European Growth Companies With High Insider Ownership May 2025

Reviewed by Simply Wall St

As European markets experience a positive shift with the pan-European STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns, growth companies with high insider ownership are gaining attention for their potential resilience and alignment of interests between management and shareholders. In this environment, stocks that combine robust growth prospects with significant insider ownership may offer unique advantages, as they often reflect confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| OrganoClick (OM:ORGC) | 33.7% | 66.8% |

Let's dive into some prime choices out of the screener.

Himalaya Shipping (OB:HSHP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Himalaya Shipping Ltd. offers dry bulk shipping services globally and has a market capitalization of NOK2.66 billion.

Operations: The company generates revenue primarily through its transportation shipping segment, amounting to $123.58 million.

Insider Ownership: 29.9%

Revenue Growth Forecast: 11.2% p.a.

Himalaya Shipping shows potential as a growth company with high insider ownership, despite recent volatility in its share price. The company has experienced significant earnings growth, with a 1290% increase over the past year and forecasts suggesting continued strong earnings growth of 38.2% annually over the next three years. While revenue is expected to grow at 11.2% per year, this is slower than some benchmarks but still above the Norwegian market average. Recent executive changes include new leadership appointments for CEO and CFO roles.

- Get an in-depth perspective on Himalaya Shipping's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Himalaya Shipping's share price might be on the cheaper side.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

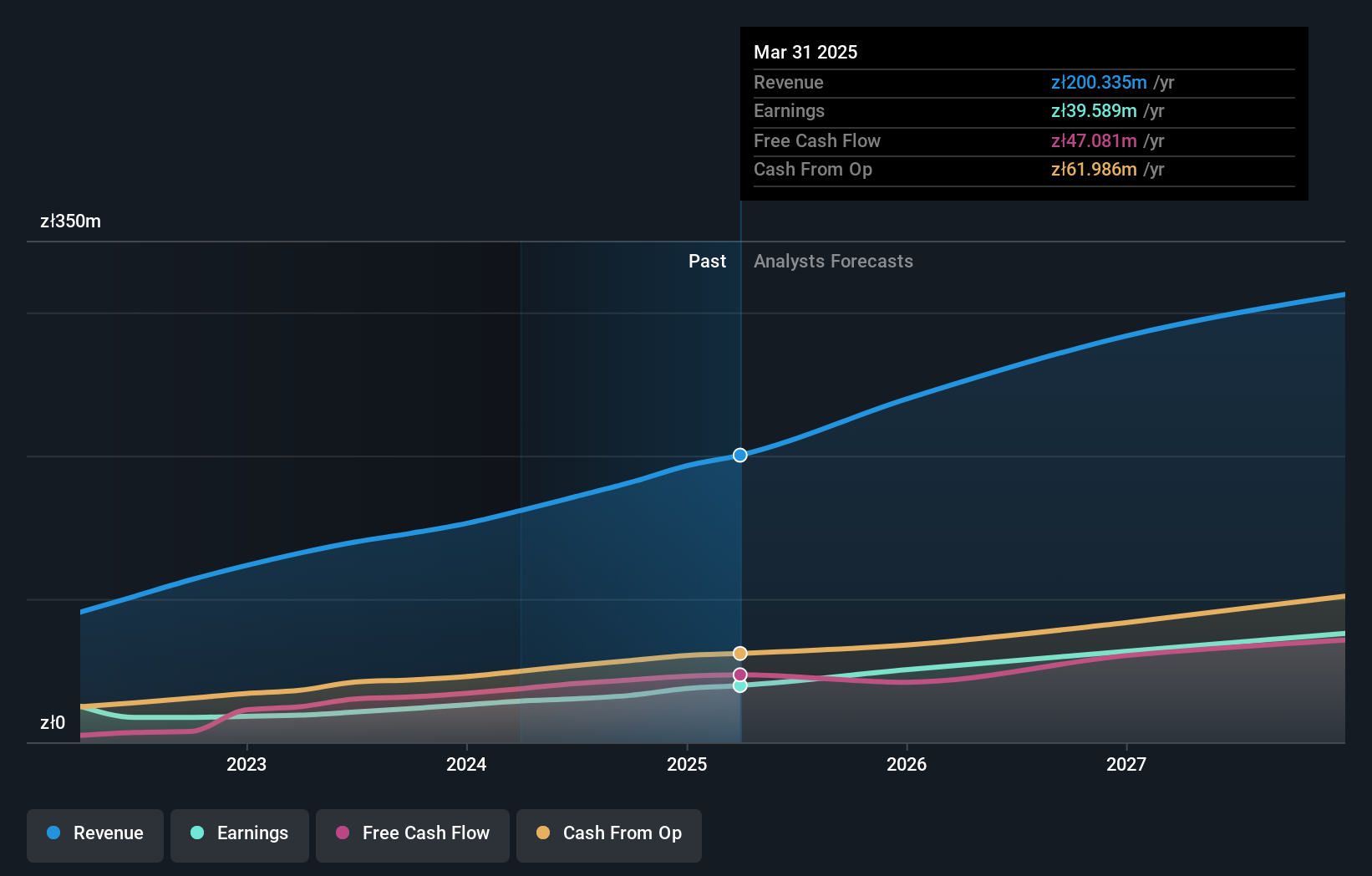

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland and has a market cap of PLN1.24 billion.

Operations: The company generates revenue through its Solutions segment, which accounts for PLN151.13 million, and its Subscriptions segment, contributing PLN41.67 million.

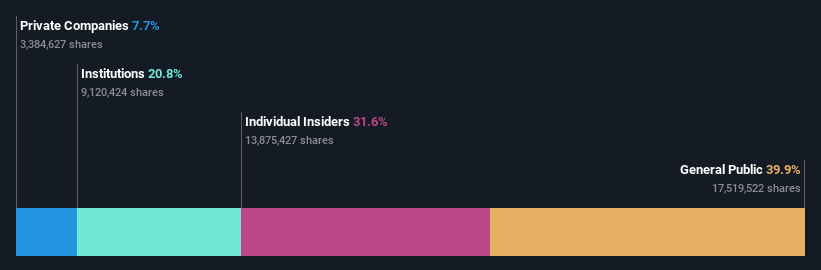

Insider Ownership: 23.6%

Revenue Growth Forecast: 13.9% p.a.

Shoper S.A. demonstrates strong growth potential with its revenue increasing from PLN 152.6 million to PLN 192.8 million and net income rising to PLN 37.51 million over the past year. The company's earnings are forecasted to grow significantly at 23.9% annually, surpassing the Polish market average, while trading at a discount of 12.8% below estimated fair value. Additionally, Shoper's return on equity is projected to be very high in three years, enhancing its investment appeal.

- Click here and access our complete growth analysis report to understand the dynamics of Shoper.

- The valuation report we've compiled suggests that Shoper's current price could be inflated.

Circus (XTRA:CA1)

Simply Wall St Growth Rating: ★★★★★☆

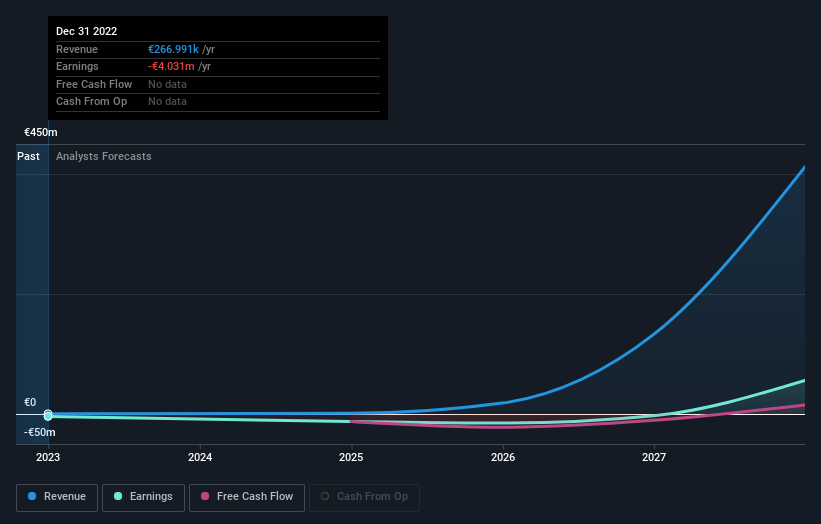

Overview: Circus SE is an AI robotics company focused on developing technologies in robotics, software, and AI for autonomous food service operations, with a market cap of €321.20 million.

Operations: The company's revenue segment is Industrial Automation & Controls, generating €0.27 million.

Insider Ownership: 26%

Revenue Growth Forecast: 41.3% p.a.

Circus SE is experiencing rapid growth, driven by its innovative AI-powered robotics solutions in the food service sector. Recent developments include a pilot partnership with REWE Markt GmbH and the launch of CA-M for defense forces. The company's earnings are forecasted to grow significantly at 51.4% annually, outpacing the German market average. Despite high volatility in share price and older financial reports, Circus' strategic initiatives and substantial insider ownership highlight its potential as a dynamic growth company in Europe.

- Unlock comprehensive insights into our analysis of Circus stock in this growth report.

- Our valuation report unveils the possibility Circus' shares may be trading at a premium.

Key Takeaways

- Dive into all 213 of the Fast Growing European Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CA1

Circus

An AI robotics company, develops various technologies in robotics, software, and Al tailored for autonomous food service operations.

High growth potential very low.

Market Insights

Community Narratives