- Norway

- /

- Marine and Shipping

- /

- OB:WWI

Do Wilh. Wilhelmsen Holding's (OB:WWI) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Wilh. Wilhelmsen Holding (OB:WWI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Wilh. Wilhelmsen Holding

Wilh. Wilhelmsen Holding's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Wilh. Wilhelmsen Holding's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 57%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

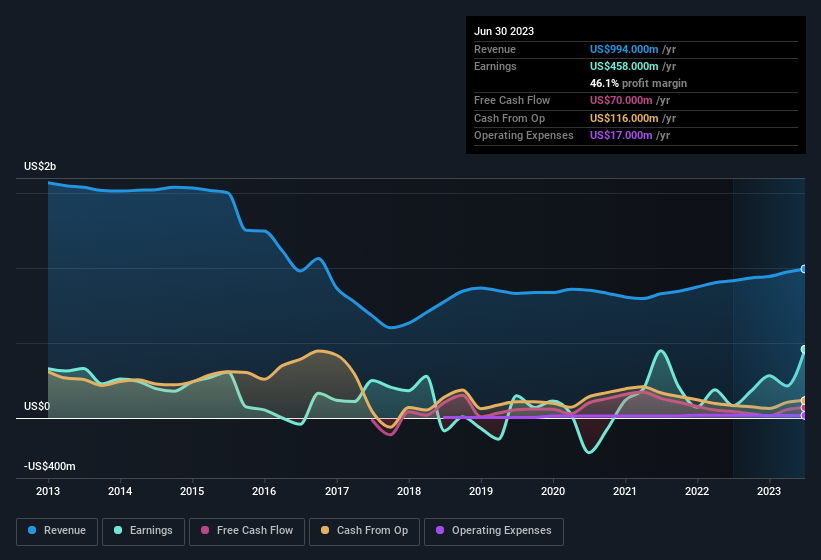

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Wilh. Wilhelmsen Holding maintained stable EBIT margins over the last year, all while growing revenue 8.6% to US$994m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Wilh. Wilhelmsen Holding's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Wilh. Wilhelmsen Holding Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Wilh. Wilhelmsen Holding insiders refrain from selling stock during the year, but they also spent US$1.6m buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Independent Director Rebekka Herlofsen for kr552k worth of shares, at about kr276 per share.

Should You Add Wilh. Wilhelmsen Holding To Your Watchlist?

Wilh. Wilhelmsen Holding's earnings per share growth have been climbing higher at an appreciable rate. Growth-minded people will be intrigued by the incredible movement in EPS growth. And may very well signal a significant inflection point for the business. If this is the case, then keeping a watch over Wilh. Wilhelmsen Holding could be in your best interest. Still, you should learn about the 1 warning sign we've spotted with Wilh. Wilhelmsen Holding.

The good news is that Wilh. Wilhelmsen Holding is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wilh. Wilhelmsen Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:WWI

Wilh. Wilhelmsen Holding

Provides maritime products and services worldwide.

Flawless balance sheet and good value.