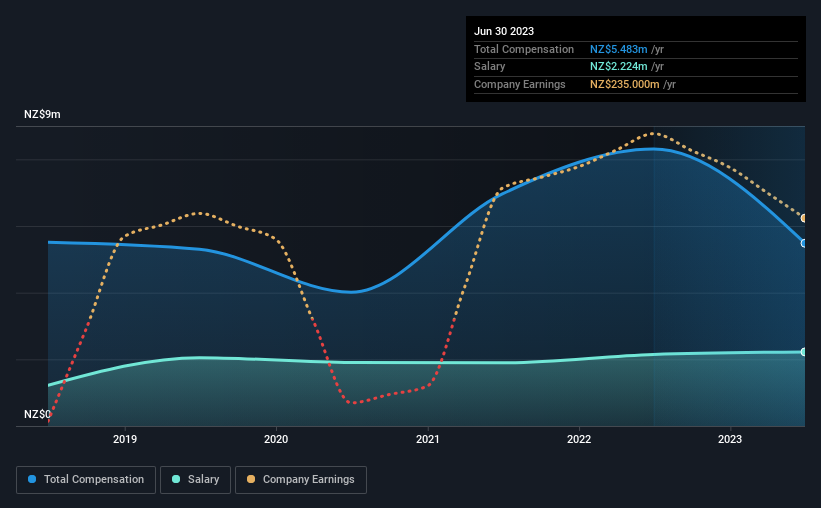

At the time of writing, our data shows that Fletcher Building Limited has a market capitalization of NZ$3.4b, and reported total annual CEO compensation of NZ$5.5m for the year to June 2023. We note that's a decrease of 34% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at NZ$2.2m.

For comparison, other companies in the New Zealand Building industry with market capitalizations ranging between NZ$1.7b and NZ$5.5b had a median total CEO compensation of NZ$4.3m. So it looks like Fletcher Building compensates Ross Taylor in line with the median for the industry. Moreover, Ross Taylor also holds NZ$4.5m worth of Fletcher Building stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | NZ$2.2m | NZ$2.1m | 41% |

| Other | NZ$3.3m | NZ$6.2m | 59% |

| Total Compensation | NZ$5.5m | NZ$8.3m | 100% |

On an industry level, roughly 71% of total compensation represents salary and 29% is other remuneration. It's interesting to note that Fletcher Building allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Fletcher Building Limited's Growth Numbers

Fletcher Building Limited has seen its earnings per share (EPS) increase by 65% a year over the past three years. In the last year, its revenue changed by just 0.3%.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Fletcher Building Limited Been A Good Investment?

Fletcher Building Limited has served shareholders reasonably well, with a total return of 26% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for Fletcher Building (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:FBU

Fletcher Building

Manufactures and distributes building products in New Zealand, Australia, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.