Key Takeaways

- Expansion into markets like Australia and New Zealand is set to boost revenue by broadening the international customer base.

- The company's direct-to-consumer model sustains high margins, supporting growth in product lines and geographical reach.

- Dependence on Asian production and German market exposure, with rising expenses and limited geographical expansion, could strain future growth and margins.

Catalysts

About RVRC Holding- Engages in the e-commerce outdoor clothing business in Germany, Sweden, Finland, and internationally.

- RevolutionRace's expansion into new markets, including Australia, South Africa, and New Zealand, is expected to drive future revenue growth by increasing their international customer base.

- The company's digital direct-to-consumer (D2C) business model allows for higher net margins by eliminating middlemen, enabling RevolutionRace to maintain industry-leading operating margins, even as they expand their product line and geographical reach.

- The introduction of new product lines, such as the Alpine Collection and upcoming footwear range, is projected to contribute to revenue growth, with the Alpine Collection alone anticipated to reach approximately SEK 100 million in sales this season.

- RevolutionRace's strong customer satisfaction and community engagement, evidenced by over 700,000 unique product reviews with an average rating of 4.6 out of 5, is likely to support customer retention and increase recurring revenue.

- The company's robust financial position, with a net cash position of SEK 270 million and available credit facilities, provides them with the flexibility to pursue growth opportunities and initiatives that can enhance earnings over time.

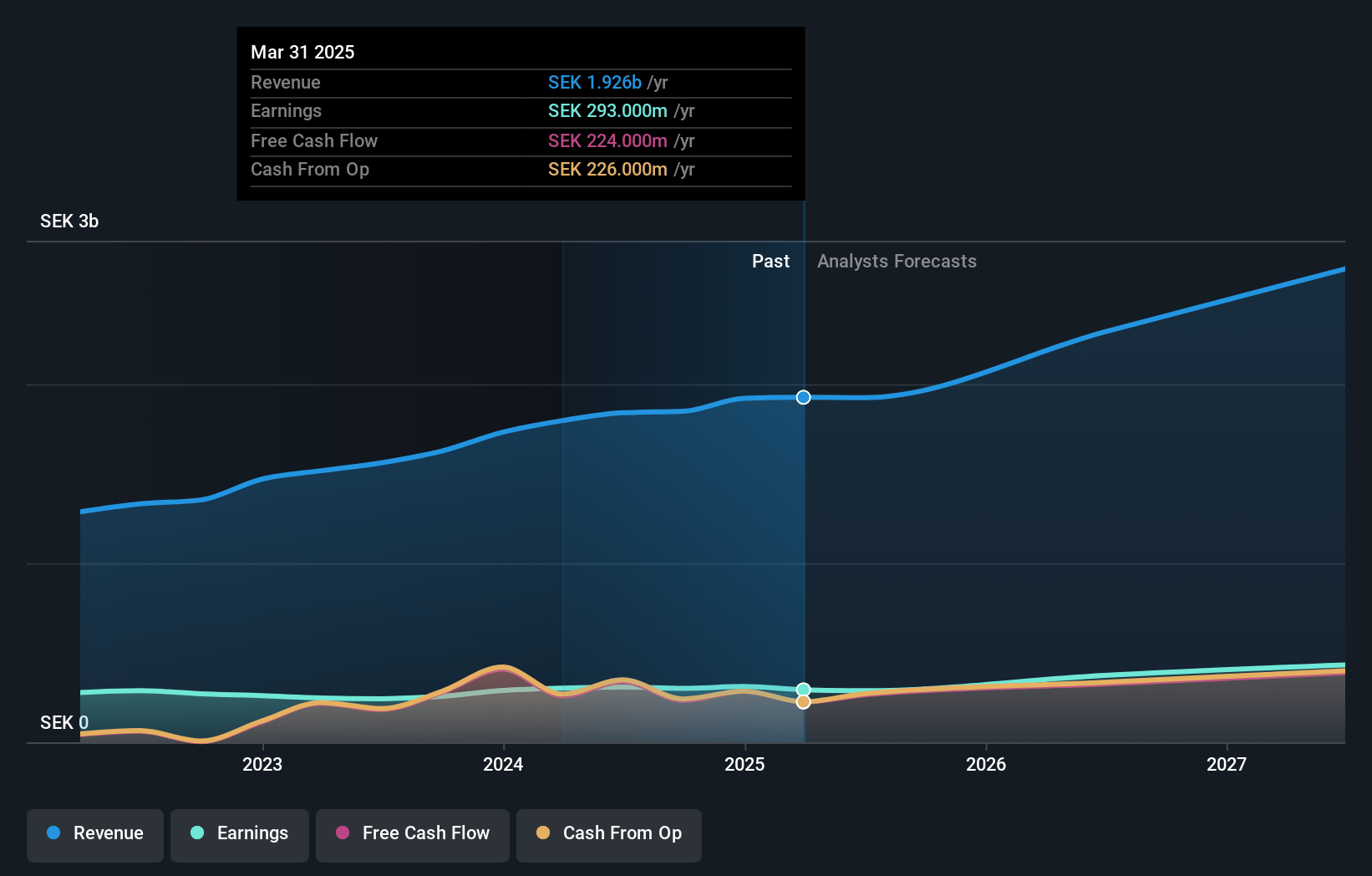

RVRC Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RVRC Holding's revenue will grow by 15.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.2% today to 16.5% in 3 years time.

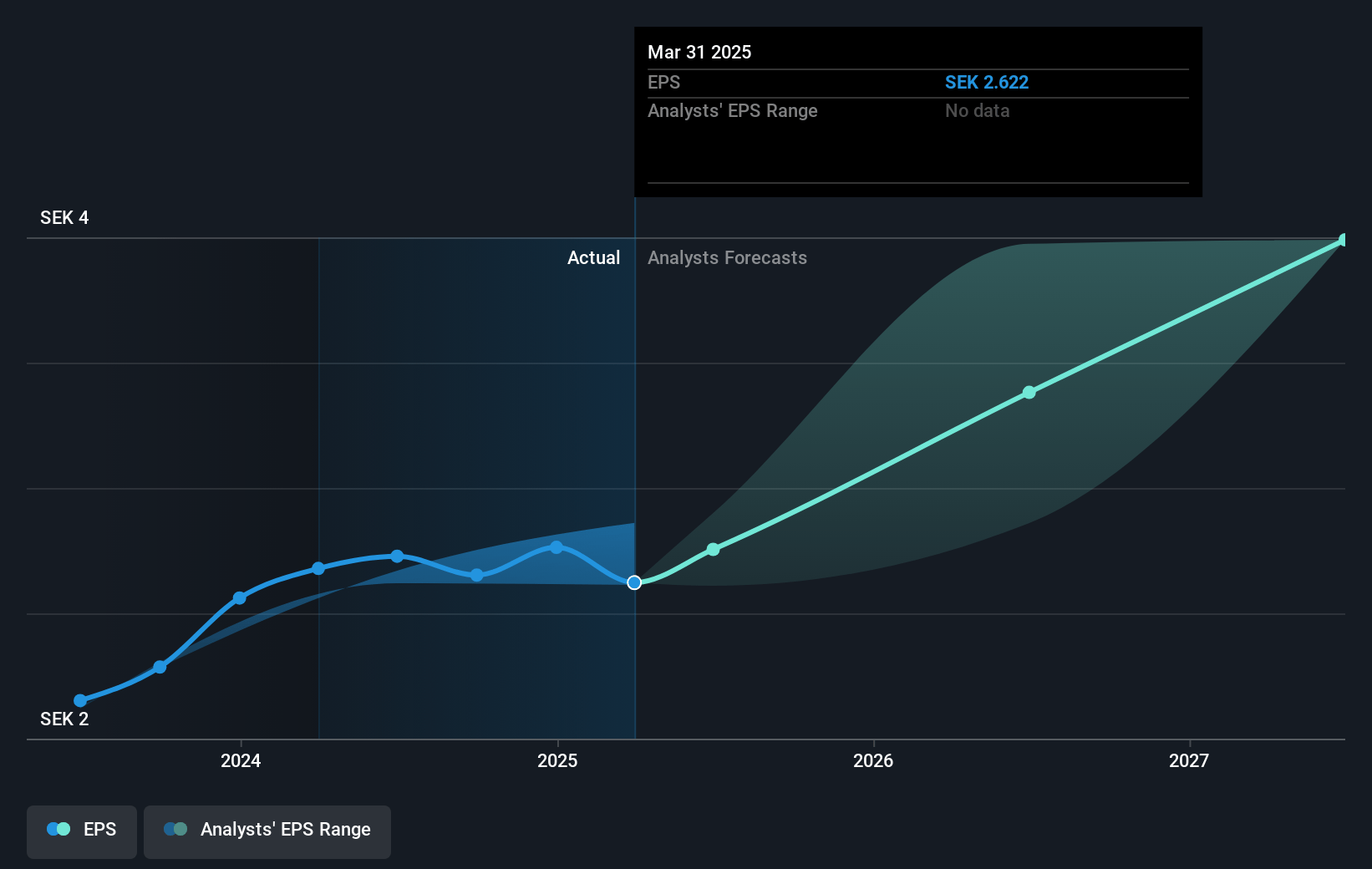

- Analysts expect earnings to reach SEK 488.3 million (and earnings per share of SEK 4.2) by about April 2028, up from SEK 311.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, down from 16.2x today. This future PE is lower than the current PE for the SE Specialty Retail industry at 20.1x.

- Analysts expect the number of shares outstanding to decline by 2.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.88%, as per the Simply Wall St company report.

RVRC Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on production in Asia means that any disruption in the supply chain, such as logistical disturbances mentioned, could affect future revenues and net margins.

- An increase in personnel and external expenses, despite being in line with sales growth, could lead to reduced net margins if not managed effectively as fixed costs could rise faster than revenues.

- The company's significant exposure to the German market, where overall consumption is reported to be declining, could negatively impact earnings and revenue if this market weakens further.

- The fact that new geographic regions like Australia and New Zealand are currently not a focus could limit future expansion opportunities, potentially affecting revenue growth.

- Rising digital marketing costs, as customer acquisition becomes more expensive, could pressure future net margins if not offset by similar increases in sales.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK63.5 for RVRC Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK72.0, and the most bearish reporting a price target of just SEK55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK3.0 billion, earnings will come to SEK488.3 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 5.9%.

- Given the current share price of SEK46.7, the analyst price target of SEK63.5 is 26.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.