- Norway

- /

- Marine and Shipping

- /

- OB:HAUTO

Is Höegh Autoliners (OB:HAUTO) Fairly Priced? Exploring Current Valuation Narratives

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 18.9% Overvalued

The prevailing narrative points to Höegh Autoliners trading well above what is considered its fair value, suggesting investors should tread carefully before expecting further upside from current levels.

Rising tariffs, port fees, and regulatory headwinds in key export markets are expected to structurally increase Höegh's shipping costs and ultimately lower transported volumes. This could directly pressure revenues and potentially compress net margins over time. The global acceleration of electric vehicle adoption, combined with a trend toward more localized production, is likely to reduce long-term transoceanic car exports and diminish the addressable market, weighing on Höegh's future volume growth and top-line expansion.

Is this market pricing too optimistic or could major growth headwinds be ahead? The story hinges on dramatic margin shifts, evolving trade flows, and a future valuation multiple that raises eyebrows. Curious which numbers are behind this bold call? There are key financial assumptions and forecasts driving this high-stakes figure. Discover the exact projections that underpin the narrative's fair value.

Result: Fair Value of $94.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, fresh volume growth out of Asia and a modernized, efficient fleet could help defend earnings in light of the broader downbeat outlook.

Find out about the key risks to this Höegh Autoliners narrative.Another View: Discounted Cash Flow Tells a Different Story

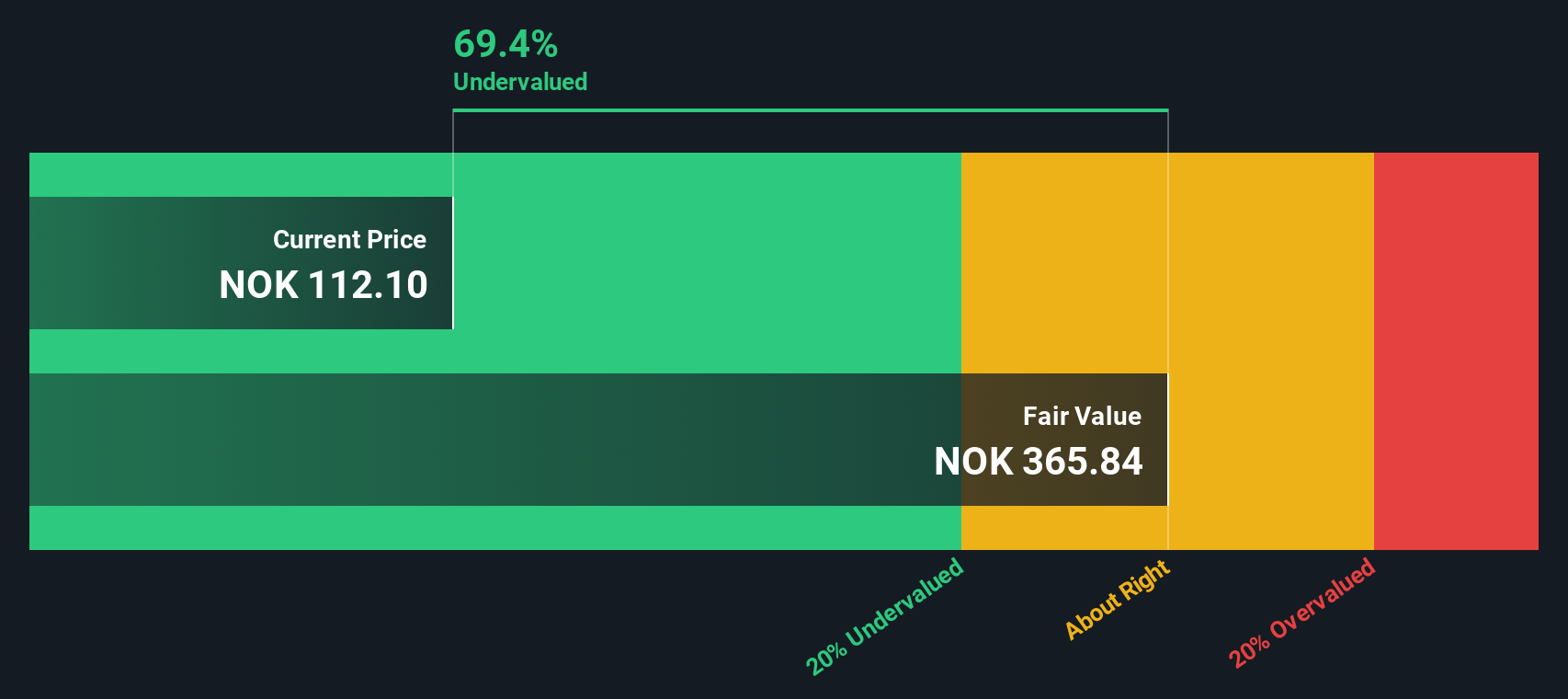

Looking from another angle, our SWS DCF model suggests the shares could be trading well below their intrinsic value. This challenges the multiples-based case that the stock is already overvalued. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Höegh Autoliners to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Höegh Autoliners Narrative

If you would rather take a hands-on approach or have your own perspective to add, it only takes a few minutes to build your own view from the data. Do it your way

A great starting point for your Höegh Autoliners research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Stay ahead of the curve by using Simply Wall Street's powerful tools to spot promising companies in booming industries and fast-changing markets. Uncover hidden gems, sector leaders, and tomorrow’s top performers before the broader market catches on.

- Boost your income potential and secure steady returns with companies offering dividend stocks with yields > 3%.

- Tap into the explosive growth and innovation fueling modern healthcare by screening for healthcare AI stocks.

- Capitalize on mispriced opportunities and invest with confidence by targeting stocks undervalued stocks based on cash flows based on their true cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Höegh Autoliners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HAUTO

Höegh Autoliners

Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets in Norway.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives