- Norway

- /

- Wireless Telecom

- /

- OB:NTEL

Investors bid Nortel (OB:NTEL) up kr75m despite increasing losses YoY, taking one-year return to 52%

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the Nortel AS (OB:NTEL) share price is up 48% in the last 1 year, clearly besting the market decline of around 8.9% (not including dividends). That's a solid performance by our standards! We'll need to follow Nortel for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Nortel

Nortel wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Nortel's revenue grew by 132%. That's a head and shoulders above most loss-making companies. While the share price gain of 48% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Nortel in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

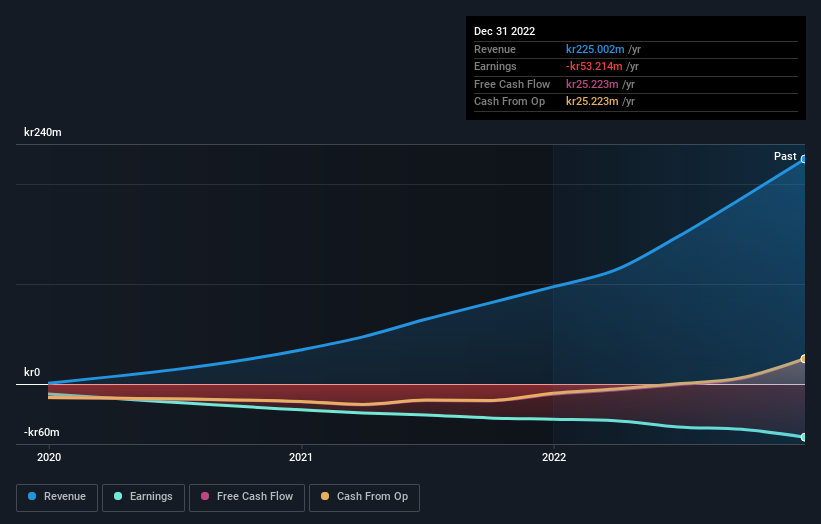

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Nortel's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Nortel's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Nortel hasn't been paying dividends, but its TSR of 52% exceeds its share price return of 48%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Nortel shareholders should be happy with the total gain of 52% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 47% in that time. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Nortel (at least 1 which is significant) , and understanding them should be part of your investment process.

Nortel is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nortel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NTEL

Nortel

Nortel AS operates as a telecommunications company for small and medium-sized businesses in Norway.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives