Asian Undervalued Small Caps With Insider Activity In May 2025

Reviewed by Simply Wall St

As Asian markets navigate the shifting landscape of global trade tensions, recent developments such as the U.S.-China tariff suspension have injected a wave of optimism into equities, including small-cap stocks. With economic indicators like inflation cooling and consumer sentiment fluctuating, investors are keenly observing how these factors might influence market dynamics. In this context, identifying promising small-cap stocks often involves looking at those with strong fundamentals and insider activity that suggest potential resilience or growth in volatile conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.1x | 0.9x | 42.32% | ★★★★★★ |

| Puregold Price Club | 8.5x | 0.4x | 23.20% | ★★★★★☆ |

| East West Banking | 3.1x | 0.7x | 34.86% | ★★★★★☆ |

| Atturra | 28.2x | 1.2x | 36.99% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 46.56% | ★★★★★☆ |

| Dicker Data | 19.1x | 0.7x | -22.65% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 39.74% | ★★★★☆☆ |

| Smart Parking | 69.9x | 6.2x | 47.97% | ★★★☆☆☆ |

| PWR Holdings | 35.1x | 4.9x | 23.87% | ★★★☆☆☆ |

| Integral Diagnostics | 159.1x | 1.8x | 42.49% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

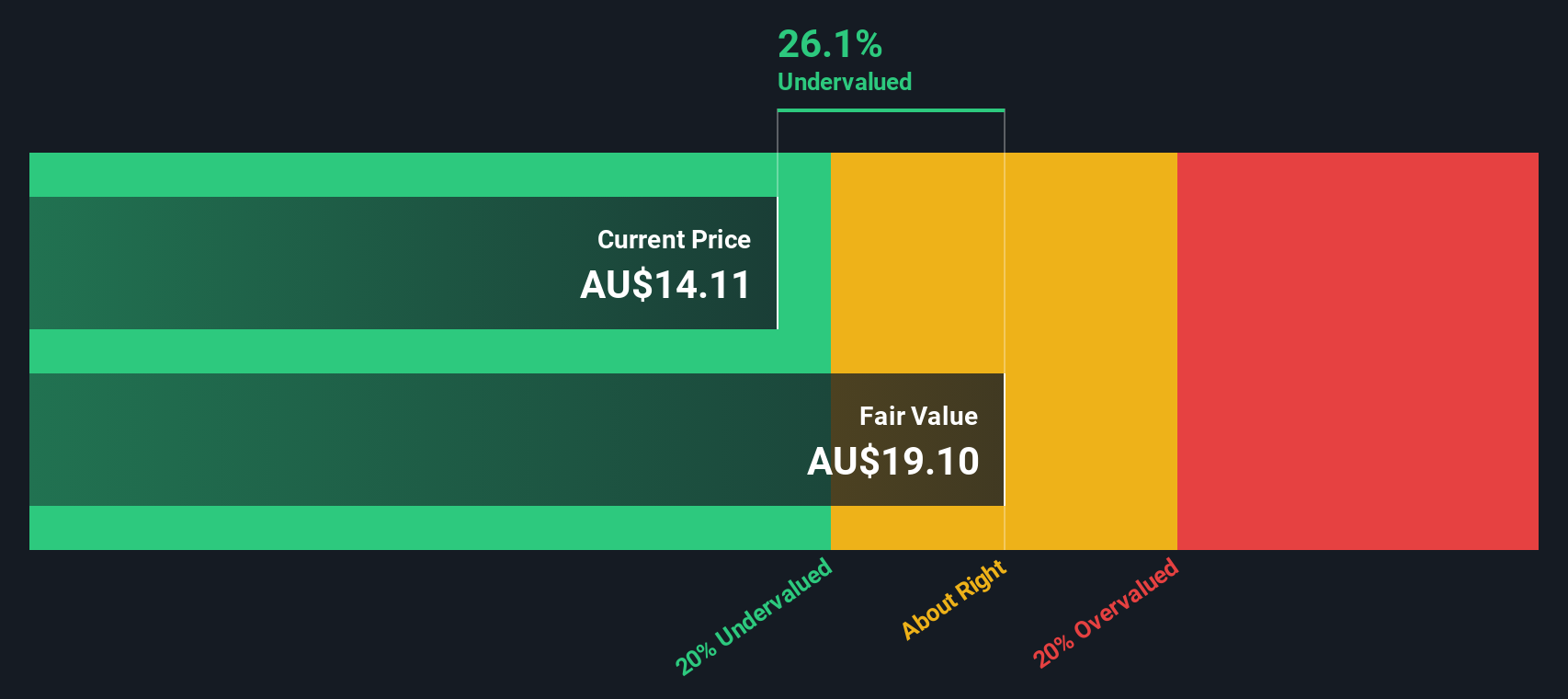

Neuren Pharmaceuticals (ASX:NEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neuren Pharmaceuticals is a biopharmaceutical company focused on developing therapies for neurological disorders, with a market capitalization of A$2.34 billion.

Operations: Neuren Pharmaceuticals generates revenue primarily from commercial products, with recent revenue reaching A$216.83 million. The company has seen a significant improvement in its gross profit margin, which was 84.79% as of the latest reporting period. Operating expenses are relatively stable compared to the substantial growth in revenue and gross profit, indicating efficient cost management.

PE: 11.3x

Neuren Pharmaceuticals, a small player in the biotech sector, is attracting attention with its innovative approach to treating hypoxic-ischemic encephalopathy (HIE) through NNZ-2591. The company recently welcomed Daryl DeKarske as Chief Regulatory Officer, leveraging their expertise in orphan drug development. Financially, Neuren's revenue dipped slightly to A$227.85 million for 2024. Insider confidence is evident with Joe Basile acquiring 14,500 shares valued at A$153,120 in March 2025. Earnings are projected to grow annually by 5.14%.

- Get an in-depth perspective on Neuren Pharmaceuticals' performance by reading our valuation report here.

Assess Neuren Pharmaceuticals' past performance with our detailed historical performance reports.

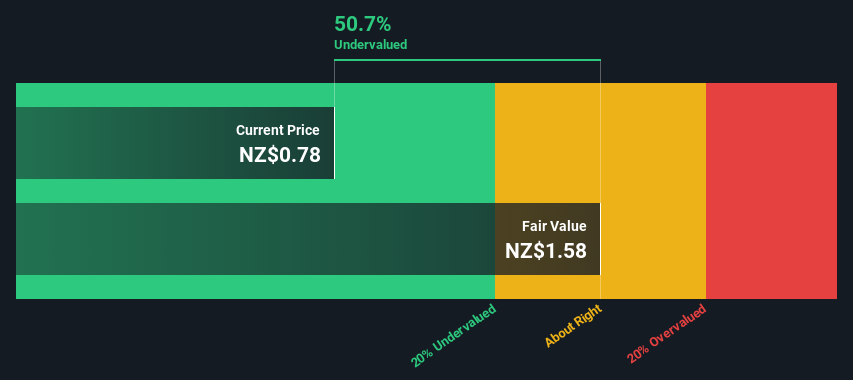

Heartland Group Holdings (NZSE:HGH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Heartland Group Holdings is a financial services company engaged in providing various lending products, including motor finance, rural and business loans, personal lending, reverse mortgages, and operates an Australian banking group with a market cap of NZ$1.35 billion.

Operations: Heartland Group Holdings' revenue is primarily driven by its Australian Banking Group and Reverse Mortgages segments, contributing NZ$78.39 million and NZ$54.55 million respectively. Over recent periods, the net income margin has shown a declining trend, from 37.46% in September 2021 to 17.68% in December 2024, indicating increasing operating expenses impacting profitability.

PE: 18.8x

Heartland Group Holdings, a small company in Asia, shows potential as an undervalued investment. Despite a drop in net income to NZ$3.6 million from NZ$37.6 million last year and lower profit margins at 17.7%, insider confidence is evident with Simon Beckett purchasing 62,824 shares for approximately NZ$55,386 recently. Earnings are projected to grow by 28% annually, offering a promising outlook despite current challenges like the low allowance for bad loans at 73%.

- Click here to discover the nuances of Heartland Group Holdings with our detailed analytical valuation report.

Learn about Heartland Group Holdings' historical performance.

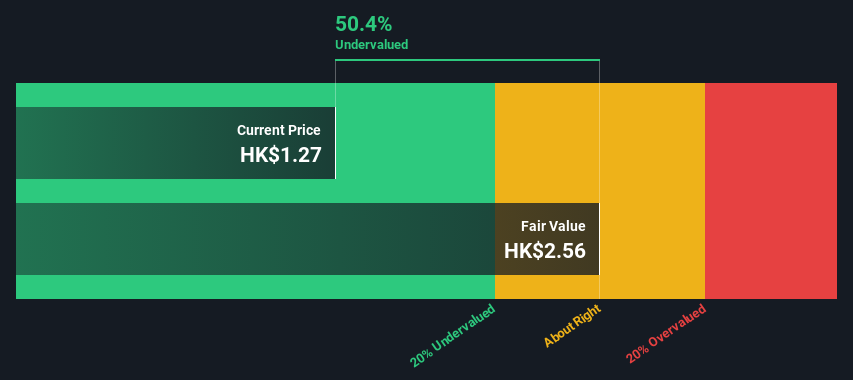

Jacobson Pharma (SEHK:2633)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Jacobson Pharma is a pharmaceutical company primarily engaged in the production and distribution of generic drugs, with a market capitalization of HK$1.56 billion.

Operations: The primary revenue stream for Jacobson Pharma is from generic drugs, with the latest reported revenue at HK$1.56 billion. The company's cost of goods sold (COGS) is HK$892.02 million, resulting in a gross profit of HK$670.87 million and a gross profit margin of 42.92%. Operating expenses are noted at HK$303.67 million, contributing to a net income margin of 16.20%.

PE: 10.2x

Jacobson Pharma, a small company in Asia, is catching attention for its low valuation and insider confidence. Between January and March 2025, insiders have been actively buying shares, signaling belief in the company's potential. Despite a 0.6% annual decline in earnings over the past five years, this pharmaceutical player remains intriguing due to its focus on growth opportunities within Asia's expanding healthcare market. However, reliance on external borrowing rather than customer deposits introduces some financial risk.

- Dive into the specifics of Jacobson Pharma here with our thorough valuation report.

Review our historical performance report to gain insights into Jacobson Pharma's's past performance.

Where To Now?

- Embark on your investment journey to our 64 Undervalued Asian Small Caps With Insider Buying selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2633

Jacobson Pharma

Through its subsidiaries, engages in the research, development, production, sale, and distribution of medicine and drugs in Hong Kong, Mainland China, Macau, Singapore, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success