- Norway

- /

- Marine and Shipping

- /

- OB:JIN

Even With A 26% Surge, Cautious Investors Are Not Rewarding Jinhui Shipping and Transportation Limited's (OB:JIN) Performance Completely

Despite an already strong run, Jinhui Shipping and Transportation Limited (OB:JIN) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 2.9% isn't as attractive.

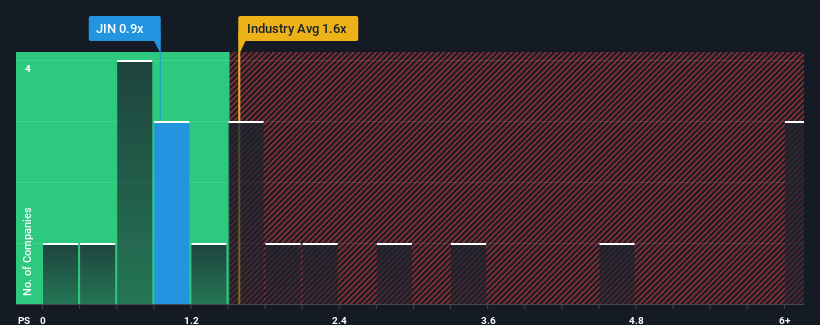

Although its price has surged higher, given about half the companies operating in Norway's Shipping industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider Jinhui Shipping and Transportation as an attractive investment with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Jinhui Shipping and Transportation

What Does Jinhui Shipping and Transportation's P/S Mean For Shareholders?

For example, consider that Jinhui Shipping and Transportation's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jinhui Shipping and Transportation will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Jinhui Shipping and Transportation would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. Even so, admirably revenue has lifted 68% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.3% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Jinhui Shipping and Transportation's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Jinhui Shipping and Transportation's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see Jinhui Shipping and Transportation currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Jinhui Shipping and Transportation you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Jinhui Shipping and Transportation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:JIN

Jinhui Shipping and Transportation

An investment holding company, engages in ship chartering and owning activities internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives