Kitron (OB:KIT) Valuation After Major Defence Contracts and Upgraded Revenue and Margin Ambitions

Reviewed by Simply Wall St

Kitron (OB:KIT) has just coupled a string of sizeable defence contracts, worth 17 million, 19 million and 55 million euros, with upgraded revenue and margin ambitions that sketch a much larger business a few years out.

See our latest analysis for Kitron.

Those contracts and the upgraded roadmap help explain why Kitron’s 1 day share price return of 3.41 percent and year to date share price return of 97.94 percent sit alongside a powerful 1 year total shareholder return of 113.57 percent. Together, these metrics signal momentum that investors clearly see as more structural than speculative.

If this defence upswing has you thinking more broadly about the sector, it could be worth exploring aerospace and defense stocks as a way to spot other potential beneficiaries of rising spend.

Yet with Kitron trading close to analyst targets, despite posting multi year triple digit returns and guiding to much higher revenues and margins, investors are left asking if there is still upside to capture or if future growth is already priced in.

Most Popular Narrative: 9.1% Undervalued

Compared with Kitron’s last close of NOK 68.25, the most followed narrative suggests a modest upside to a fair value of roughly NOK 75 per share.

The analysts have a consensus price target of NOK65.0 for Kitron based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be €1.0 billion, earnings will come to €71.4 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 7.7%.

If you would like to see how aggressive revenue targets, richer margins and a lower future earnings multiple can still add up to potential upside from here, the full narrative breaks down the earnings path, the valuation bridge and the assumptions that underpin that higher fair value.

Result: Fair Value of $75.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside could unravel if tariffs bite harder than expected or if weaker Asian and CEE demand drags on growth and margins.

Find out about the key risks to this Kitron narrative.

Another Way To Look At Value

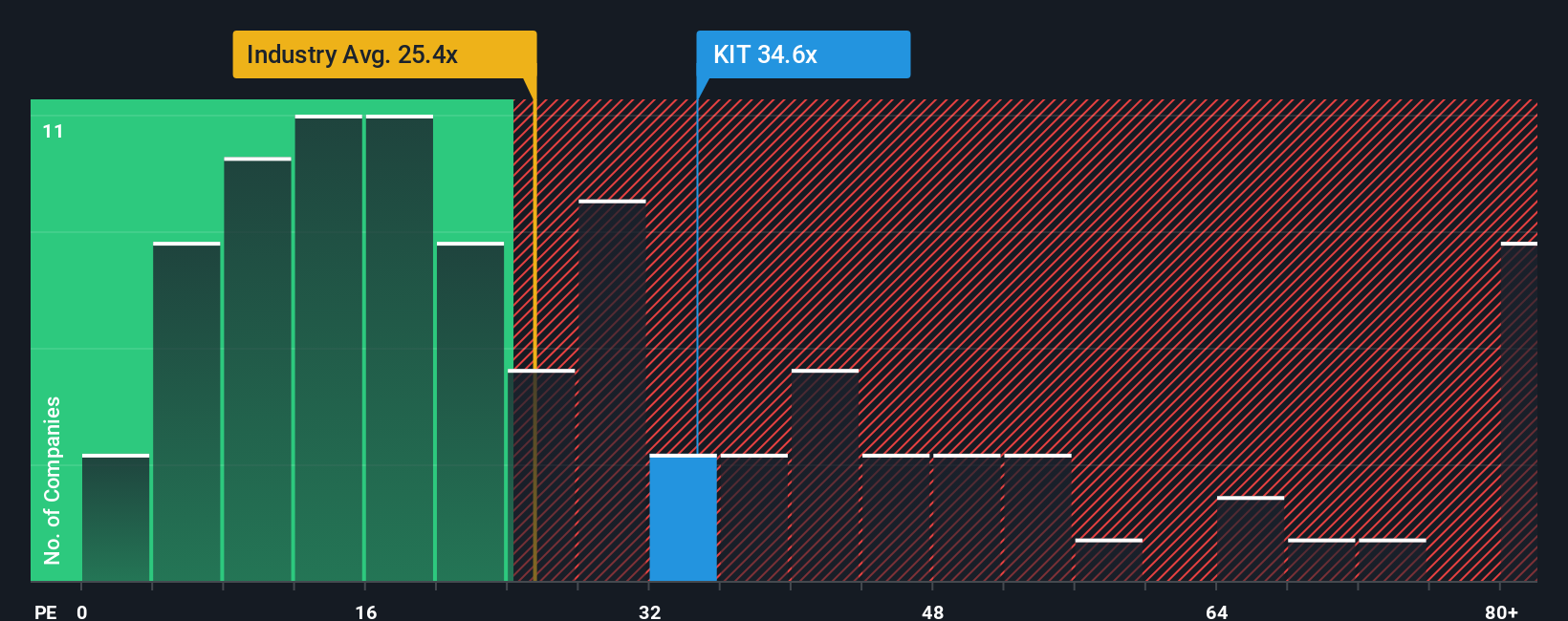

While the narrative suggests Kitron is modestly undervalued, a simple earnings multiple tells a tougher story. At 39.6 times earnings against a European electronic sector on 24.1 times, and a fair ratio of 39.1 times, today’s price leaves little obvious multiple based upside. Is momentum already doing the heavy lifting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kitron Narrative

If you see the story differently or want to challenge the assumptions with your own research, you can build a fresh view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kitron.

Looking for more investment ideas?

Kitron may look compelling today, but the real edge comes from lining up your next moves early, so do not miss the other opportunities on your radar.

- Capture potential multi baggers early by scanning these 3605 penny stocks with strong financials for financially solid small caps before attention and valuations surge.

- Target the next wave of innovation by filtering these 30 healthcare AI stocks that blend medical breakthroughs with scalable AI powered business models.

- Explore reliable income streams by reviewing these 12 dividend stocks with yields > 3% offering yields above 3 percent that may support long term portfolio resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kitron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KIT

Kitron

Operates as an electronics manufacturing services provider in Norway, Sweden, Denmark, Lithuania, Germany, Poland, the Czech Republic, India, China, Malaysia, and the United States.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion