- Norway

- /

- Tech Hardware

- /

- OB:ASTK

Introducing Asetek (OB:ASTK), The Stock That Soared 475% In The Last Five Years

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the Asetek A/S (OB:ASTK) share price. It's 475% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 45% over the last quarter.

Check out our latest analysis for Asetek

We don't think that Asetek's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Asetek saw its revenue grow at 8.3% per year. That's a pretty good long term growth rate. Arguably it's more than reflected in the very strong share price gain of 42% a year over a half a decade. We usually like strong growth stocks but it does seem the market already appreciates this one quite well!

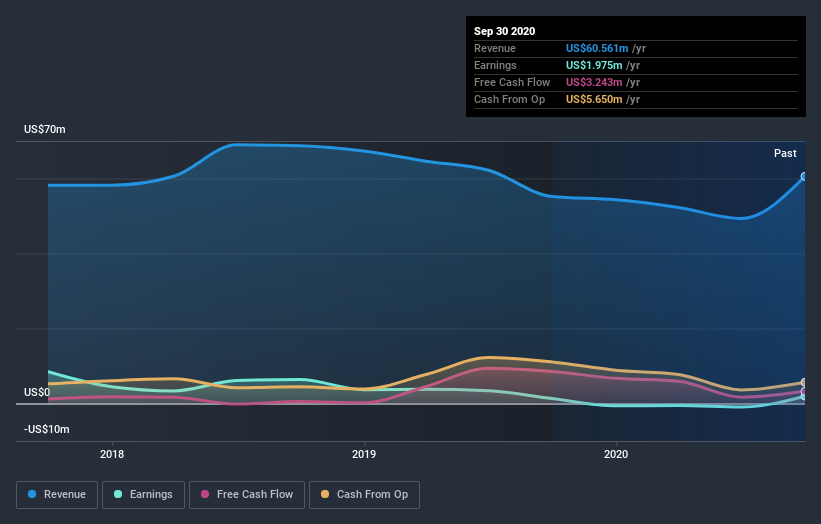

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Asetek's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Asetek's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Asetek shareholders, and that cash payout contributed to why its TSR of 483%, over the last 5 years, is better than the share price return.

A Different Perspective

It's good to see that Asetek has rewarded shareholders with a total shareholder return of 293% in the last twelve months. That's better than the annualised return of 42% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Asetek better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Asetek you should be aware of.

Asetek is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

When trading Asetek or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:ASTK

Asetek

Engages in the designing, developing, and marketing of liquid cooling solutions in Asia, Europe, and the Americas.

Adequate balance sheet and slightly overvalued.