How Robust Order Backlog and New Defense Contracts at Kitron (OB:KIT) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Kitron recently attracted attention after reporting robust fundamentals, with significant growth in its order backlog and new contracts secured in the Defense & Aerospace sector, alongside expanded production capacity across Norway and Sweden.

- This combination of increased orders and facility enhancements highlights Kitron's ability to capitalize on sector demand and positions the company for continued potential revenue growth.

- We'll explore how the strong order backlog and growing Defense & Aerospace contracts may reshape Kitron's investment narrative going forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Kitron Investment Narrative Recap

The key conviction for a Kitron shareholder is belief in the company's ability to convert its growing order backlog and Defence & Aerospace contracts into meaningful, profitable growth, while effectively managing production capacity and costs. The recent surge in new contracts and expanded facilities strengthens the short-term revenue outlook, though high input costs and gross margin pressure remain pertinent risks that could dampen earnings momentum if not tightly controlled.

One of the standout recent announcements reinforcing this momentum is the EUR 4 million airborne radar module order received in July, which builds directly into the strong Defense & Aerospace pipeline cited in the latest update. This award exemplifies how sector-specific contracts may feed into the company's main catalysts, especially as production ramps up in Norway and Sweden.

Yet, despite upbeat sectoral momentum, investors should also consider how persistent pressure on gross margins from rising material costs could impact future net profitability if order mix does not shift toward higher-margin projects...

Read the full narrative on Kitron (it's free!)

Kitron's narrative projects €1.0 billion revenue and €71.4 million earnings by 2028. This requires 16.5% yearly revenue growth and a €42.7 million earnings increase from €28.7 million today.

Uncover how Kitron's forecasts yield a NOK65.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

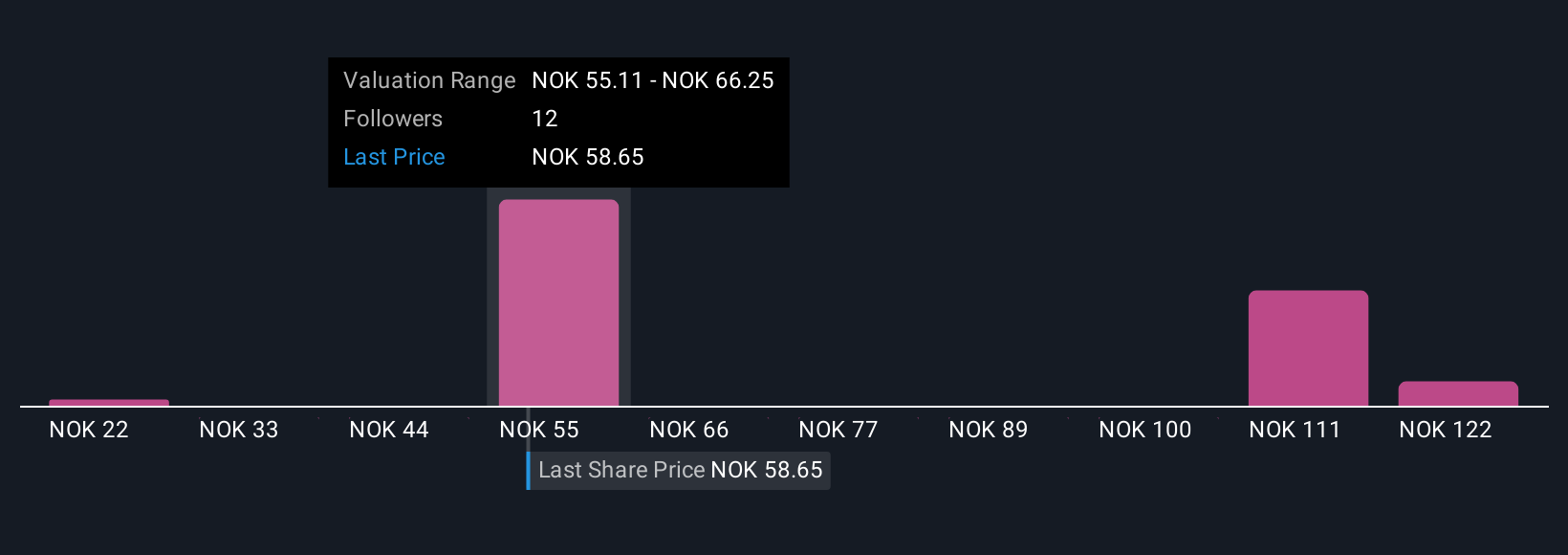

Simply Wall St Community members provided seven fair value estimates for Kitron, ranging widely from NOK 21.67 to NOK 133.12. Against this diversity, the fundamental outlook hinges on whether order backlog growth can effectively translate into future earnings gains, perspectives worth reviewing if you are weighing Kitron’s performance potential.

Explore 7 other fair value estimates on Kitron - why the stock might be worth over 2x more than the current price!

Build Your Own Kitron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kitron research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Kitron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kitron's overall financial health at a glance.

No Opportunity In Kitron?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kitron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KIT

Kitron

Operates as an electronics manufacturing services provider in Norway, Sweden, Denmark, Lithuania, Germany, Poland, the Czech Republic, India, China, Malaysia, and the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives