- Norway

- /

- Communications

- /

- OB:SMOP

Smartoptics Group (OB:SMOP) Margin Pressure Challenges Bullish Growth Narrative Despite Strong Profit Outlook

Reviewed by Simply Wall St

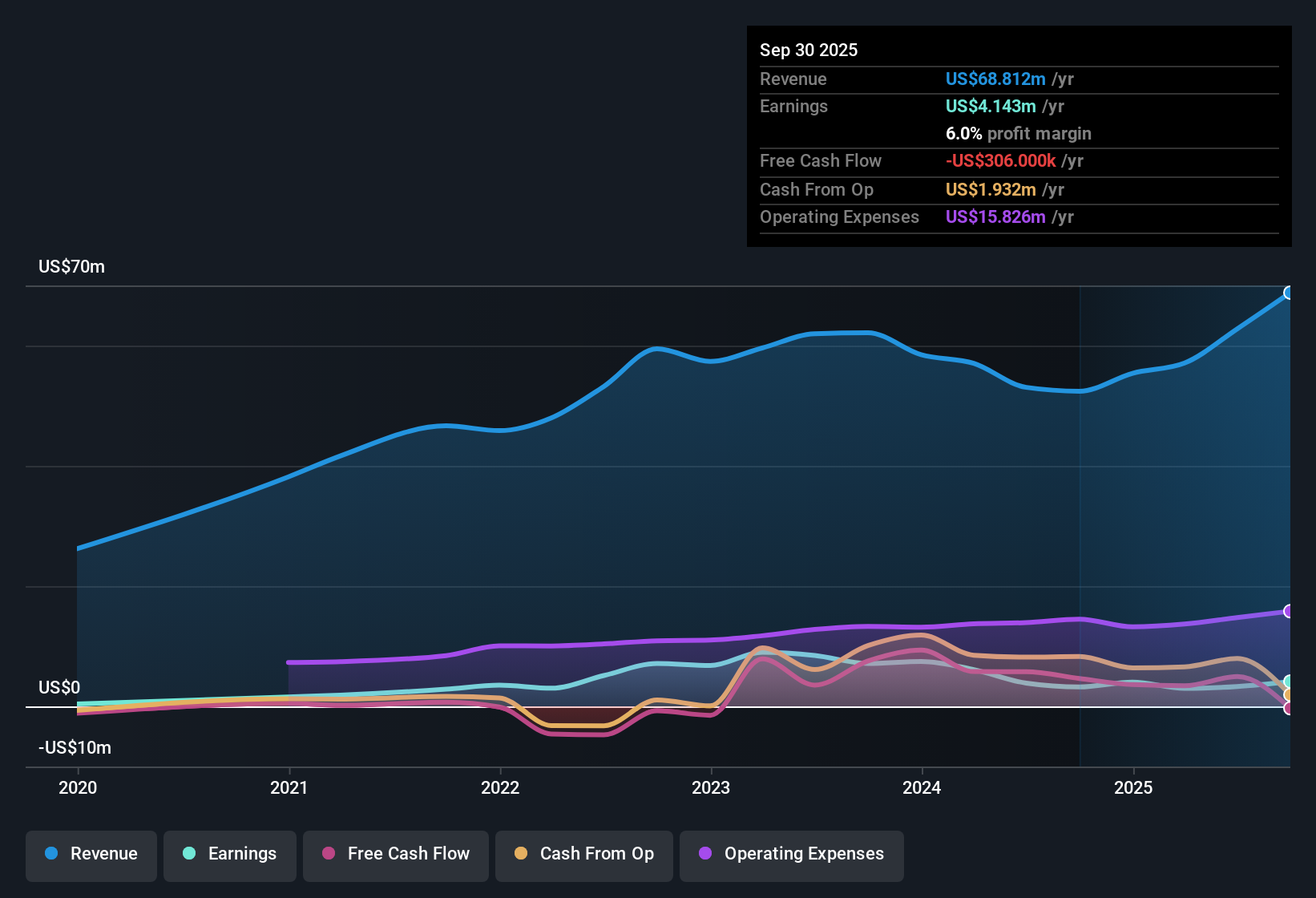

Smartoptics Group (OB:SMOP) reported forecast revenue growth of 20.2% per year, far outpacing the broader Norwegian market’s 2.8% annual rate. EPS is expected to climb rapidly as well, with profit forecasts projecting a substantial 59.8% gain per year over the next three years. This is well ahead of the Norwegian market’s 14.2% expectation. While SMOP has posted strong annual earnings growth of 6.9% over the past five years, net profit margins have tightened to 5.3% from last year’s 7.3%, indicating some margin pressure even as growth accelerates.

See our full analysis for Smartoptics Group.To dig deeper, we’re about to stack these numbers against the most widely followed narratives, seeing which stories the financials support and where the results might defy expectations.

See what the community is saying about Smartoptics Group

Margin Pressure as Growth Bets Raise Costs

- Net profit margins have narrowed from 7.3% last year to 5.3% this year. Yearly earnings growth averaged 6.9% over the past five years, and profit growth is forecast at 59.8% per year for the next three years.

- According to the analysts' consensus view, large account strategy and sustained investments in R&D are expected to support long-term competitiveness. However, growing reliance on new wins and the risk of rising operating expenses could weigh down future margins.

- Consensus narrative highlights that increased spending on talent and innovation is key to expanding in advanced network projects, yet also warns that rapidly scaling costs could erode improving margins if top-line growth stalls.

- There is a contrast between forecast margin expansion to 12.7% in three years and the short-term margin contraction observed currently.

- Momentum in R&D and organizational growth is a double-edged sword. It powers the upside but challenges margins until efficiencies kick in. 📊 Read the full Smartoptics Group Consensus Narrative.

Premium Valuation Outpaces Sector Benchmarks

- Smartoptics is trading at a high price-to-earnings ratio of 89.3x, significantly above both the European industry average of 42.2x and its peer average of 47.8x. The current share price of NOK 30.3 is well above its estimated DCF fair value of NOK 10.35.

- Analysts' consensus view suggests that the current valuation bakes in aggressive growth assumptions, requiring Smartoptics to shrink its PE ratio to 20.3x by 2028 through delivering on profit growth targets.

- Delivering $14.3 million in earnings and expanding profit margins to 12.7% would bridge some of the valuation gap. However, the stock still looks expensive compared to traditional benchmarks absent flawless execution.

- Consensus notes the NOK 24.20 analyst price target is 20% below the current share price, suggesting investor optimism may already be fully priced in for now.

Share Price Churn Reflects Growth-Risk Tradeoff

- The share price has not been stable in the last three months. Analysts identify this lack of steady performance as a minor risk, adding a layer of volatility for new investors considering entry.

- Analysts' consensus view recognizes that while robust growth prospects and strong recent sales are fueling optimism, ongoing dependence on wider macroeconomic factors and successful execution of large account wins could drive significant swings in future price action.

- The consensus narrative calls out that potential tariff increases in the U.S. and fluctuations in customer activity may add to price unpredictability unless offset by the successful ramp-up of new products and partnerships.

- Variability in revenue recognition or project timing, particularly across EMEA and the Americas, means that even with a healthy long-term growth trend, the near-term ride could remain choppy for shareholders.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Smartoptics Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have fresh insight into these results? Why not share your unique take and publish a narrative of your own in just a few minutes with Do it your way.

A great starting point for your Smartoptics Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Smartoptics Group faces margin pressure and a premium valuation, which leaves little room for error if growth falters or top-line results disappoint.

If overpaying for potential is not your style, compare with these 838 undervalued stocks based on cash flows to spot companies trading closer to their actual worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMOP

Smartoptics Group

Provides optical networking solutions and devices in the Americas, Europe, the Middle East, Africa, and the Asia–Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)