- Finland

- /

- Consumer Durables

- /

- HLSE:YIT

March 2025's Top European Growth Stocks With Insider Influence

Reviewed by Simply Wall St

As European markets navigate the complexities of U.S. trade policy uncertainty and a recent rate cut by the ECB, investor sentiment remains cautiously optimistic, buoyed by potential increases in defense and infrastructure spending within the region. In this environment, growth companies with significant insider ownership can stand out as compelling opportunities due to their potential for strong alignment between management and shareholder interests, offering resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.8% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Let's review some notable picks from our screened stocks.

YIT Oyj (HLSE:YIT)

Simply Wall St Growth Rating: ★★★★☆☆

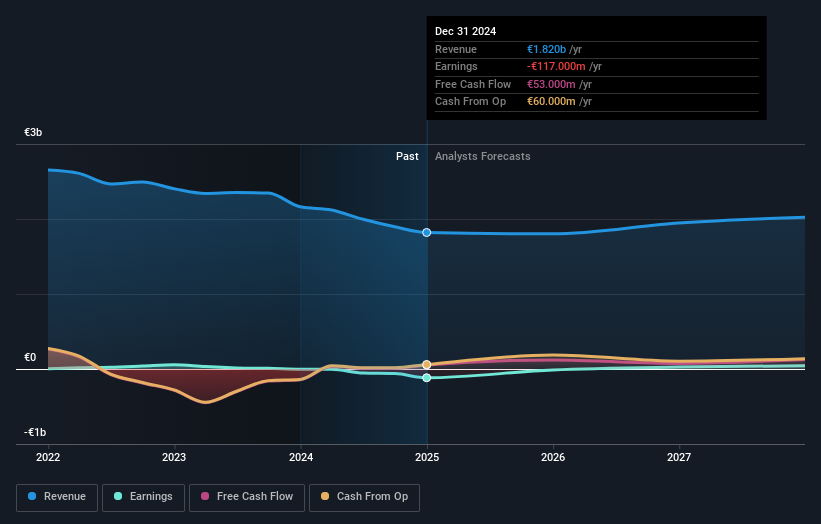

Overview: YIT Oyj offers construction services across Finland, Central Eastern Europe, the Czech Republic, Slovakia, Poland, and the Baltic countries with a market cap of €521.10 million.

Operations: The company's revenue segments include Housing (€731 million), Infrastructure (€393 million), and Business Premises (€734 million).

Insider Ownership: 10.4%

YIT Oyj is navigating a complex landscape, with its profitability forecasted to grow significantly over the next three years. Despite recent financial setbacks, including a net loss of €39 million in Q4 2024, the company remains strategically active with projects like the €18 million apartment development in Kladno and a €100 million data center in Kajaani. Trading below fair value and showing no substantial insider trading activity recently, YIT's growth potential is tempered by high volatility and debt challenges.

- Delve into the full analysis future growth report here for a deeper understanding of YIT Oyj.

- Our comprehensive valuation report raises the possibility that YIT Oyj is priced lower than what may be justified by its financials.

Himalaya Shipping (OB:HSHP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Himalaya Shipping Ltd. offers dry bulk shipping services globally and has a market cap of NOK2.73 billion.

Operations: The company generates revenue primarily from its transportation - shipping segment, amounting to $123.58 million.

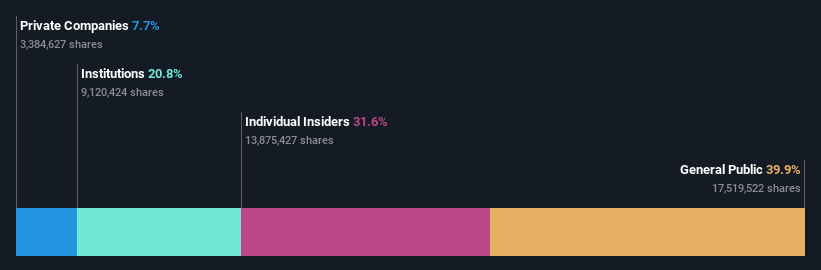

Insider Ownership: 31.6%

Himalaya Shipping is experiencing substantial growth, with earnings forecasted to increase significantly at 38.18% annually, outpacing the Norwegian market. Recent financial results show a strong revenue surge to US$123.58 million for 2024, despite a decline in quarterly net income. The company trades well below its estimated fair value and maintains high insider ownership without recent insider trading activity. Its robust return on equity forecast of 42.6% further underscores its growth potential amidst consistent dividend distributions.

- Click here to discover the nuances of Himalaya Shipping with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Himalaya Shipping's current price could be quite moderate.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) specializes in solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK4.95 billion.

Operations: The company's revenue primarily comes from its Furniture & Fixtures segment, which generated SEK6.59 billion.

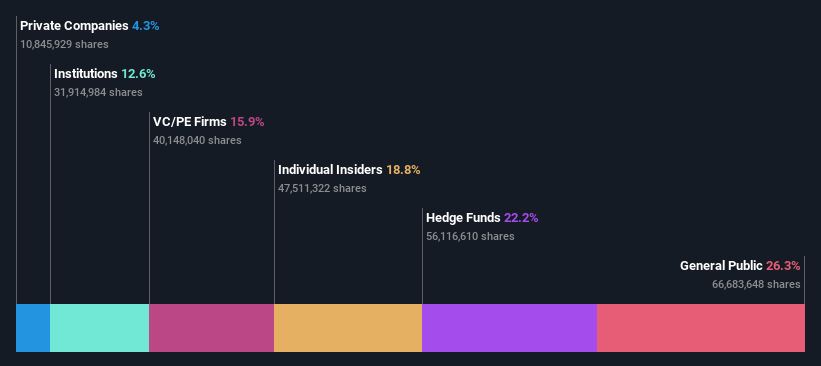

Insider Ownership: 18.8%

ITAB Shop Concept's earnings are projected to grow significantly at 33.17% annually, surpassing the Swedish market's growth rate. Despite a recent decrease in net income for Q4 2024 to SEK 73 million, revenue increased to SEK 1.77 billion. The company trades substantially below its estimated fair value and lacks recent insider trading activity. While expected revenue growth of 13.4% is slower than desired, it still exceeds the broader market forecast in Sweden.

- Dive into the specifics of ITAB Shop Concept here with our thorough growth forecast report.

- Our expertly prepared valuation report ITAB Shop Concept implies its share price may be lower than expected.

Next Steps

- Reveal the 223 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:YIT

YIT Oyj

Provides construction services in Finland, Central Eastern European, the Czech Republic, Slovakia, Poland, Baltic countries, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives