Norwegian Air Shuttle (OB:NAS): Assessing Valuation as Operating Results Reflect Ongoing Recovery

Reviewed by Kshitija Bhandaru

Norwegian Air Shuttle (OB:NAS) just released its latest operating results, and the numbers point to a steady improvement in demand and operational capacity as traffic continues to recover after the pandemic.

See our latest analysis for Norwegian Air Shuttle.

Norwegian Air Shuttle has been building positive momentum, with a year-to-date share price return of nearly 49% that reflects renewed investor confidence following recent operational gains and a rebound in travel demand. Although performance over longer periods shows volatility, such as a three-year total shareholder return of 144% compared to a five-year total return that’s still in the negative, the current uplift suggests the recovery narrative is winning over the market for now.

If the steady recovery in airline demand has you searching for more ideas, it could be a smart move to broaden your outlook and discover fast growing stocks with high insider ownership

With the share price riding recent gains and fundamentals showing solid, though not explosive, growth, the key question is whether Norwegian Air Shuttle is still undervalued or if the market has already priced in its future recovery.

Most Popular Narrative: 2% Undervalued

Norwegian Air Shuttle's last close price of NOK16.96 sits just below the narrative's fair value estimate of NOK17.30, hinting at a stock that could still be slightly underappreciated by the market. This sets the stage for a valuation framework built on projected operating momentum, new initiatives, and evolving demand patterns.

The acquisition of Wideroe and the resulting operational synergies, as well as the launch of a new distribution platform, are expected to streamline operations and enhance efficiency, potentially improving net margins. The introduction of Program X, focusing on cost reduction and revenue initiatives, suggests that Norwegian Air Shuttle is committed to enhancing profitability, likely impacting earnings positively in the coming years.

Curious about the blueprint behind this near-fair value call? The storyline is built on bold growth levers, profit margin improvement, and future-focused strategic bets. Want to see the numbers and projections that drive this calculation, plus what could send the valuation soaring? Uncover the details in the full narrative.

Result: Fair Value of NOK17.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal issues and intense competition in the corporate travel sector remain potential hurdles that could disrupt Norwegian Air Shuttle’s anticipated growth trajectory.

Find out about the key risks to this Norwegian Air Shuttle narrative.

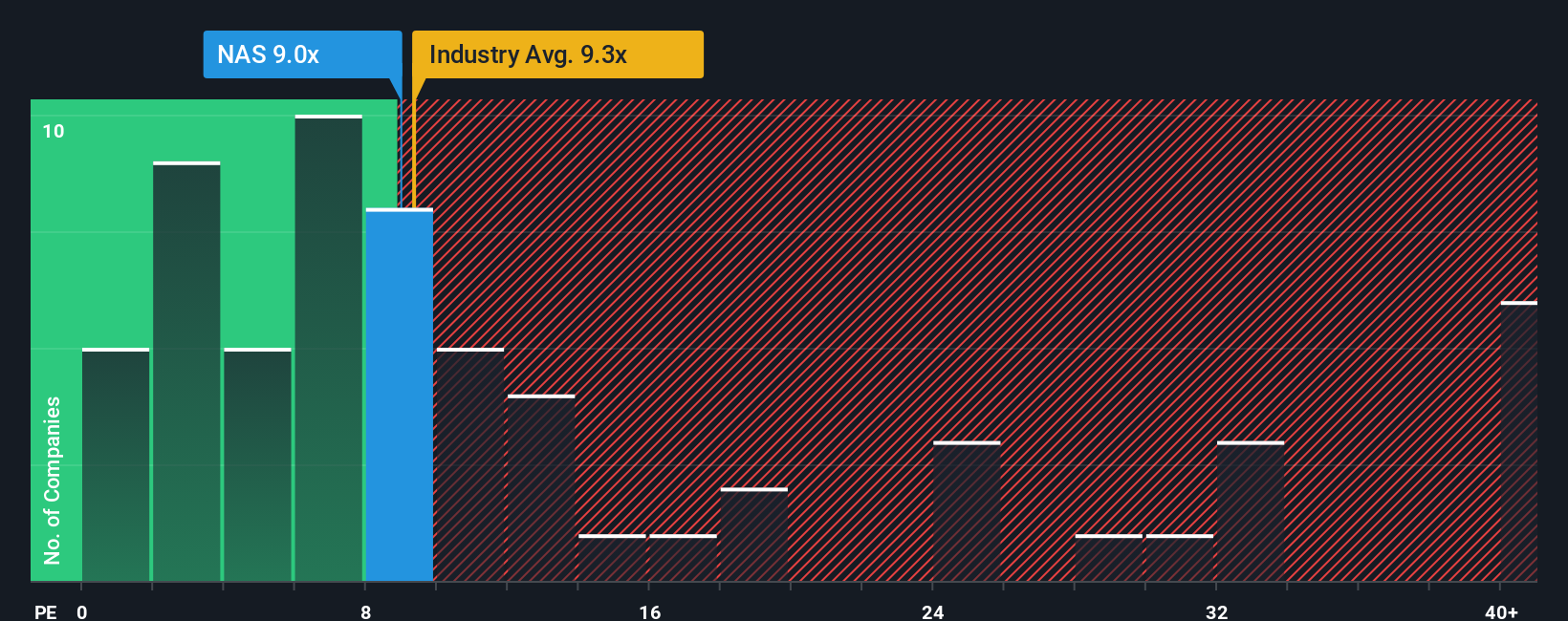

Another View: A Look at Earnings-Based Valuation

While some analysts point to a fair value close to Norwegian Air Shuttle’s current share price, looking at its earnings ratio tells a less optimistic story. Shares are trading at 9.9x earnings, higher than both the industry average (9.6x) and peer average (3.5x), as well as above the fair ratio of 8.1x. This gap suggests the market could be overpricing the company relative to typical norms, signaling increased valuation risk. Is the optimism already built into today’s price, or could momentum drive the multiple even higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Norwegian Air Shuttle Narrative

If you have a different perspective or want to dive into the numbers yourself, you can craft your own analysis in just a few minutes, or Do it your way.

A great starting point for your Norwegian Air Shuttle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

The smartest investors never limit their horizons to just one stock. Give yourself the edge with these handpicked opportunities powered by the Simply Wall Street Screener.

- Boost your portfolio's growth potential when you tap into these 25 AI penny stocks, which are powering advancements in automation, big data, and predictive analytics.

- Strengthen your passive income strategy by reviewing these 18 dividend stocks with yields > 3%, featuring companies with stable payouts and yields above 3%.

- Position yourself at the forefront of innovation by tracking these 26 quantum computing stocks, driving breakthroughs in computing and beyond.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Air Shuttle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NAS

Norwegian Air Shuttle

Provides air travel services in Norway and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives