European Stocks Estimated Up To 45.7% Below Intrinsic Value Offer Potential Opportunities

Reviewed by Simply Wall St

Amidst ongoing uncertainty about U.S. trade policy, the European market has experienced mixed returns, with the pan-European STOXX Europe 600 Index snapping a ten-week streak of gains. Despite this volatility, opportunities may arise as certain stocks are estimated to be trading significantly below their intrinsic value, offering potential for investors who focus on fundamental strengths and undervaluation in these turbulent times.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.80 | €107.22 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK258.00 | SEK510.61 | 49.5% |

| Vimi Fasteners (BIT:VIM) | €0.97 | €1.90 | 49% |

| CTT Systems (OM:CTT) | SEK226.00 | SEK444.87 | 49.2% |

| Wienerberger (WBAG:WIE) | €34.86 | €68.58 | 49.2% |

| Comet Holding (SWX:COTN) | CHF235.50 | CHF461.22 | 48.9% |

| TF Bank (OM:TFBANK) | SEK369.00 | SEK719.63 | 48.7% |

| Storytel (OM:STORY B) | SEK89.70 | SEK177.35 | 49.4% |

| Star7 (BIT:STAR7) | €6.25 | €12.33 | 49.3% |

| W5 Solutions (OM:W5) | SEK73.40 | SEK143.13 | 48.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Pluxee (ENXTPA:PLX)

Overview: Pluxee N.V. provides employee benefits and engagement solutions services across France, Latin America, Continental Europe, and internationally with a market cap of €3.36 billion.

Operations: The company generates revenue from its operations across different regions, with €0.46 billion from Latin America, €0.22 billion from the Rest of The World, and €0.53 billion from Continental Europe.

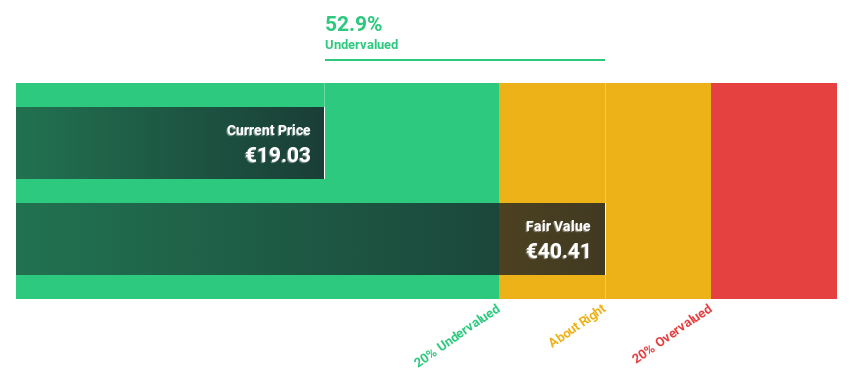

Estimated Discount To Fair Value: 38.6%

Pluxee is trading at €23, significantly below its estimated fair value of €37.48, indicating potential undervaluation based on cash flows. Its earnings are forecast to grow at 18.9% annually, surpassing the French market's growth rate. However, revenue growth is expected to be moderate at 7.9% per year. Recent share repurchase plans up to €15 million may enhance shareholder value and support performance initiatives, despite large one-off items impacting financial results previously noted.

- Our expertly prepared growth report on Pluxee implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Pluxee here with our thorough financial health report.

Kitron (OB:KIT)

Overview: Kitron ASA is an electronics manufacturing services company operating in multiple countries including Norway, Sweden, and the United States, with a market cap of NOK9.40 billion.

Operations: The company's revenue is primarily derived from Electronics Manufacturing Services (EMS), amounting to €647.20 million.

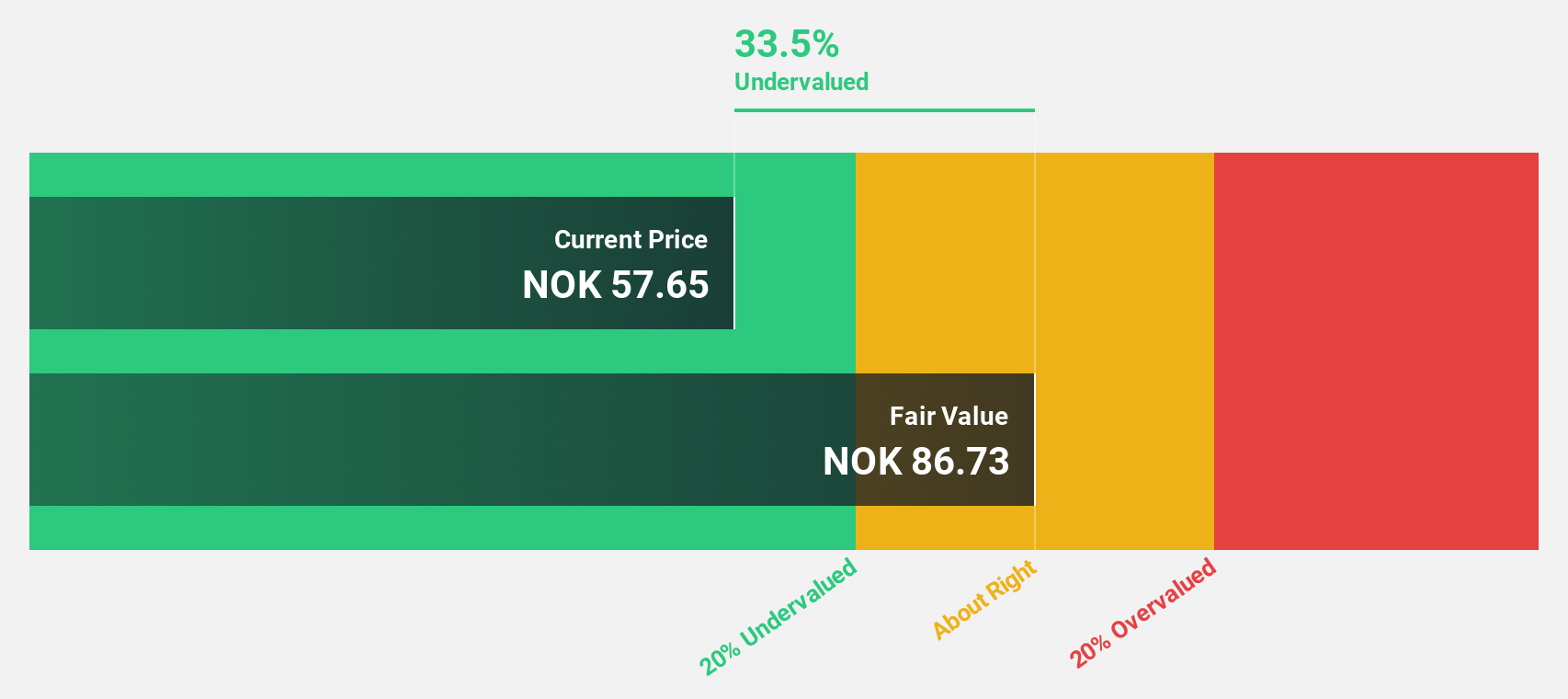

Estimated Discount To Fair Value: 33.3%

Kitron, trading at NOK 47.24, is significantly below its estimated fair value of NOK 70.88, highlighting potential undervaluation based on cash flows. Earnings are projected to grow at a robust 22.9% annually, outpacing the Norwegian market's growth rate. However, recent financial results show a decline in profit margins and net income compared to the previous year. Despite high debt levels and insider selling activity, strategic contracts with Kongsberg and others may bolster future revenues.

- Upon reviewing our latest growth report, Kitron's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Kitron's balance sheet health report.

JOST Werke (XTRA:JST)

Overview: JOST Werke SE manufactures and supplies safety-critical systems for the commercial vehicle industry across Germany, Europe, North America, Asia, Pacific, and Africa with a market cap of €804.60 million.

Operations: The company's revenue segment is Auto Parts & Accessories, generating €1.13 billion.

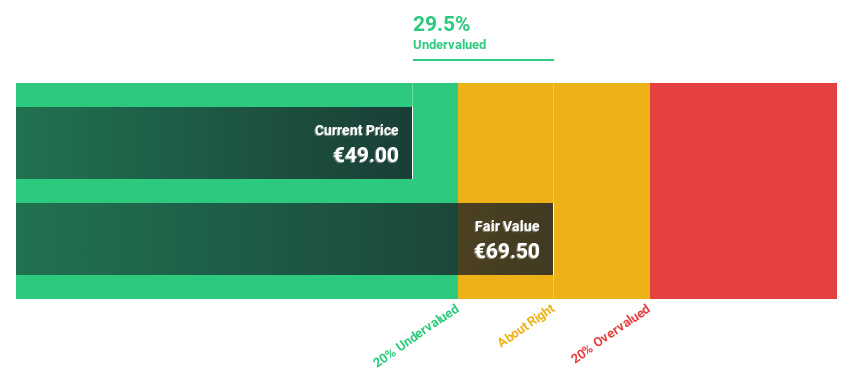

Estimated Discount To Fair Value: 45.7%

JOST Werke, trading at €54, is significantly undervalued with an estimated fair value of €99.39. Despite a decline in profit margins from 5.3% to 3.2% and high debt levels, its earnings are forecast to grow at 33.2% annually, outpacing the German market's growth rate of 16.5%. While revenue growth is moderate at 14.4%, it still exceeds the broader market's pace, highlighting potential for future cash flow improvements despite current challenges.

- Insights from our recent growth report point to a promising forecast for JOST Werke's business outlook.

- Unlock comprehensive insights into our analysis of JOST Werke stock in this financial health report.

Where To Now?

- Get an in-depth perspective on all 201 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade JOST Werke, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:JST

JOST Werke

Manufactures and supplies safety-critical systems for the commercial vehicle industry in Germany, Europe, North America, Asia, Pacific, and Africa.

Reasonable growth potential with adequate balance sheet.