As European markets navigate the complexities of global trade tensions and economic shifts, the pan-European STOXX Europe 600 Index recently experienced a decline amid heightened uncertainty. Despite these challenges, opportunities may arise for discerning investors who seek out small-cap stocks that demonstrate resilience and potential in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Norbit (OB:NORBT)

Simply Wall St Value Rating: ★★★★★☆

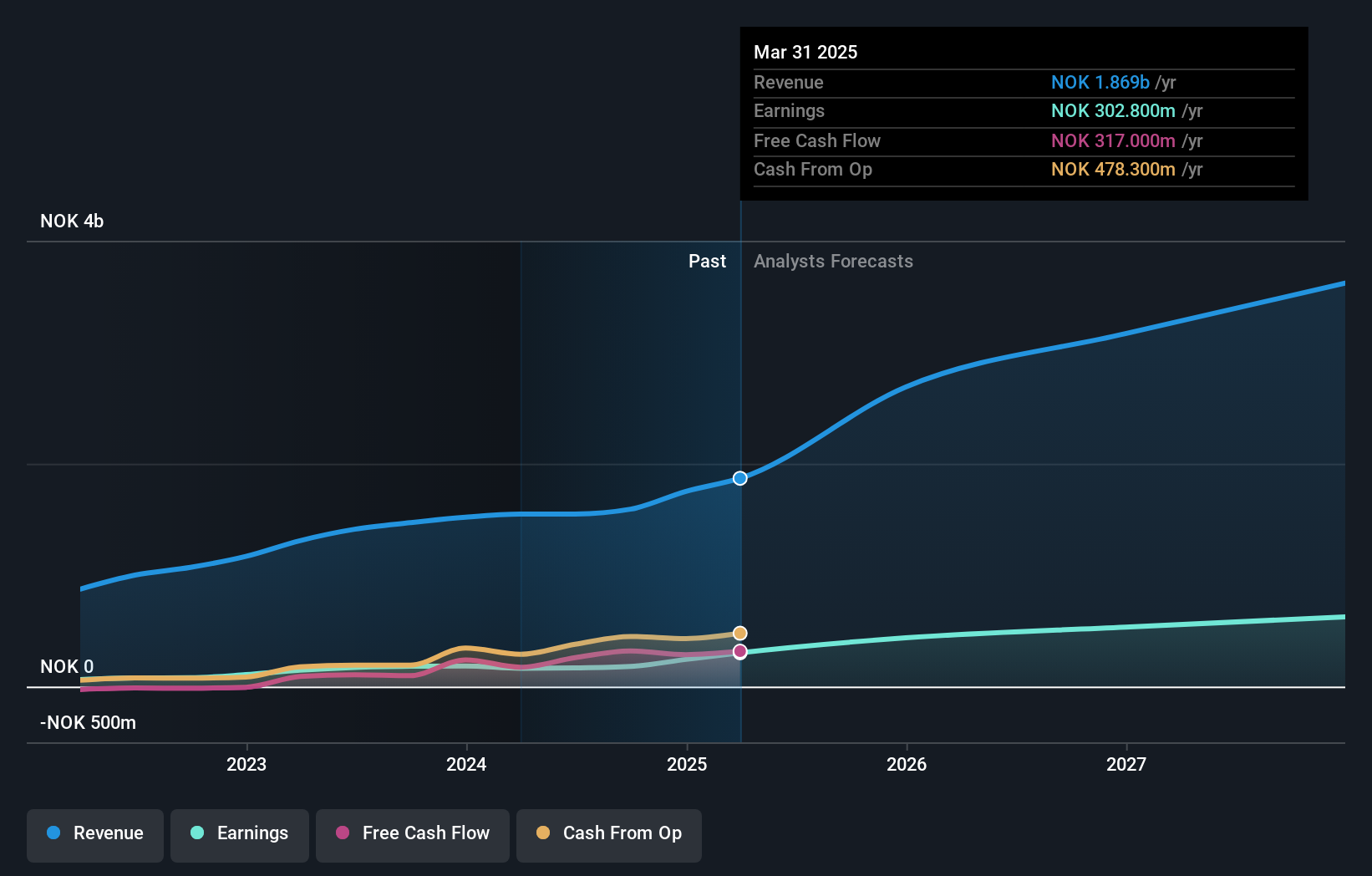

Overview: Norbit ASA offers technology solutions across various industries and has a market capitalization of NOK7.94 billion.

Operations: Norbit ASA generates revenue primarily from its Oceans, Connectivity, and Product Innovation and Realization (PIR) segments, with Oceans contributing NOK743.90 million and PIR adding NOK543.10 million. The Connectivity segment brings in NOK515.70 million.

Norbit, a promising player in the European market, has shown robust financial health with a net debt to equity ratio of 21.9%, indicating satisfactory leverage. The company reported earnings growth of 31% last year, outpacing the electronic industry average of 6.7%. Its strategic initiatives, including product launches like WBMS X and partnerships such as Toll4Europe, are likely to drive revenue growth. Recent orders worth NOK 260 million in defense further bolster its prospects. However, reliance on acquisitions could pose risks to organic growth stability and supply chain constraints may impact expected expansion plans.

RVRC Holding (OM:RVRC)

Simply Wall St Value Rating: ★★★★★★

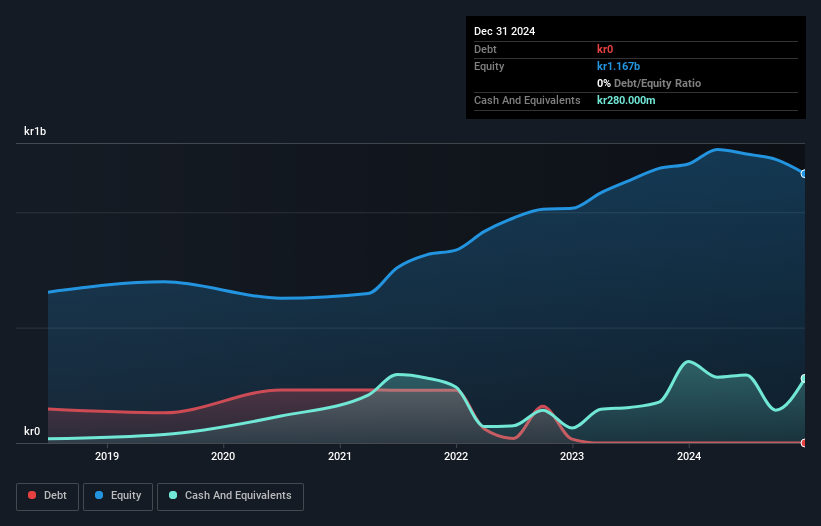

Overview: RVRC Holding AB (publ) operates in the e-commerce outdoor clothing sector across Germany, Sweden, Finland, and other international markets with a market capitalization of SEK5.07 billion.

Operations: RVRC generates revenue primarily from its retail apparel segment, amounting to SEK1.92 billion. The company's financial performance can be analyzed through its gross profit margin, which reflects the efficiency of its production and sales processes.

RVRC Holding, a nimble player in the retail space, is making waves with its international expansion strategy targeting markets like Australia and New Zealand. The company's direct-to-consumer approach supports robust profit margins, bolstered by new product lines such as the Alpine Collection. Financially sound with SEK 270 million in net cash, RVRC is well-positioned to capitalize on growth opportunities despite potential risks from supply chain issues and rising costs. Recent earnings show promising growth with sales reaching SEK 684 million for Q2 2024 compared to SEK 613 million the previous year. Analysts project a revenue increase of 15.4% annually over three years, setting a price target around SEK63.5 per share amidst diverse market opinions ranging from SEK55 to SEK72.

VBG Group (OM:VBG B)

Simply Wall St Value Rating: ★★★★★★

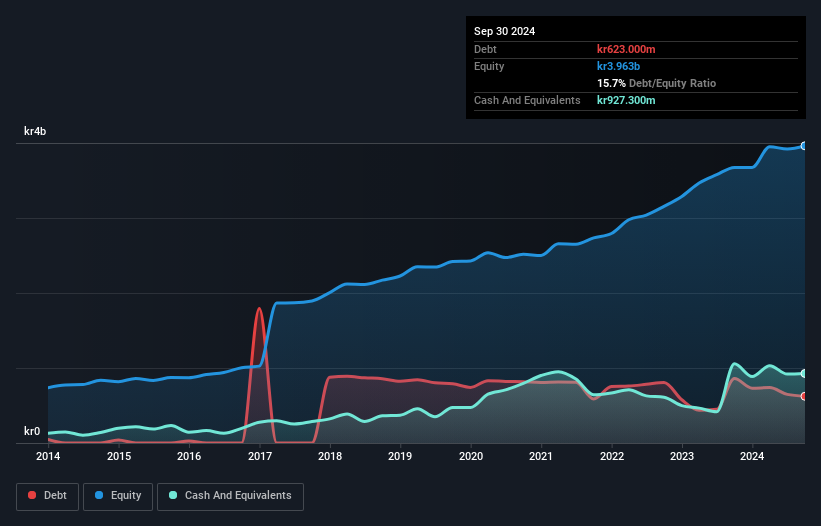

Overview: VBG Group AB (publ) is a company that develops, manufactures, markets, and sells industrial products across various international markets including Europe, North America, and Asia with a market capitalization of approximately SEK7.06 billion.

Operations: The company's revenue primarily comes from three segments: Mobile Thermal Solutions (SEK3.04 billion), Truck & Trailer Equipment (SEK1.54 billion), and RINGFEDER Power Transmission (SEK997.30 million).

VBG Group, a small cap player in the machinery sector, has been making strides with its earnings growth of 3.4% over the past year, outpacing the industry's 1.2%. Trading at 60.9% below estimated fair value suggests potential upside for investors. The company's financial health is robust, with more cash than total debt and a reduced debt-to-equity ratio from 30.5% to 20.9% over five years. Recent results show full-year net income at SEK 588 million, up from SEK 572 million last year, despite a slight dip in sales to SEK 5,579 million from SEK 5,740 million previously.

- Take a closer look at VBG Group's potential here in our health report.

Examine VBG Group's past performance report to understand how it has performed in the past.

Summing It All Up

- Click through to start exploring the rest of the 348 European Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade VBG Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VBG B

VBG Group

Develops, manufactures, markets, and sells various industrial products in Sweden, Germany, rest of the Nordic countries and Europe, the United States, rest of North America, Brazil, Australia, New Zealand, China, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives