- Norway

- /

- Marine and Shipping

- /

- OB:SNI

A Fresh Look at Stolt-Nielsen (OB:SNI) Valuation Following Recent Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 16.5% Undervalued

The leading narrative considers Stolt-Nielsen to be trading below its estimated fair value, suggesting room for upside according to analysts’ projections.

"Stolt-Nielsen is diversifying its portfolio with strategic acquisitions like Hassel 4 and LNG carrier Avenir. These additions are expected to contribute approximately $50 million annually to EBITDA and are likely to impact earnings growth positively."

Craving the full story behind this bullish outlook? The analysts’ math relies on ambitious plans for growth and a financial formula that is not often seen outside high-growth industries. Curious which forward-looking numbers power this big valuation call? Stick around to uncover the surprising assumptions that could help explain the discount or prove it fleeting.

Result: Fair Value of NOK402.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing geopolitical tensions and potential tariffs on maritime operations could place significant pressure on Stolt-Nielsen’s core tanker business and overall revenue growth.

Find out about the key risks to this Stolt-Nielsen narrative.Another View: Our DCF Model’s Take

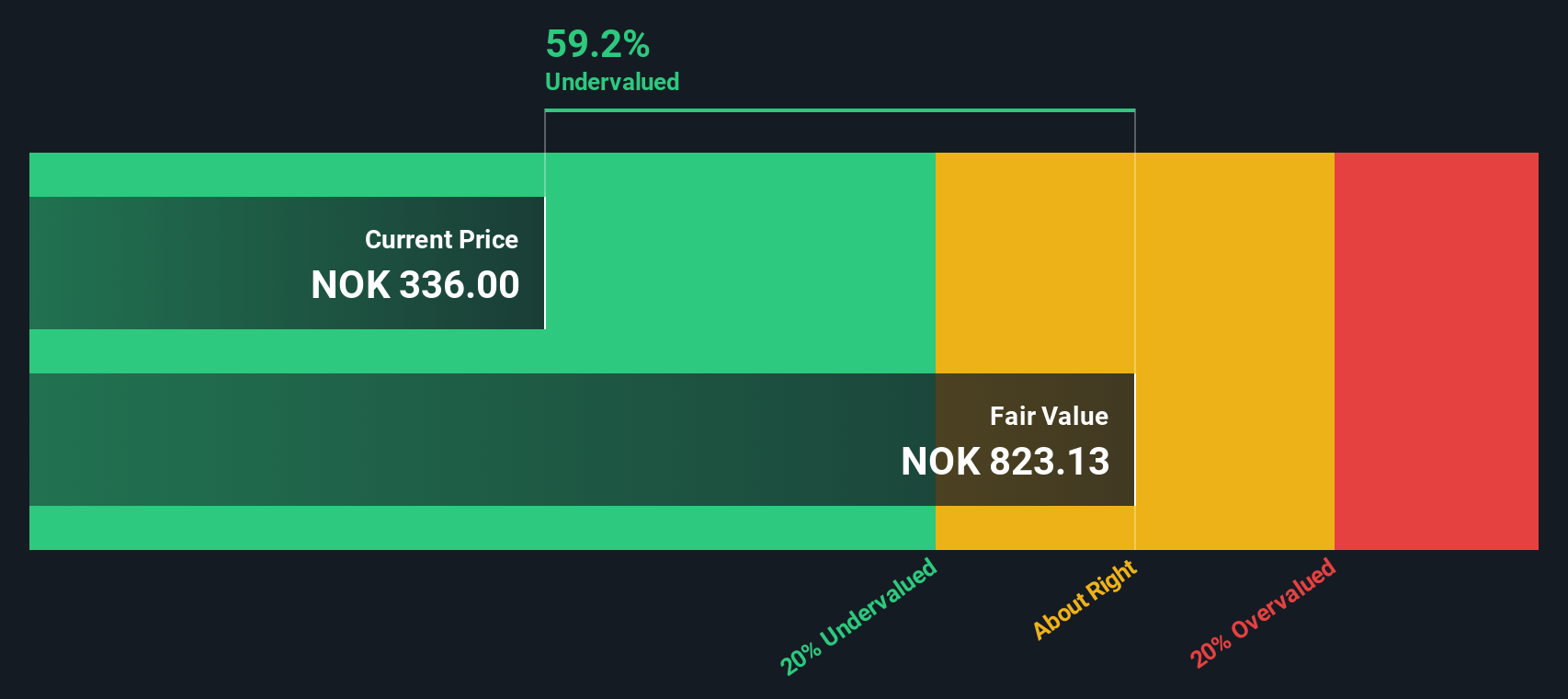

Switching lenses, the SWS DCF model also judges Stolt-Nielsen as undervalued, which aligns with the previous valuation. It is worth considering, however, whether market conditions could change quickly enough to challenge both views.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stolt-Nielsen for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stolt-Nielsen Narrative

If you see things differently or want to dive into the numbers for yourself, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Stolt-Nielsen research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why limit your strategy to just one stock? Take charge and uncover potential winners that suit your goals, risk appetite, and interests using our selective tools.

- Spot companies offering reliable payouts and aim for steady income streams with dividend stocks with yields > 3%, a tool built to highlight strong, high-yielding opportunities.

- Tap into fast-growing sectors and ride technology’s next wave by using our focused lens on quantum computing stocks to bring emerging quantum innovators to your radar.

- Capture undervalued gems before the crowd catches on. Use data-driven insights to unearth bargains via undervalued stocks based on cash flows and give yourself the edge smart investors look for.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OB:SNI

Stolt-Nielsen

Provides transportation, storage, and distribution solutions for bulk liquid chemicals, edible oils, acids, and other specialty liquids worldwide.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives